CT DRS CT-941X 2024-2026 free printable template

Show details

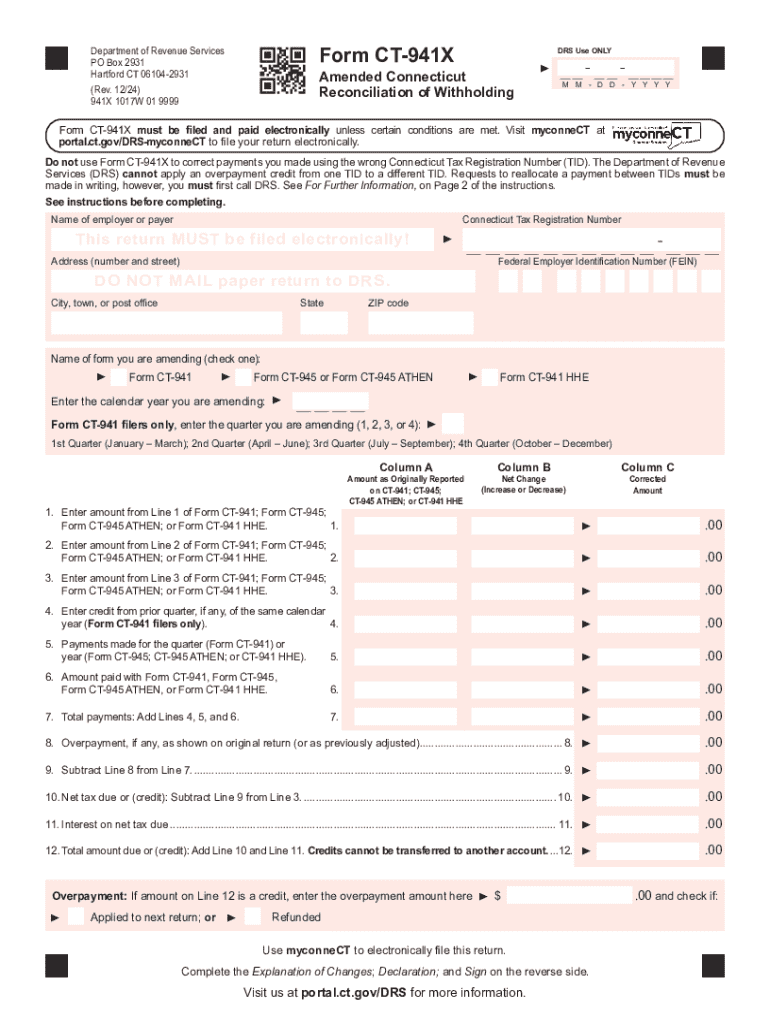

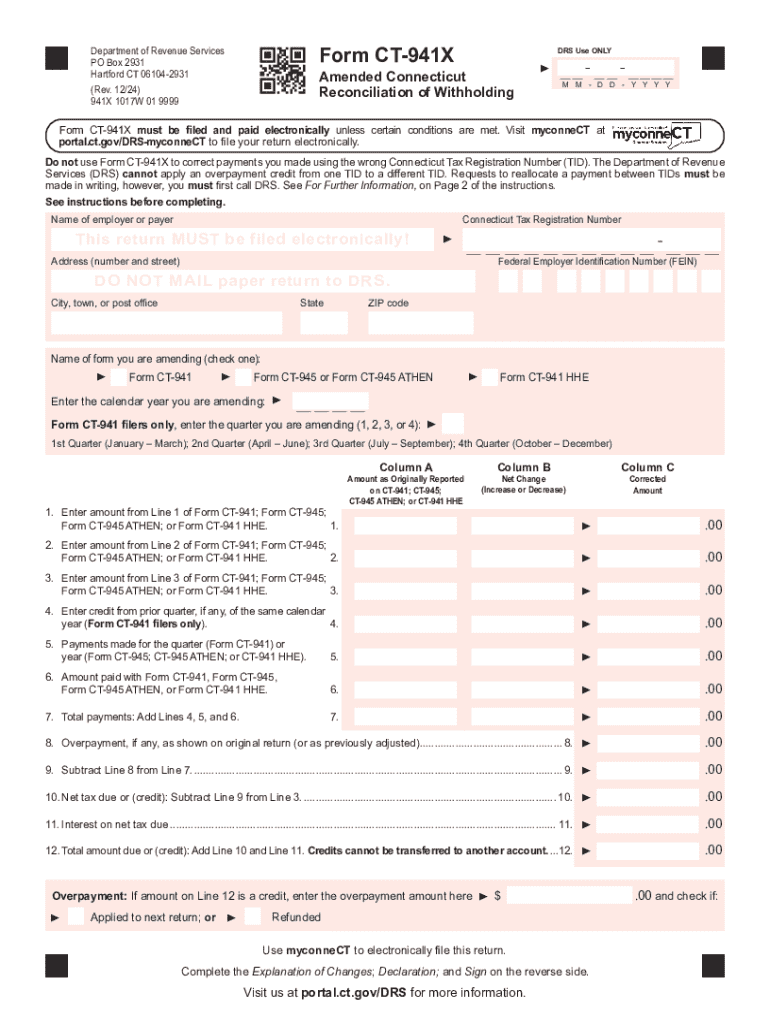

Form CT-941X Department of Revenue Services PO Box 2931 Hartford CT 06104-2931 Rev. 12/24 941X 1017W 01 9999 DRS Use ONLY Amended Connecticut Reconciliation of Withholding M M - D D - Y Y Y Y Form CT 941X must be filed and paid electronically unless certain conditions are met. Line Instructions In Column A enter the amount reported on the original Form CT 941 Form CT 945 Form CT 945 ATHEN or Form CT 941 HHE. each line which has been changed. Any decrease should be in parentheses. Visit...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-941X

Edit your CT DRS CT-941X form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-941X form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS CT-941X online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CT DRS CT-941X. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-941X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-941X

How to fill out CT DRS CT-941X

01

Obtain the CT-941X form from the Connecticut Department of Revenue Services website or your local office.

02

Fill out the top section of the form with your name, address, and identification number.

03

Indicate the tax year for which you are filing the amendment.

04

Review your original CT-941 form and determine the corrections needed.

05

Enter the corrected amounts in the appropriate sections of the CT-941X form.

06

Provide explanations for each correction made in the designated area.

07

Calculate any additional tax owed or refund due based on the amended figures.

08

Sign and date the form at the bottom before submission.

09

Submit the completed CT-941X form to the CT DRS, either by mail or electronically, following their submission guidelines.

10

Keep a copy of the submitted form for your records.

Who needs CT DRS CT-941X?

01

Individuals or businesses that need to amend their previously filed CT-941 form due to errors in reported wages or tax withheld.

02

Tax filers who discover discrepancies in their original filings after submission.

03

Employers who need to correct information related to employee withholding tax.

Fill

form

: Try Risk Free

People Also Ask about

What is the CT 1040V form?

Purpose: Complete Form CT‑1040V if you filed your Connecticut income tax return electronically and elect to make payment by check. You must pay the total amount of tax due on or before April 15, 2023. Any unpaid balance will be subject to penalty and interest.

What are the CT withholding codes?

