Get the free Securities Fraud Claims on Behalf of Atlas Lithium ...

Get, Create, Make and Sign securities fraud claims on

Editing securities fraud claims on online

Uncompromising security for your PDF editing and eSignature needs

How to fill out securities fraud claims on

How to fill out securities fraud claims on

Who needs securities fraud claims on?

Securities fraud claims on form: A comprehensive how-to guide

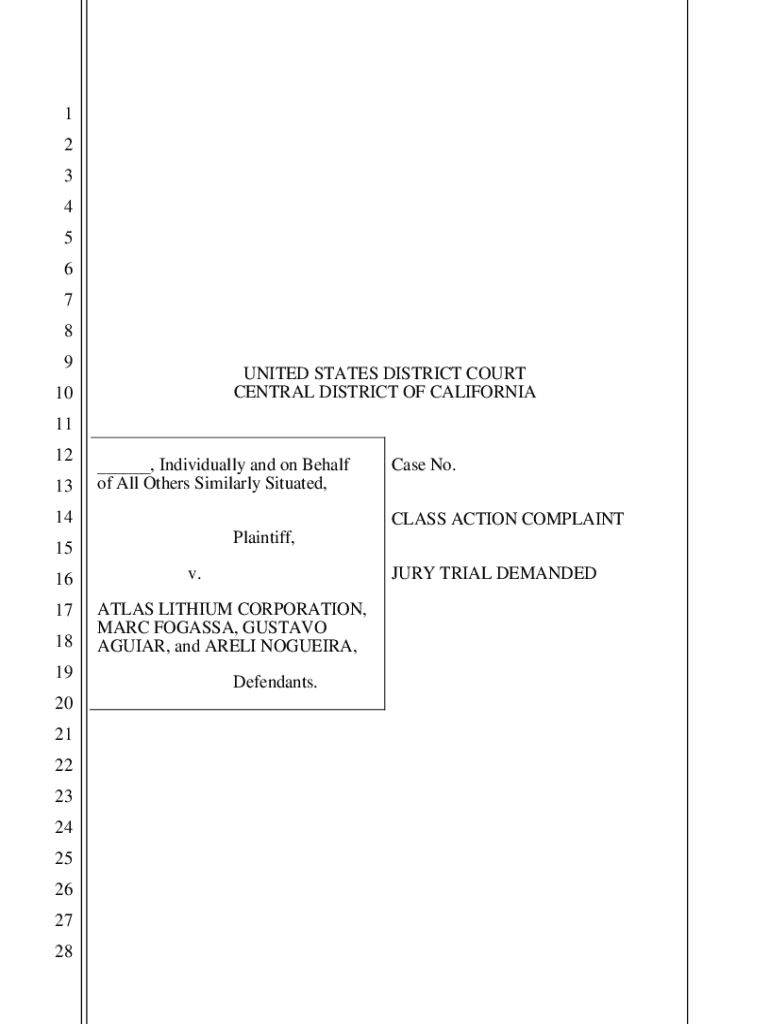

Understanding securities fraud

Securities fraud involves deceitful practices in the financial markets, which can cause significant harm to investors. It encompasses various illegal activities aimed at manipulating or misrepresenting information to gain financial benefits. This includes misleading statements about a company's performance, earnings, or projections that can influence stock prices.

Common types of securities fraud include insider trading, where individuals trade stocks based on non-public information; pump and dump schemes, whereby fraudsters inflate the price of a stock to sell at a profit before the price collapses; and Ponzi schemes, which lure investors with promises of high returns, paying earlier investors with the later ones' funds rather than legitimate profits.

The impact on investors and markets is profound. Victims often suffer significant financial losses, and the overall integrity of the markets is threatened, which can lead to reduced investor confidence.

Recognizing securities fraud claims

Identifying potential securities fraud claims begins with understanding common indicators of fraud. Potential investors need to be vigilant about signs that may suggest foul play. Among these indicators are unusually high returns that seem unrealistic compared to market averages, suggesting manipulation.

Other red flags include a lack of transparency from companies regarding their financial reporting and operations. Investors should also be cautious if they receive unsolicited investment offers from unknown sources or if they notice significant discrepancies in information provided by companies or brokers.

Legal definitions set forth by regulatory bodies establish that securities fraud includes various acts of misrepresentation or omission that can lead to investor losses. Understanding these standards is crucial in determining whether a claim may be valid.

Legal framework for securities fraud

The primary legal framework governing securities fraud includes key regulations such as the Securities Act of 1933 and the Securities Exchange Act of 1934. The former requires disclosure of important financial information to investors, while the latter addresses issues regarding the trading of securities and enforcement against fraudulent activities.

Jurisdictional considerations also play a critical role. Securities fraud claims can be adjudicated under federal law, predominantly managed by the Securities and Exchange Commission (SEC), or under various state laws. Depending on the circumstances, investors may need to navigate different legal pathways, as some jurisdictions might have additional regulations.

