CT DRS CT-941X 2015 free printable template

Show details

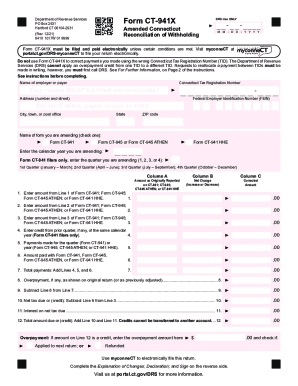

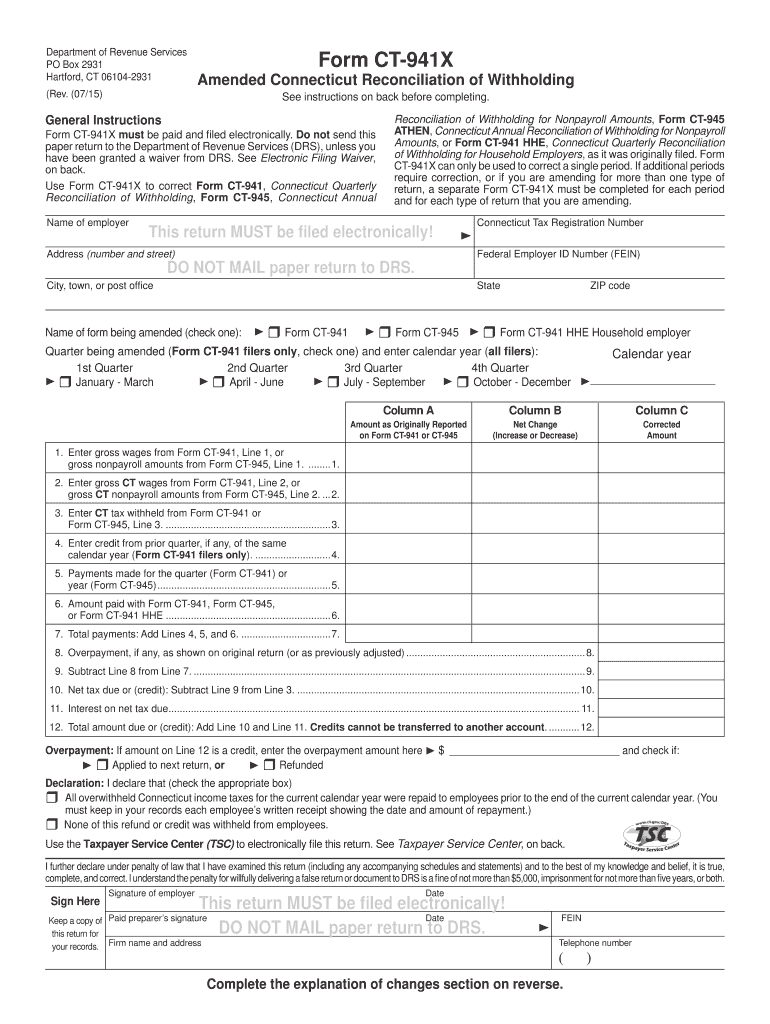

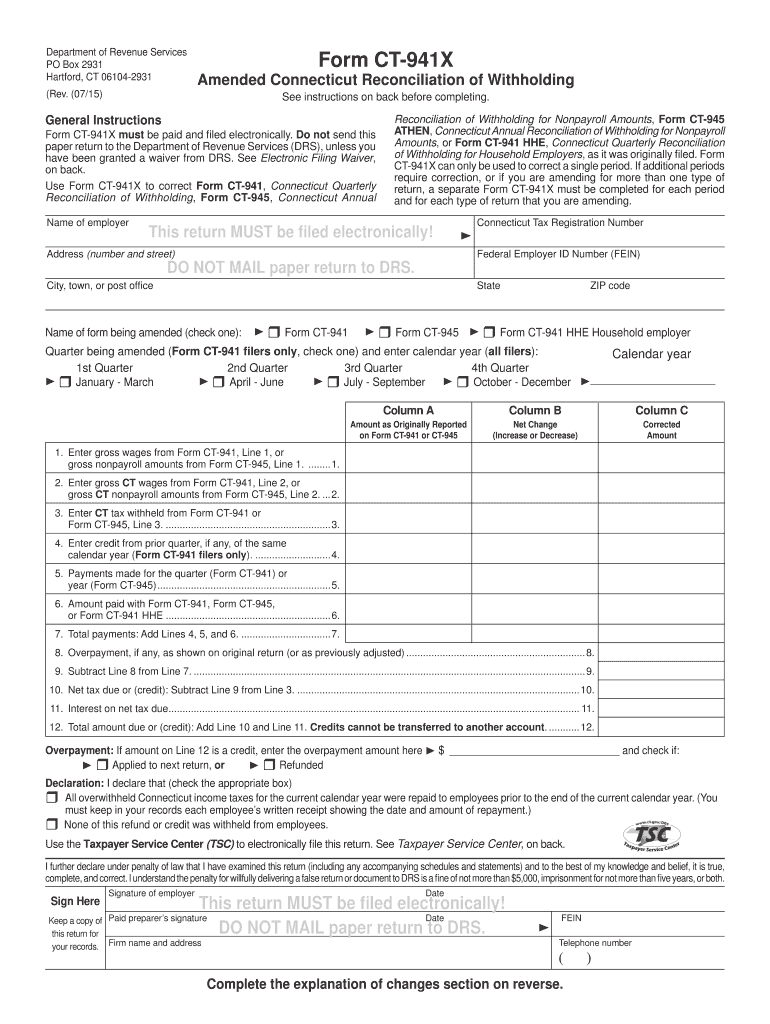

Department of Revenue Services PO Box 2931 Hartford CT 06104-2931 Form CT-941X Amended Connecticut Reconciliation of Withholding Rev. 07/15 See instructions on back before completing. If additional periods require correction or if you are amending for more than one type of return a separate Form CT-941X must be completed for each period and for each type of return that you are amending. Reconciliation of Withholding Form CT-945 Connecticut Annual Name of employer ATHEN Connecticut Annual...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ct 941x 2015 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 941x 2015 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct 941x 2015 form online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ct 941x 2015 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

CT DRS CT-941X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ct 941x 2015 form

How to fill out ct 941x 2015 form?

01

Gather all necessary information: Before filling out the form, collect all relevant financial records and tax documents for the specific tax year.

02

Identify the appropriate sections: The ct 941x 2015 form is used to correct errors made on previously filed ct 941 or ct 941x forms. Identify the sections that need to be corrected and fill them out accurately.

03

Provide accurate information: Fill in the necessary fields with accurate information, including your employer identification number (EIN), business name, address, and the specific details of the corrections you are making.

04

Complete the payment section: If there are any changes in the tax amount owed or the refund requested, provide accurate payment details in the designated section.

05

Review and double-check: Carefully review the entire form to ensure accuracy and completeness. Verify that all calculations are correct and that all necessary supporting documents are attached.

06

Sign and submit: Sign the ct 941x 2015 form, and ensure that it is submitted to the appropriate tax authority by the specified deadline.

Who needs ct 941x 2015 form?

01

Businesses and employers: The ct 941x 2015 form is primarily required by businesses and employers who need to correct errors made on previously filed ct 941 or ct 941x forms related to their employment taxes.

02

Those who have identified mistakes on previous forms: Any individual or organization that has identified mistakes or inaccuracies on previously filed ct 941 or ct 941x forms for the tax year 2015 would need to use the ct 941x 2015 form to correct those errors.

