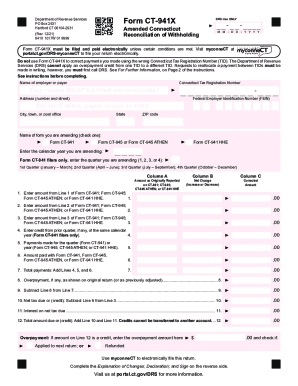

CT DRS CT-941X 2013 free printable template

Show details

Department of Revenue Services PO Box 2931 Hartford, CT 06104-2931 Form CT-941X Amended Connecticut Reconciliation of Withholding Complete this return in blue or black ink only. See instructions on

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your connecticut amended 2013 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your connecticut amended 2013 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit connecticut amended 2013 form online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit connecticut amended 2013 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

CT DRS CT-941X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out connecticut amended 2013 form

How to fill out connecticut amended 2013 form:

01

Download the connecticut amended 2013 form from the official website or obtain a physical copy from the local tax office.

02

Review the instructions provided with the form to understand the requirements and necessary documentation.

03

Fill in your personal information accurately, including your name, address, and social security number.

04

Provide information from your original tax return, such as the filing status, income, deductions, and credits. Be sure to include any changes or corrections.

05

Attach any supporting documentation or schedules as required. This may include forms related to income adjustments, deductions, or credits.

06

Double-check all the information filled out on the form for accuracy and completeness.

07

Sign and date the form in the appropriate sections.

08

Make a copy of the completed form and all attached documentation for your records.

09

Send the completed connecticut amended 2013 form to the designated address as specified in the instructions.

Who needs connecticut amended 2013 form:

01

Individuals who have filed a previous tax return for the year 2013 and need to make changes or corrections to that return.

02

Taxpayers who have discovered errors or omissions in their original tax return filed for the year 2013.

03

Individuals who have received new information or documentation that affects the tax information reported on their original tax return for the year 2013.

Instructions and Help about connecticut amended 2013 form

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is connecticut amended form?

Connecticut amended form is a document that is used to correct errors or make changes to a previously filed Connecticut state tax return.

Who is required to file connecticut amended form?

Any individual or business entity who needs to make changes or corrections to their previously filed Connecticut state tax return is required to file the connecticut amended form.

How to fill out connecticut amended form?

To fill out the connecticut amended form, you will need to provide your personal information, including your name, address, and social security number. You will also need to accurately report the changes or corrections you are making to your previously filed Connecticut state tax return.

What is the purpose of connecticut amended form?

The purpose of connecticut amended form is to allow taxpayers to correct errors or make changes to their previously filed Connecticut state tax return.

What information must be reported on connecticut amended form?

On the connecticut amended form, taxpayers must report the changes or corrections they are making to their previously filed Connecticut state tax return. This may include adjustments to income, deductions, credits, or other relevant information.

When is the deadline to file connecticut amended form in 2023?

The deadline to file connecticut amended form in 2023 is typically April 15th, which is the same as the deadline for filing the regular Connecticut state tax return. However, it is recommended to check with the Connecticut Department of Revenue Services for any updated deadlines or extensions.

What is the penalty for the late filing of connecticut amended form?

The penalty for the late filing of connecticut amended form can vary depending on various factors, such as the amount of tax owed and the reason for the delay. It is advisable to consult the Connecticut Department of Revenue Services or a tax professional for accurate and specific penalty information based on your situation.

How do I execute connecticut amended 2013 form online?

With pdfFiller, you may easily complete and sign connecticut amended 2013 form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit connecticut amended 2013 form online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your connecticut amended 2013 form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my connecticut amended 2013 form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your connecticut amended 2013 form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Fill out your connecticut amended 2013 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.