IRS Notice 703 2024 free printable template

Show details

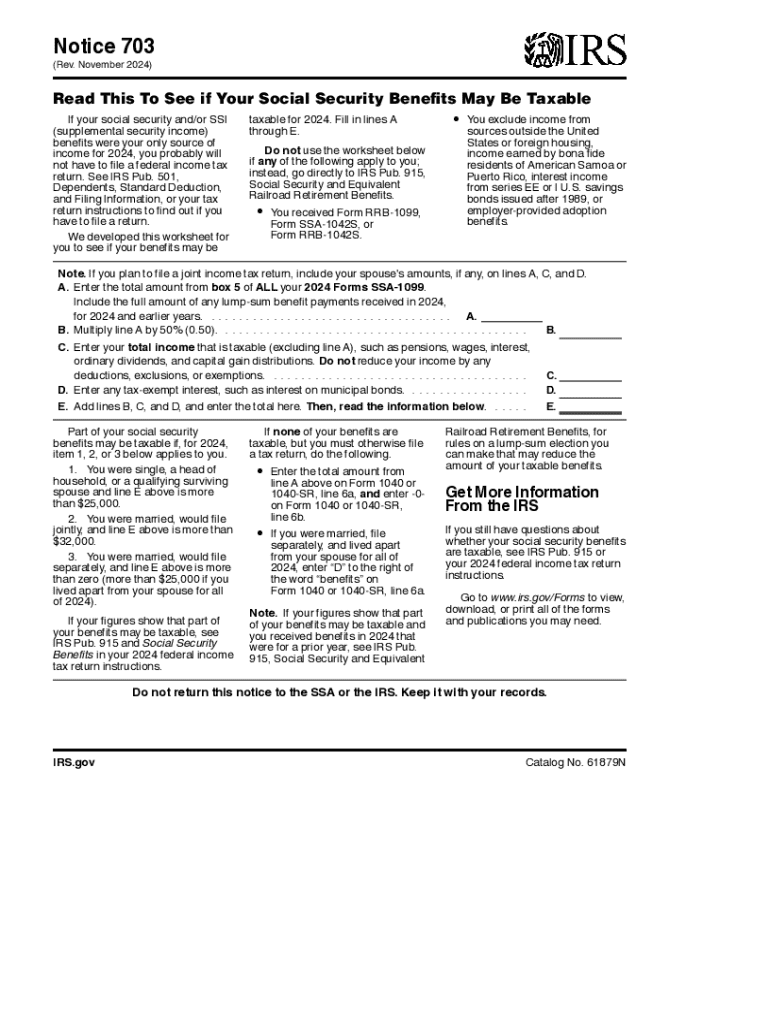

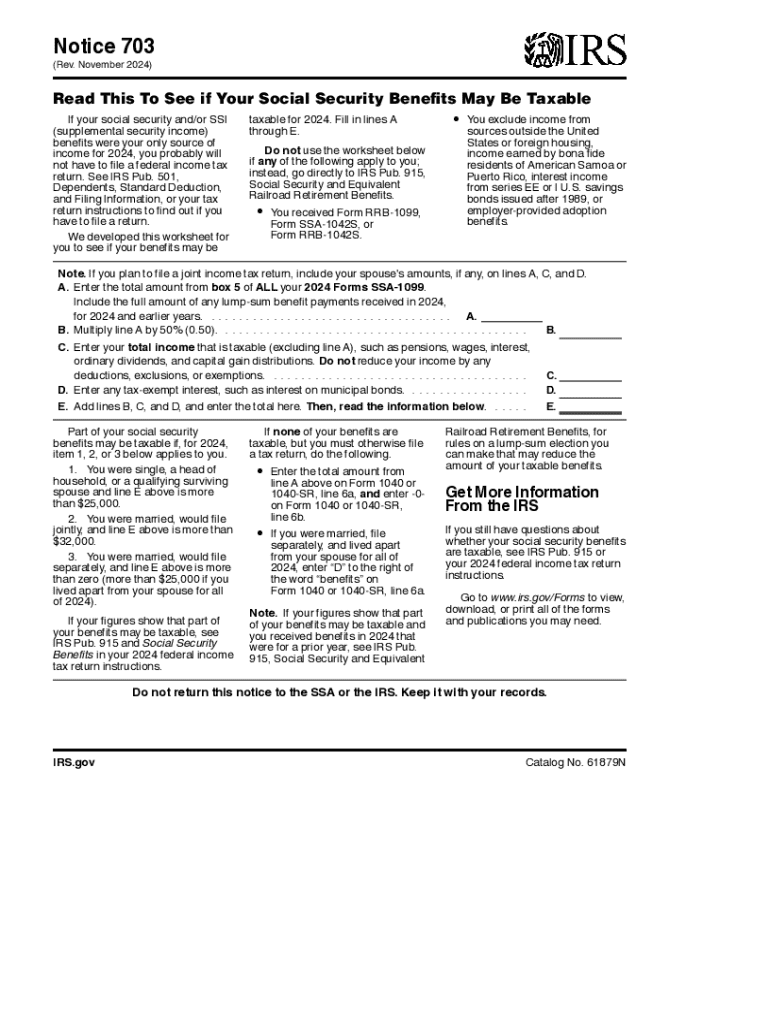

Notice 703 Rev. November 2024 Read This To See if Your Social Security Benefits May Be Taxable If your social security and/or SSI supplemental security income benefits were your only source of income for 2024 you probably will not have to file a federal income tax return. See IRS Pub. 501 Dependents Standard Deduction and Filing Information or your tax return instructions to find out if you have to file a return* We developed this worksheet for you to see if your benefits may be taxable for...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Notice 703

Edit your IRS Notice 703 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Notice 703 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Notice 703 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS Notice 703. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Notice 703 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Notice 703

How to fill out IRS Notice 703

01

Start by downloading the IRS Notice 703 from the official IRS website or obtain a physical copy from the IRS office.

02

Read the instructions provided on the notice carefully to understand your obligations.

03

Fill in your personal information in the designated fields, including your name, address, and taxpayer identification number.

04

Indicate the tax period related to the notice.

05

If applicable, provide any additional information or documentation requested on the form.

06

Review all filled sections to ensure accuracy and completeness.

07

Sign and date the notice at the bottom where indicated.

08

Send the completed notice back to the IRS address provided in the instructions, ensuring you keep a copy for your records.

Who needs IRS Notice 703?

01

Taxpayers who have received IRS Notice 703 regarding the need to clarify their tax situation or respond to discrepancies related to tax returns.

02

Individuals or entities that have been notified about missing information or specific actions required by the IRS regarding their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

What is a 703 from Social Security?

A worksheet (IRS Notice 703) is included for determining whether any portion of your Social Security benefits received is subject to income tax. How do you know the amount of taxes withheld from your benefits? At the end of each year, we send a Form 1042S (Social Security Benefit Statement) to each beneficiary.

