CT DRS CT-941X 2009 free printable template

Show details

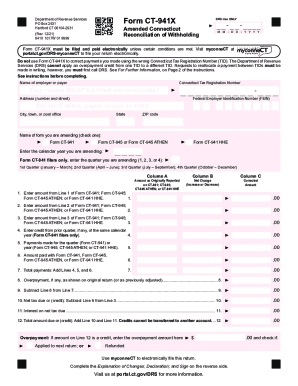

Department of Revenue Services PO Box 2931 Hartford CT 06104-2931 Form CT-941X Amended Connecticut Reconciliation of Withholding Complete this return in blue or black ink only. The total amounts reported for gross Connecticut wages or nonpayroll amounts on Form s CT-941 Form CT-945 Line 2 or if applicable total Connecticut wages reported on Form CT-W3 Line 2 or total CT-941X Back Rev. 12/09 In Column A enter the amount reported on the original Form CT-941 Form CT-945 or Form CT-941 DRS/P. To...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ct 941x 2009 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 941x 2009 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct 941x 2009 form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ct 941x 2009 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

CT DRS CT-941X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ct 941x 2009 form

How to fill out ct 941x 2009 form?

01

Obtain a copy of the ct 941x 2009 form from the relevant tax authorities or download it from their official website.

02

Read the instructions provided with the form carefully to understand the requirements and procedures for filling it out correctly.

03

Fill in the identifying information at the top of the form, including your name, address, social security number, and employer identification number (EIN) if applicable.

04

Enter the tax period for which you are filing the form in the designated section.

05

Calculate and report the adjustments you are making to your original ct 941 form in order to correct any errors or discrepancies. Provide explanations for each adjustment made.

06

Calculate the revised amounts for each tax liability, such as federal income tax withheld, social security tax, and Medicare tax, and enter these revised amounts in the appropriate sections of the form.

07

Summarize the total adjustments and revised tax liabilities on the form and complete any additional sections or schedules as required.

08

Sign and date the form, certifying that the information provided is accurate and complete.

09

Keep a copy of the completed form for your records and submit it to the relevant tax authorities by the specified deadline.

Who needs ct 941x 2009 form?

01

Employers who have identified errors or discrepancies in their previously filed ct 941 form for the year 2009.

02

Employers who have made adjustments to their tax liabilities for the year 2009 and need to report these changes to the tax authorities.

03

Employers who have been instructed by the tax authorities to file a revised form ct 941x for the year 2009 to correct any inaccuracies or omissions in their original filing.

Instructions and Help about ct 941x 2009 form

Fill form : Try Risk Free

People Also Ask about ct 941x 2009 form

What is CT 945?

What is the 941x for employee retention credit?

What is the CT-941 HHE form?

How to fill out 941x for ERC credit?

How do I amend my 941 for the employee retention credit?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ct 941x form?

The ct 941x form is a tax form used by employers in Connecticut to make corrections to previously filed ct 941 forms.

Who is required to file ct 941x form?

Employers in Connecticut who need to correct information on previously filed ct 941 forms are required to file ct 941x forms.

How to fill out ct 941x form?

To fill out the ct 941x form, you will need to provide information about the corrections you are making, such as the incorrect figures on the original form and the correct figures that should have been reported. You can find detailed instructions on how to fill out the form on the official Connecticut Department of Revenue Services website.

What is the purpose of ct 941x form?

The ct 941x form is used to correct errors or make adjustments on previously filed ct 941 forms. It ensures accurate reporting of tax information by employers in Connecticut.

What information must be reported on ct 941x form?

The ct 941x form requires you to report the corrections or adjustments you are making to previously reported figures on the ct 941 form. This includes providing the original incorrect figures and the correct figures that should have been reported.

When is the deadline to file ct 941x form in 2023?

The deadline to file the ct 941x form in 2023 has not been specified. It is recommended to check the official Connecticut Department of Revenue Services website or consult with a tax professional for the most up-to-date information.

What is the penalty for the late filing of ct 941x form?

The penalty for the late filing of the ct 941x form in Connecticut may vary. It is best to refer to the official Connecticut Department of Revenue Services website or consult with a tax professional for specific penalty information.

How can I send ct 941x 2009 form to be eSigned by others?

ct 941x 2009 form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for signing my ct 941x 2009 form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your ct 941x 2009 form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit ct 941x 2009 form on an iOS device?

Create, edit, and share ct 941x 2009 form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your ct 941x 2009 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.