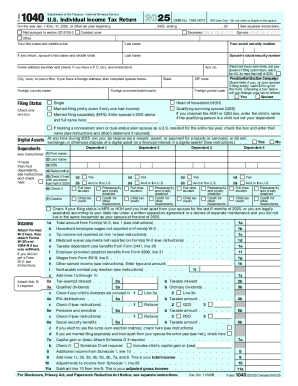

IRS 1040 2024 free printable template

Instructions and Help about IRS 1040

How to edit IRS 1040

How to fill out IRS 1040

Latest updates to IRS 1040

About IRS previous version

What is IRS 1040?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040

What should I do if I realize I've made a mistake on my IRS 1040 after submitting?

If you need to correct an error on your IRS 1040 after submission, you should file an amended return using Form 1040-X. This form allows you to clarify discrepancies and fix any mistakes related to personal information or calculations. Ensure you include any necessary documentation to support your corrections.

How can I track the status of my IRS 1040 submission?

To track the status of your IRS 1040, you can use the IRS 'Where's My Refund?' tool available on their website. This tool provides updates on the processing of your return or refund. If you e-filed, this service is particularly useful for checking the acceptance and progress of your submission.

What should I do if my IRS 1040 submission is rejected?

If your IRS 1040 e-filing is rejected, review the rejection code provided by the IRS to determine the specific issue. Common reasons include mismatched personal information or duplicate submissions. After fixing the error, you can resubmit your form electronically or by mail if necessary.

What documentation should I keep after filing my IRS 1040?

After filing your IRS 1040, retain copies of your return, any W-2s or 1099s, and supporting documents for at least three years. This period aligns with the IRS audit window. Additionally, keeping records of any correspondence with the IRS concerning your return is advisable.

How does e-signature work when filing the IRS 1040 electronically?

When e-filing your IRS 1040, an electronic signature is created by using your prior year's adjusted gross income (AGI) or a self-selected PIN. This process digitally verifies your identity, allowing you to submit your return securely without needing a physical signature.

See what our users say