Get the free Annual Report

Get, Create, Make and Sign annual report

How to edit annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual report

How to fill out annual report

Who needs annual report?

Navigating the Annual Report Form: A Comprehensive Guide

Overview of the annual report form

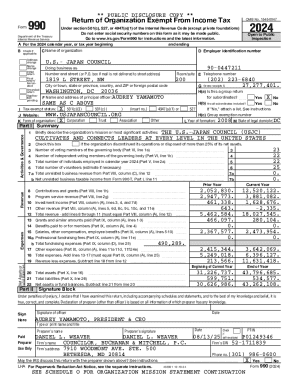

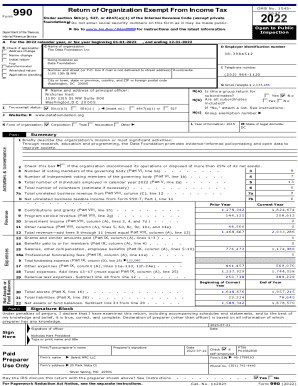

An annual report form is a crucial document that businesses and organizations must file to maintain compliance with state regulations. It provides a summary of the company's activities over the past year and typically includes essential information such as financial performance, ownership structure, and operational activities. The primary purpose of the annual report form is to keep stakeholders informed about the business's performance and facilitate transparency.

Filing an annual report form is vital for all businesses, including limited liability companies (LLCs) and corporations. This submission helps ensure that the entity remains in good standing within its state of incorporation and is essential for future business dealings, including securing loans or attracting investors. Understanding the key requirements and filing deadlines is crucial, as these can vary widely by state.

Understanding the structure of an annual report form

The structure of an annual report form can vary by state and industry but generally includes several key sections. Knowing what sections to expect can help streamline the completion process and ensure all necessary information is correctly provided. Most forms will require basic information about the business, including its name, address, and registration details.

A typical annual report form will comprise the following sections:

While the above sections are common, it's important to be aware that some states may have additional requirements or variations. For example, New York's Department of State (DOS) has specific forms for corporations and LLCs that may require supplementary information, so always check your state's guidelines.

Fees and costs associated with filing

Filing an annual report form typically incurs a standard fee set by the state’s secretary of state office. These filing fees can vary significantly across states, with some states charging less than $100, while others may require fees upwards of $500. It's essential to budget for these fees and take note of any state-specific requirements.

In addition to standard filing fees, businesses must be aware of late fees and penalties. Missing the deadline for filing your annual report can lead to additional costs and potential administrative penalties.

How to obtain the annual report form

Acquiring the annual report form is straightforward as most states make these forms available online through their official websites. Businesses can simply visit their state’s Department of State or Secretary of State website to find the appropriate form for their specific business type—be it an LLC or corporation.

Additionally, tools like pdfFiller offer a convenient alternative. Users can download the required annual report forms as PDF files, which can then be filled, edited, and signed directly within the platform.

Step-by-step guide to filling out the annual report form

Filling out the annual report form can seem daunting, but by following a structured approach, you can simplify the process and ensure you meet all requirements. Here’s a step-by-step guide to help you fill out your form effectively.

Begin by gathering all necessary documentation and information you’ll need to complete the form. This includes financial statements from the past year, the business identification numbers (like the DOS ID number), and information on any changes in ownership or management.

Common mistakes to avoid when filling out the annual report form

Avoiding common pitfalls is critical when completing your annual report form. Many businesses make the mistake of omitting critical information, which can lead to delays or penalties. Always double-check that you’ve included all necessary data, especially the business name and address, financial details, and ownership information.

Another common mistake stems from misunderstanding state-specific regulations. Different jurisdictions may have unique requirements that must be adhered to in the annual report form. Failure to comply can result in issues such as fines or losing good standing.

Frequently asked questions (FAQs)

Businesses frequently have questions about annual report filings. For instance, if you miss the deadline for submitting your annual report form, you may be subject to penalties, which can range from fines to administrative dissolution of the business entity. It's crucial to rectify the situation as soon as possible, which may involve filing for an extension if applicable.

Another common inquiry involves amending an annual report after submission. If you realize there are discrepancies in your information, most states allow you to submit amendments, but it’s essential to follow the correct procedures set forth by your particular Secretary of State's office.

Tracking your annual report status

Once your annual report form is submitted, it’s wise to track its status to ensure everything is processed as expected. Various states provide online tracking tools through their official websites. This allows businesses to monitor the submission's progress, verify that it has been accepted, and confirm that there are no outstanding issues. It’s often recommended to check the status within a few days after submission for peace of mind.

Understanding response times from state offices can also vary. Generally, it's advisable to allow two to four weeks for processing, after which you'll receive confirmation of your filing via email or mail.

Using pdfFiller for managing your annual report form

pdfFiller offers an innovative solution for individuals and teams to manage their annual report forms efficiently. With its cloud-based platform, pdfFiller provides users with comprehensive document management capabilities, allowing them to create, edit, and collaborate on documents seamlessly.

Accessibility is one of the prime benefits of pdfFiller; users can access their forms and documents from any device, making it easier than ever to prepare and file necessary paperwork, regardless of location.

Contact information for state divisions

Businesses often require direct access to state-specific resources when filing their annual report forms. Most states have dedicated sections on their official websites, where users can find forms, guidelines, and contact methods for inquiries. For example, the New York Department of State provides ample resources relevant to LLCs and corporations, including direct links to their reporting requirements and contact information for assistance.

Knowing how to reach out to these state divisions can help clarify any confusion regarding specific requirements or filing processes. Typically, states offer several contact methods, including phone numbers, email addresses, and sometimes live chat options to address your concerns promptly.

Engaging with pdfFiller’s features

pdfFiller is packed with innovative tools designed to enhance the user experience for handling annual report forms. Many users enjoy utilizing interactive elements, such as digital signatures and real-time collaboration features, which enable efficient teamwork while handling important documents. As businesses operate within a fast-paced environment, having such tools can simplify many administrative tasks.

User testimonials often highlight how pdfFiller's comprehensive features have improved their document management processes. Companies utilizing the platform frequently note enhanced productivity and decreased turnaround times for critical filings like annual reports.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute annual report online?

How do I fill out the annual report form on my smartphone?

How do I complete annual report on an Android device?

What is annual report?

Who is required to file annual report?

How to fill out annual report?

What is the purpose of annual report?

What information must be reported on annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.