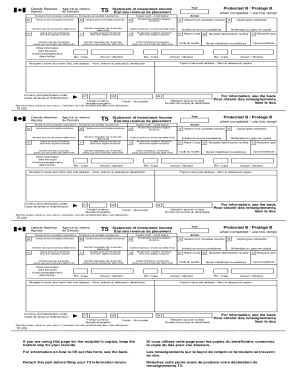

Canada T5 2010 free printable template

Show details

T5 Summary Commerce RETURN OF INVESTMENT INCOME DECLARATION DES REVENUE DE PLACEMENTS Do not use this area N 'inscribed rain ICI See information on the back. Complete this form using the instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada T5

Edit your Canada T5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada T5 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada T5. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T5

How to fill out Canada T5

01

Gather the necessary information, including the payer's information and the recipient's information.

02

Obtain the total amount of income to report, as shown on the relevant financial statements.

03

Fill out the payer's section with the name, address, and business number.

04

Complete the recipient's section with their name, address, and social insurance number.

05

Enter the appropriate income amounts in the specified boxes on the form.

06

Check the form for accuracy and completeness.

07

Provide copies to both the recipient and the Canada Revenue Agency by the deadline.

Who needs Canada T5?

01

Individuals or businesses that have paid dividends, interest, or other forms of income to Canadian residents.

02

Financial institutions that report interest income paid to account holders.

03

Corporations that distribute dividends to shareholders.

04

Trusts that report income distributed to beneficiaries.

Fill

form

: Try Risk Free

People Also Ask about

Where to download T5?

How to Get a T5 Online? The easiest way to get a T5 taxpayer slip is online through the financial institution that manages your investment or savings account. You can also get the T5 slip directly from your CRA account. Go to CRA's official website and log in to your account.

How do I create a T5 slip?

Steps to preparing the T5 slip Fill in the recipient's full name and address. Indicate the payer's (the name of your corporation) name and address. Specify the year in which the dividend or payment was received. Establish whether or not the dividend paid is eligible or non-eligible.

How do I get a T5 form?

Steps to access your T5 through online banking Under the 'My Accounts' list in the left hand column, click 'View e-Documents' Under the 'Documents' listing, locate your T5 and click the related link. Reference the warning and click the 'Continue' button. View, print or save your T5 as required.

How do I file a T5 summary?

Filing the T5 Summary If you file 1 to 50 T5 slips, we encourage you to file over the Internet using Web Forms or Internet file transfer. However, you can file up to 50 T5 slips on paper. If you file more than 50 T5 slips for a calendar year, you must file the T5 information return over the Internet.

WHO issues T5?

A T5 slip must be prepared by a bank or a financial institution, and issued to you (the taxpayer) and to the Canada Revenue Agency (CRA). You use it to report any investment income you have on your tax return.

Why didn't I get a T5?

Not everyone receives a T5 T5's are only issued in situations where you've earned at least $50 of interest income throughout the year. Additionally, interest earned within registered investments (RRSP, TFSA, etc.) won't trigger a T5 since that interest is tax sheltered and doesn't need to be reported as income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Canada T5?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your Canada T5 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the Canada T5 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your Canada T5 in seconds.

How do I edit Canada T5 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign Canada T5 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is Canada T5?

Canada T5 is a tax form used to report various types of investment income such as interest, dividends, and certain capital gains earned by individuals, partnerships, and trusts in Canada.

Who is required to file Canada T5?

Organizations and entities that have paid out interest, dividends, and other income from investments totaling more than $50 to individuals or other organizations during the tax year are required to file Canada T5.

How to fill out Canada T5?

To fill out Canada T5, you need to provide specific information including your name, the recipient’s name, their tax identification number, the amounts of income paid, and the type of income. You can use the T5 guide provided by the Canada Revenue Agency for detailed instructions.

What is the purpose of Canada T5?

The purpose of Canada T5 is to ensure proper reporting of investment income to the Canada Revenue Agency (CRA) and to inform recipients about the income they need to report on their personal tax returns.

What information must be reported on Canada T5?

The information that must be reported on Canada T5 includes the recipient's name and address, their tax identification number, the total amount of income paid, the type of income (such as interest or dividends), and the payer's information.

Fill out your Canada T5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.