CT DRS CT-941X 2020 free printable template

Show details

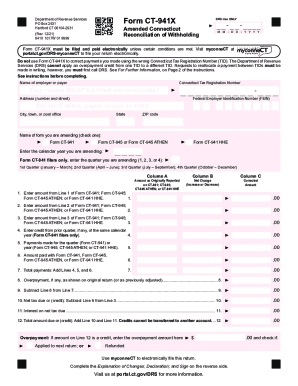

Form CT941XDepartment of Revenue Services PO Box 2931 Hartford CT 061042931 (Rev. 09/20) 941X 1017W 01 9999DRS Use Unamended Connecticut Reconciliation of Withholding M D D Y Y Y Form CT941X must

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ct amended 2020 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct amended 2020 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct amended online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit connecticut amended form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

CT DRS CT-941X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ct amended 2020 form

How to fill out ct amended?

01

Review the original CT (Certificate of Title) document carefully to understand the necessary amendments.

02

Obtain the appropriate amended forms from the relevant authority or department.

03

Fill out the amended forms accurately, providing all required information and ensuring it matches the information on the original CT document.

04

Attach any supporting documents or evidence that may be necessary for the amendments.

05

Double-check all the information filled in the amended forms for any errors or omissions.

06

Submit the completed amended forms, along with the original CT document and any required fees, to the relevant authority or department.

Who needs ct amended?

01

Individuals or entities who have identified errors or changes in the information on their existing CT.

02

People who have recently bought or sold a property and need to update the ownership details on the CT.

03

Organizations or individuals who have made changes to the property, such as adding an extension or changing its purpose, and need to reflect these amendments on the CT.

04

In some cases, banks or financial institutions may request amendments to the CT if there are changes in mortgage or lien details.

05

Any other individuals or organizations who have a legal requirement or need to update the information on the CT.

Video instructions and help with filling out and completing ct amended

Instructions and Help about ct reconciliation form

Fill form ct 941 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the penalty for the late filing of ct amended?

The penalty for the late filing of a CT amended return can vary depending on the specific circumstances and the amount of tax owed. Generally, a penalty of 10% of the tax due may apply for each month or part of a month that the return is late, up to a maximum of 25% of the tax due. Additionally, interest may be charged on any unpaid tax from the original due date until the tax is paid in full. It is important to note that each state may have its own specific penalties and interest rates, so it is recommended to consult the Connecticut Department of Revenue Services or a tax professional for accurate and specific information.

What is ct amended?

"CT Amended" is a term often used to refer to an amended tax return filed in the state of Connecticut. When a taxpayer needs to correct or update information on their original tax return, they file an amended return known as a "CT Amended Return" in Connecticut. This allows taxpayers to correct any errors, report additional income, or claim additional deductions or credits that were overlooked on their initial return.

Who is required to file ct amended?

Individuals or businesses who need to correct errors or update information on their previously filed Connecticut tax returns are typically required to file an amended return. This could include changes to income, deductions, credits, or any other relevant information.

How to fill out ct amended?