How do I fill out a 703 notice?

You do not actually need to fill out IRS Notice 703. In fact, at the bottom of the page, you will see a note to not return the notice to the SSA or IRS. The document is yours to keep and only serves to help you calculate your taxable income for that tax year.

How to calculate taxable amount of Social Security benefits 2022?

For the 2022 tax year (which you will file in 2023), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

At what age is Social Security no longer taxable?

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”

What is an IRS Notice 703?

A Notice 703 is a brief worksheet the Internal Revenue Service uses to help taxpayers determine whether their Social Security benefits are taxable in a given year. It is sent with the SSA-1099 form you should automatically receive each year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS Notice 703?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific IRS Notice 703 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit IRS Notice 703 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing IRS Notice 703.

How can I fill out IRS Notice 703 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your IRS Notice 703. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IRS Notice 703?

IRS Notice 703 is a notice issued by the Internal Revenue Service that provides taxpayers with information about their tax obligations, particularly in relation to certain tax filings or changes in tax laws.

Who is required to file IRS Notice 703?

Individuals or entities that need to inform the IRS about specific tax-related situations or updates may be required to file IRS Notice 703.

How to fill out IRS Notice 703?

To fill out IRS Notice 703, taxpayers should carefully read the instructions provided with the notice, complete the required fields accurately, and ensure that all necessary information is included before submitting it to the IRS.

What is the purpose of IRS Notice 703?

The purpose of IRS Notice 703 is to provide guidance and communicate necessary information to taxpayers regarding compliance with tax laws and requirements.

What information must be reported on IRS Notice 703?

The information that must be reported on IRS Notice 703 typically includes taxpayer identification details, relevant tax periods, and any specific changes or situations that need to be communicated to the IRS.

Fill out your IRS Notice 703 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Notice 703 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.