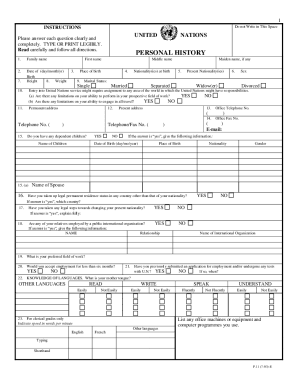

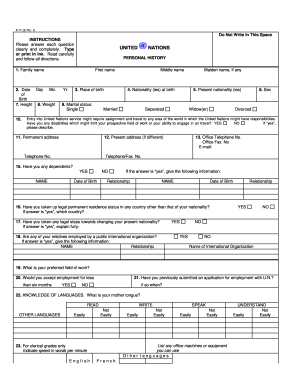

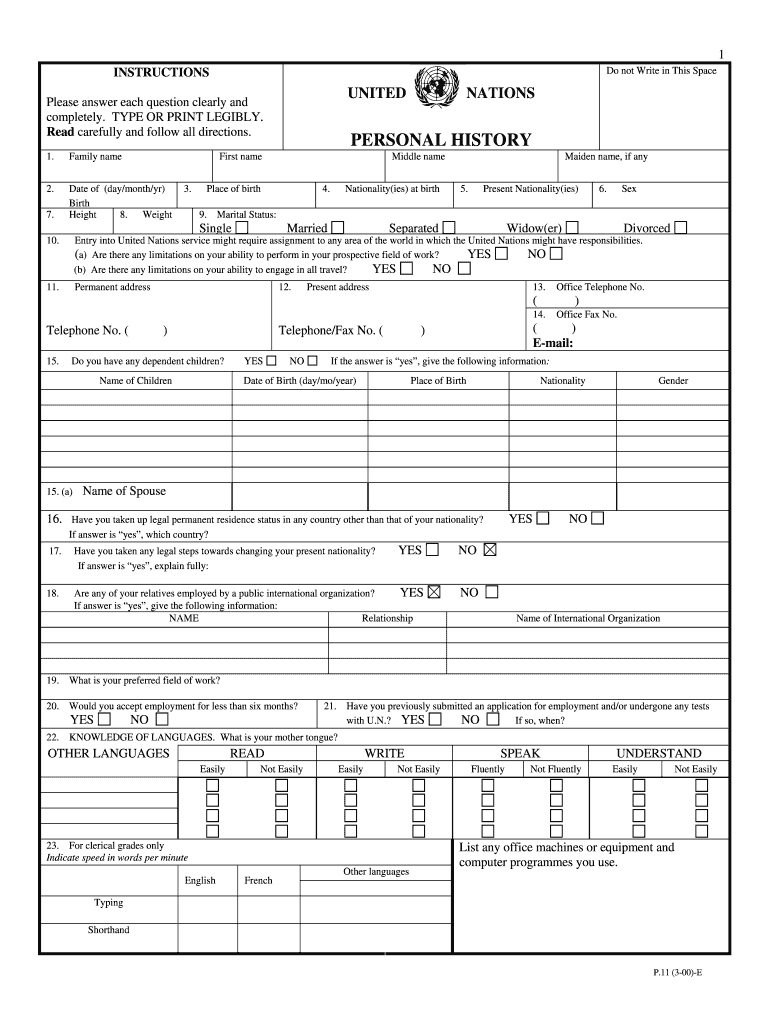

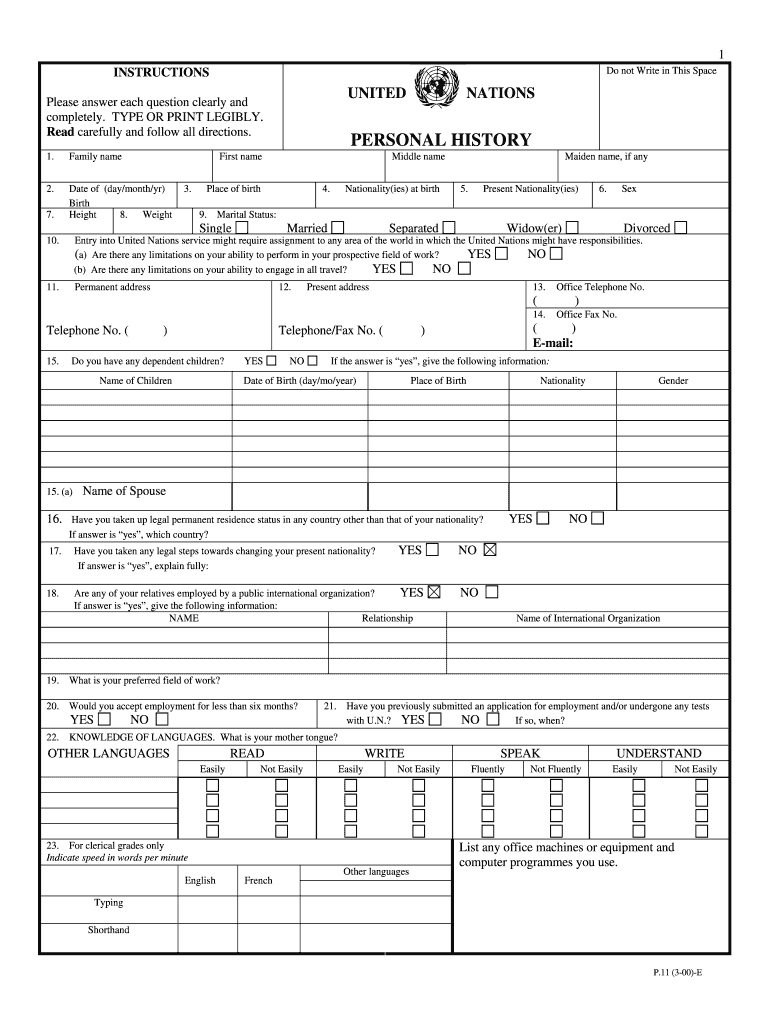

UN P.11 2000 free printable template

Show details

Give both gross and net salaries per annum for your last or present post. ... any misrepresentation or material omission made on a Personal History form or other ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your p11 form 2000 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your p11 form 2000 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit p11 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit un p11 form online. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

UN P.11 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out p11 form 2000

How to fill out p11 form:

01

Start by obtaining a blank copy of the p11 form either from the relevant government agency or by downloading it from their official website.

02

Read the instructions carefully to understand what information is required and how to complete each section.

03

Begin by filling out your personal details such as your name, contact information, and social security number.

04

Provide information about your employment history, including the names of previous employers, the dates of employment, and the positions held.

05

Declare any additional sources of income, such as freelance work or rental properties, if applicable.

06

Indicate any tax exemptions or deductions you are eligible for by following the instructions provided.

07

Double-check all the information you have entered to ensure accuracy and completeness.

08

Sign and date the form as required and make a copy for your records before submitting it to the appropriate authorities.

Who needs p11 form:

01

Individuals who are employed or have been employed in the past and need to report their income and tax details to the respective government agency.

02

Those who have additional sources of income that need to be declared for tax purposes, such as self-employment or rental income.

03

People who want to claim specific tax exemptions or deductions based on their circumstances, as allowed by the tax regulations in their country.

Fill u n application form pdf : Try Risk Free

What is un p11 form?

This form allows you to apply or express interest for Field positions in the General Service and National Professional categories, for Temporary Appointments in the Professional category, or for working under one of the affiliate schemes (UNOPS, Individual consultant or contractor, deployee, secondee, etc.).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is p11 form?

A P11 form is an HMRC form used to record details of an employee's pay and tax information. It is used to calculate the amount of tax and National Insurance Contributions (NICs) an employee should pay in a tax year. The form is completed by the employer and submitted to HMRC.

How to fill out p11 form?