Moreover, regulatory bodies such as the SEC and the Financial Industry Regulatory Authority (FINRA) play pivotal roles in monitoring market activities and bringing fraud offenders to justice. Their efforts help to promote compliance and protect investors from deceptive practices.

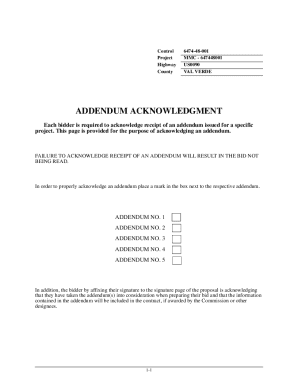

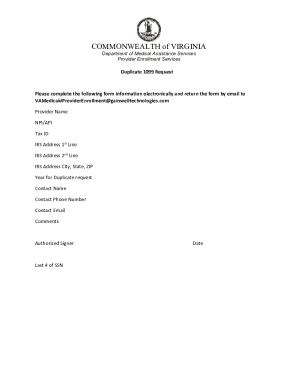

Filing a securities fraud claim using the form

When preparing to file a securities fraud claim, it is essential to understand how to complete the form accurately. Start by gathering all necessary information and documentation, such as personal identification and a comprehensive investment history, which presents a clear picture of your engagement in the affected securities.

The claim form typically consists of various sections where you’ll need to provide your personal information, elaborate on the specifics of the fraud, and detail the damages and losses incurred due to the fraudulent activities. It’s crucial to detail your experience, as this will aid in justifying your claim.

Common mistakes to avoid when filling out the form include not providing complete information or omitting vital details that correlate to your case. Ensuring accuracy and thoroughness is key to increasing the likelihood of your claim being considered valid.

Supporting your claim with documentation

Robust documentation is essential for establishing a credible securities fraud claim. Types of documentation to include might involve transaction records that track your investments, communications with brokers that note any misleading information or promises, and financial statements that highlight your losses.

Evidence is critical in supporting your claim. Compile all relevant documentation and ensure it’s well-organized. Presenting a strong case requires more than just verbal assertions; it necessitates solid proof in the form of records and documents that can corroborate your allegations of fraud.

The review process for securities fraud claims

After submission, what can you expect from the review process? Typically, the timeframe for claim reviews can vary significantly depending on the complexity of the case and the volume of claims being processed. During this period, the relevant regulatory body or court may assess the validity and merit of your claim based on the provided evidence.

Several factors may influence the review process, including the clarity of your documentation, the strength of your claims, and the legal standards applicable in your jurisdiction. Be prepared for questions or additional requests for information as your claim undergoes scrutiny.

Possible outcomes of securities fraud claims

The resolution of a securities fraud claim can lead to several different outcomes. A successful claim might result in various types of compensation, including monetary damages that reflect the losses suffered. Settlements may also be structured to offer compensation over time or through lump-sum payments, depending on the agreement reached.

Alternative dispute resolution methods, such as mediation and arbitration, can provide routes for resolving disputes without lengthy litigation. These options often lead to faster resolutions and can be more cost-effective for all parties involved.

Common questions about securities fraud claims

Navigating securities fraud claims can leave many investors with questions. One common concern is whether to file a claim independently or to seek an attorney's assistance. While it’s possible to handle claims without legal representation, consulting an expert can ensure your rights are fully protected, especially given the complexities involved.

Another frequent inquiry relates to claim denials. Potential claimants should understand their options if a claim is rejected — whether through appeal, resubmission with more evidence, or alternative legal routes. Additionally, knowing the statute of limitations for filing a claim is crucial; generally, investors have a limited time frame in which to act.

Engaging with professional services

Considering hiring legal assistance can be beneficial for dealing with securities fraud claims. A securities fraud attorney can provide substantial advantages, including deep knowledge of the legal landscape, effective navigation through complex regulatory processes, and strategic advice tailored to your circumstances.

Furthermore, utilizing tools like pdfFiller can streamline the document management process. With its interactive tools for form filling, along with organization and editing features, users can efficiently manage their claims, which is especially valuable when dealing with intricate legal paperwork.

Key resources for further assistance

For individuals seeking additional assistance with securities fraud claims, numerous resources are at your disposal. Regulatory bodies and consumer protection agencies provide valuable information regarding filing claims, managing securities, and navigating legal frameworks.

Legal aid organizations can also offer guidance, particularly for less affluent individuals. Additionally, utilizing platforms like pdfFiller enhances ongoing document management needs, providing access to templates and tools designed to assist in maintaining documentation throughout the claim process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my securities fraud claims on directly from Gmail?

How can I send securities fraud claims on for eSignature?

Can I edit securities fraud claims on on an Android device?

What is securities fraud claims on?

Who is required to file securities fraud claims on?

How to fill out securities fraud claims on?

What is the purpose of securities fraud claims on?

What information must be reported on securities fraud claims on?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.