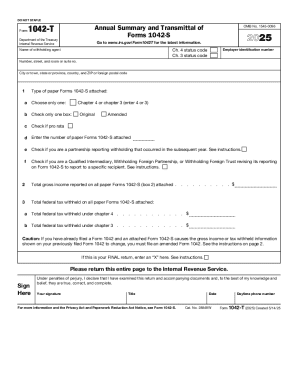

IRS 1042-T 2024 free printable template

Instructions and Help about 1042 t instructions

How to edit 1042 t instructions

How to fill out 1042 t instructions

Latest updates to 1042 t instructions

All You Need to Know About 1042 t instructions

What is 1042 t instructions?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1042-T

What should I do if I realize I made a mistake after submitting the 1042 t?

To correct mistakes after submitting the 1042 t instructions, you need to file an amended return following IRS guidelines. It’s important to clearly indicate that the return is amended and provide the correct information. Keeping copies of all correspondence is vital for record retention and to ensure compliance.

How can I verify the status of my submitted 1042 t?

You can verify the receipt and processing status of your submitted 1042 t instructions by checking the IRS's online tool, or by contacting their customer service. Ensure that you have the relevant information ready for a smoother inquiry process.

Are e-signatures acceptable when submitting the 1042 t instructions?

Yes, e-signatures are generally acceptable for the 1042 t instructions when filed electronically, provided you follow the IRS's requirements for electronic signatures. Always check the specific filing guidelines to ensure compliance with legal and operational nuances.

What common errors should I avoid when submitting the 1042 t?

Some common errors in submitting the 1042 t instructions include incorrect filing status, missing taxpayer identification numbers, and math mistakes. Double-checking the information and ensuring all required fields are filled can help avoid these issues.

What should I do if I receive a notice or letter from the IRS regarding my 1042 t submission?

If you receive a notice from the IRS concerning your 1042 t instructions, carefully read the letter for instructions. Prepare any requested documentation and respond in the timeframe specified to ensure that your case is addressed appropriately.