IRS 720 2023 free printable template

Instructions and Help about IRS 720

How to edit IRS 720

How to fill out IRS 720

About IRS previous version

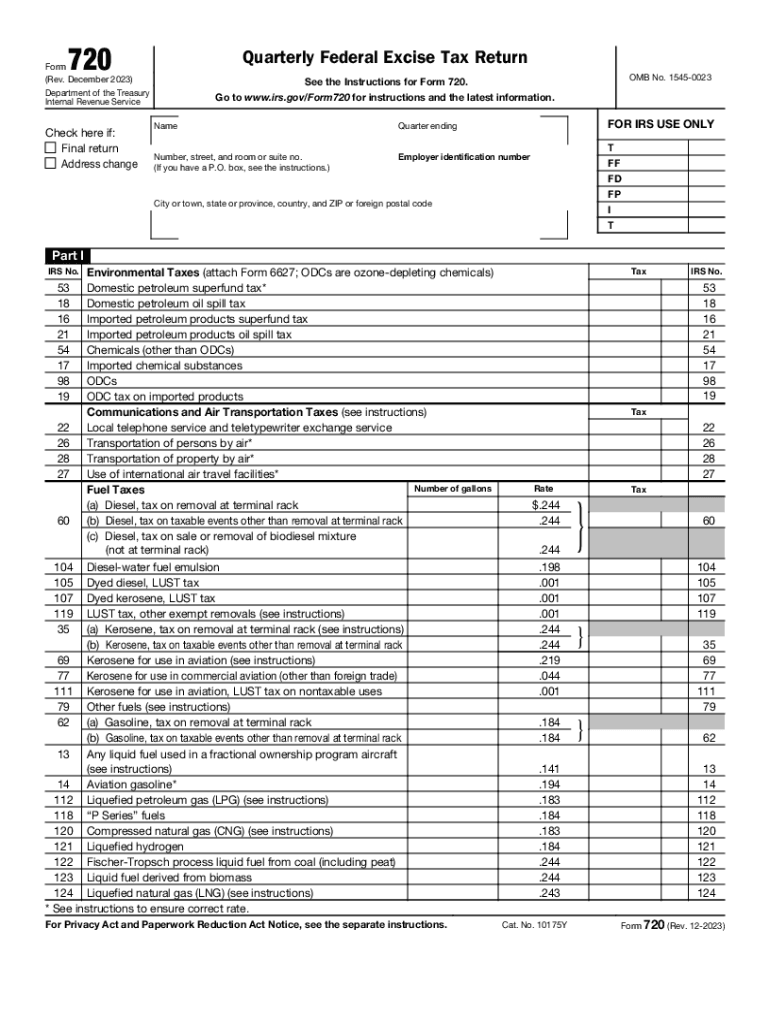

What is IRS 720?

Who needs the form?

Components of the form

What payments and purchases are reported?

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 720

How can I correct mistakes on my IRS 720 after submission?

If you need to correct errors on your IRS 720 after submission, you must file an amended version of the form. It's crucial to clearly indicate the changes made and ensure you follow the IRS guidelines for corrections. Additionally, keep records of both the original and amended forms for your files.

What should I do if my e-filed IRS 720 is rejected?

In case your e-filed IRS 720 is rejected, review the rejection code provided by the IRS for specific errors. You will need to correct the issues and resubmit the form. Quick actions are essential to avoid delays in processing your submission.

How long should I retain records related to the IRS 720?

For IRS 720 filings, it is recommended to retain records for at least three years from the date of filing. This duration ensures compliance during potential audits and verifies your submitted information if needed in the future.

What steps should I take if I receive a notice regarding my IRS 720?

If you receive a notice from the IRS concerning your IRS 720, carefully read the correspondence to understand the reason. Gather any documentation requested and respond promptly, as timely communication can help resolve the situation efficiently.

Are there any common errors to avoid when filing the IRS 720?

Common errors when filing IRS 720 include incorrect tracking numbers and failing to report accurate payment amounts. Double-checking your entries and keeping up with IRS updates can significantly reduce the risk of making such mistakes.

See what our users say