Connecticut State Income Tax Withholding Information Filing StatusDescriptionBHead of HouseholdCMarried - Filing Jointly, Spouse Not WorkingDMarried - Filing Jointly, Both Spouses Working (combined income greater than $100,500)FSingle1 more row

What is CT W4?

Form CT-W4, Employee's Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

What is the CT-941 HHE form?

Form CT-941 HHE is used to reconcile annual Connecticut income tax withholding from household employee wages only. Do not use this form to amend a previously filed Form CT-941 HHE. See Amended Returns, on this page. Form CT-941 HHE must be filed and paid electronically unless certain conditions are met.

What is CT 945?

Form CT-945 is used to reconcile annual Connecticut income tax withholding from nonpayroll amounts only.

What is the difference between state W4 and federal W4?

For one thing, most employees need to complete a Federal Form W-4, but not everyone needs to complete a state Form W-4. In addition, a Federal Form W-4 tells you how much Federal income tax to withhold from each employee's pay. A state Form W-4 tells you how much state income tax to withhold.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CT DRS CT-941X without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including CT DRS CT-941X, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get CT DRS CT-941X?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the CT DRS CT-941X. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the CT DRS CT-941X electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your CT DRS CT-941X in seconds.

What is CT DRS CT-941X?

CT DRS CT-941X is a form used for making an adjustment to previously filed Connecticut income tax returns.

Who is required to file CT DRS CT-941X?

Businesses and individuals who need to correct errors or make adjustments to their previously filed CT-941 returns are required to file CT DRS CT-941X.

How to fill out CT DRS CT-941X?

To fill out CT DRS CT-941X, follow the instructions provided with the form, enter the required information accurately, and indicate the reason for the adjustment.

What is the purpose of CT DRS CT-941X?

The purpose of CT DRS CT-941X is to allow taxpayers to correct mistakes or changes in previously submitted CT-941 filings to ensure accurate tax reporting.

What information must be reported on CT DRS CT-941X?

CT DRS CT-941X requires reporting of corrected income, withholding amounts, and any additional information pertinent to the adjustments being made.

Fill out your CT DRS CT-941X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-941x is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.