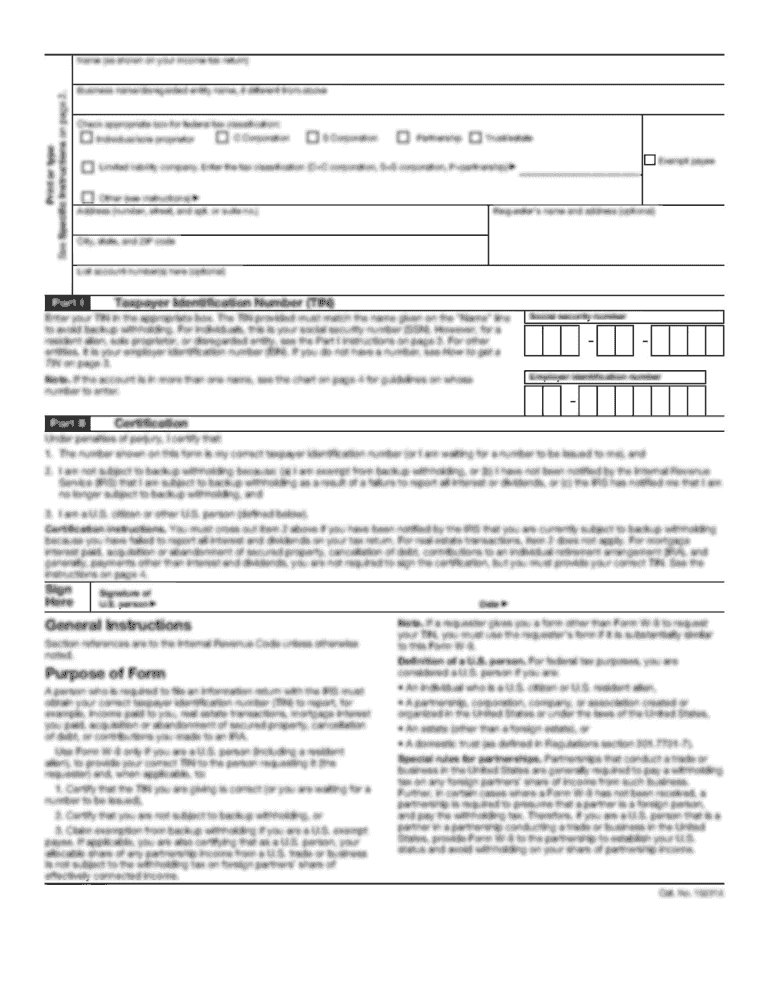

To fill out an amended CT (Connecticut) tax return, follow these steps:

1. Obtain the correct form: Obtain Form CT-1040X, which is used for filing an amended tax return in Connecticut. You can download it from the Connecticut Department of Revenue Services (DRS) website or request a copy by mail.

2. Gather necessary documentation: Collect all relevant documentation, including your original CT tax return, any supporting documents, and any new or corrected documents that are being added to the amended return.

3. Complete the top section: On Form CT-1040X, fill in your name, Social Security number, and address. Also, indicate whether you are filing as single, married filing jointly, married filing separately or head of household.

4. Provide the amended information: In the "Explanation of Changes" section, explain the reasons for the changes you are making on the amended return.

5. Complete the revised tax information: Fill in the revised figures for the lines that need to be changed or corrected. For example, if you need to update your income or deductions, enter the correct amounts on the amended return.

6. Provide supporting documentation: Include any required supporting documents to substantiate the changes made on the amended return. This may include updated W-2s, 1099s, or other relevant forms.

7. Calculate the changes and adjustments: Enter the adjusted figures for the relevant lines, and calculate the difference between the amended amounts and the originally reported amounts.

8. Complete the payment or refund information: If the changes result in an additional amount owed, enclose payment with the amended return. If the changes result in a refund, enter your bank account information for direct deposit or select a refund option.

9. Sign and date the amended return: Sign and date the form to acknowledge that the information provided is accurate and complete.

10. Submit the amended return: Keep a copy of the completed Form CT-1040X for your records, and mail the original to the Connecticut Department of Revenue Services. The address to send the amended return will be provided on the form.

Remember to check the Connecticut DRS website or consult with a tax professional if you have specific questions or need additional guidance while filling out the CT amended tax return.

What is the purpose of ct amended?

CT amended is a term that typically refers to an amendment made to the Constitution of the state of Connecticut. The purpose of such amendments is to update or modify specific provisions of the state constitution in order to reflect the changing needs and values of the people of Connecticut. Amendments may be proposed by the state legislature or through a citizen-initiated petition, and they require approval by a majority of voters in a statewide referendum. The purpose of CT amended is to ensure that the state constitution remains a relevant and effective governing document that reflects the will of the people.

What information must be reported on ct amended?

The specific information that must be reported on a CT (Connecticut) amended tax return can vary depending on the nature of the changes being made. However, typically, the following information is required:

1. Personal Information: The taxpayer's name, Social Security number, address, and filing status (single, married filing jointly, etc.).

2. Explanation of Changes: A clear explanation of the changes being made to the original tax return. This could include additional income, revised deductions, corrections to errors, or any other modifications.

3. Updated Income: Any additional income earned or changes in previously reported income, such as wages, self-employment earnings, rental income, investment income, etc.

4. Revised Deductions: Any changes to deductions, such as adjustments to itemized deductions, changes in business expenses, modifications to education-related deductions, etc.

5. Tax Credits: Any new or adjusted tax credits that apply to the taxpayer's situation. This may include credits for childcare expenses, education expenses, energy-saving improvements, adoption, etc.

6. Payments and Refunds: Any changes to tax payments made or refunds owed, such as additional payments made, revised estimated tax payments, or refunds due to the taxpayer.

7. Important Attachments: Any supporting documentation related to the changes made. This can include copies of W-2s, 1099s, receipts, schedules, or any other relevant paperwork.

It is important to note that these requirements may change over time, and it is always advisable to consult the official guidelines provided by the Connecticut Department of Revenue Services or seek professional advice when filing an amended tax return.

How do I execute ct amended online?

Filling out and eSigning connecticut amended form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit ct 941 in Chrome?

ct 941 form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out ct 941x using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign ct form 941 x and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your ct amended 2020 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct 941 is not the form you're looking for?Search for another form here.

Keywords relevant to ct form amended

Related to ct gov drs ct941x form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.