1. Start by filling in your basic personal details, including your name, address, phone number, and email address.

2. On the second page, you will need to provide information about your passport. This includes the passport number, issuing authority, date of issue, and the expiry date.

3. On the third page, you will need to provide information about your employment history. This includes details of your current and previous employers, start and end dates of employment, and your job title.

4. On the fourth page, you will need to provide information about your educational qualifications. This includes details of any qualifications you have, the awarding body, and the date of completion.

5. On the fifth page, you will need to provide information about your skills and experience. This includes details of any relevant courses you have taken, language proficiency, and any other relevant skills or experience.

6. On the sixth page, you will need to provide information about your criminal record. This includes any convictions or cautions you have received, and the dates they were issued.

7. On the seventh page, you will need to provide information about your health. This includes details of any medical conditions, medications, or treatments you are receiving.

8. Finally, you will need to sign and date the form.

What information must be reported on p11 form?

The P11 form is an HMRC form used to report the details of an employee's employment history and pay. The information required includes:

-Name and address

-National Insurance number

-Tax code

-Start and end dates of employment

-Payroll number

-Amounts paid and deductions

-Hours worked

-Sick pay and other benefits

-Type of contract

-Overtime and other additional pay

-Taxable benefits

-Relevant pension contributions

-Any other payments or deductions.

When is the deadline to file p11 form in 2023?

The Internal Revenue Service (IRS) does not have a specific deadline for filing Form P11 for the 2023 tax year. Generally, Form P11 must be filed by April 15th of the following year or the date an individual's income tax return is due, whichever is later.

What is the penalty for the late filing of p11 form?

The penalty for late filing of a P11 form is a fine of up to £3,000.

How can I send p11 form for eSignature?

When you're ready to share your un p11 form online, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit personal history form straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit un p11 form.

Can I edit un p11 form 2022 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign un p11 form download. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your p11 form 2000 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal History Form is not the form you're looking for?Search for another form here.

Keywords relevant to un application form

Related to p11 form un

If you believe that this page should be taken down, please follow our DMCA take down process

here

.