03

Those who have received a notice from the tax authority: If you have received a notice from the tax authority requesting you to correct errors on your previously filed ct 941 or ct 941x forms for the tax year 2015, you would need to use the ct 941x 2015 form to respond to the notice and make the necessary corrections.

Instructions and Help about ct 941x 2015 form

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ct 941x form?

The ct 941x form is a form used for correcting errors on previously filed Connecticut Quarterly Reconciliation of Withholding form (CT-941) for Employment Taxes.

Who is required to file ct 941x form?

Employers in Connecticut who need to correct errors on their previously filed CT-941 form are required to file ct 941x form.

How to fill out ct 941x form?

To fill out ct 941x form, you need to provide your business information, the period covered by the form, the details of the correction being made, and any additional information required by the form. It is recommended to refer to the official instructions provided by the Connecticut Department of Revenue Services for detailed guidance.

What is the purpose of ct 941x form?

The purpose of ct 941x form is to correct errors made on previously filed CT-941 form, such as reporting incorrect wage or withholding information.

What information must be reported on ct 941x form?

On ct 941x form, you must report your business information, the period covered, the specific correction being made, and any additional information requested by the form.

When is the deadline to file ct 941x form in 2023?

The deadline to file ct 941x form in 2023 is typically the same as the deadline for filing the original CT-941 form, which is the last day of the month following the end of the quarter.

What is the penalty for the late filing of ct 941x form?

The penalty for the late filing of ct 941x form may vary. It is recommended to refer to the official guidelines provided by the Connecticut Department of Revenue Services for information on specific penalties and consequences.

How do I complete ct 941x 2015 form online?

pdfFiller makes it easy to finish and sign ct 941x 2015 form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit ct 941x 2015 form straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing ct 941x 2015 form.

Can I edit ct 941x 2015 form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign ct 941x 2015 form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your ct 941x 2015 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.