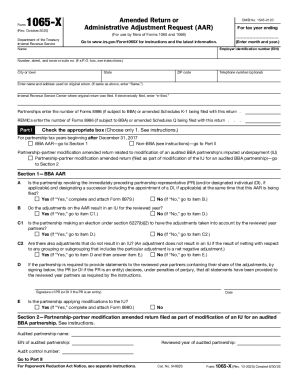

IRS 1065-X 2023 free printable template

Instructions and Help about IRS 1065-X

How to edit IRS 1065-X

How to fill out IRS 1065-X

Latest updates to IRS 1065-X

About IRS 1065-X 2023 previous version

What is IRS 1065-X?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1065-X

What steps should I take if I realize there are mistakes on my filed IRS 1065-X?

If you discover mistakes on your filed IRS 1065-X, you should prepare an amended return correcting those errors. Make sure to accurately detail the changes and provide any necessary documentation to support your amendments. It's advisable to review the IRS instructions for specific guidelines on revising your submission.

How can I verify the status of my IRS 1065-X submission?

To verify the status of your IRS 1065-X submission, you can use the IRS online tools or contact their helpline for personalized assistance. Keep your submission details handy, as you may need them to confirm processing or identify any potential issues with your filing.

What should I do if my IRS 1065-X is rejected due to a common e-file error?

If your IRS 1065-X is rejected, check the e-file rejection code provided in the notification. This code will guide you to understand the nature of the error. After correcting the issue, you can resubmit your IRS 1065-X electronically or via mail, following any noted procedures to avoid future rejections.

Are there specific legal nuances to be aware of when filing IRS 1065-X for a nonresidential partner?

When filing IRS 1065-X for a nonresident partner, it’s important to adhere to the specific rules regarding reporting income and tax liabilities as they can differ from those applicable to residents. Consult IRS guidelines to ensure compliance with all legal and operational nuances and to account for any required withholding.