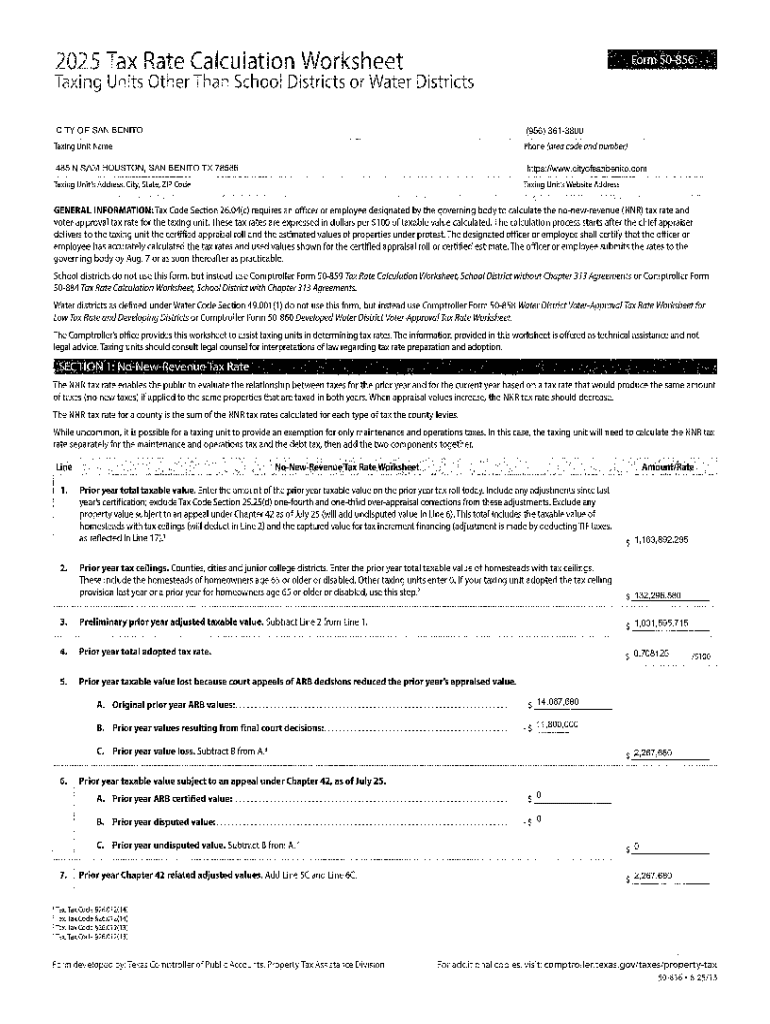

Get the free 2025 Tax Rate Calculation Worksheet

Get, Create, Make and Sign 2025 tax rate calculation

Editing 2025 tax rate calculation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 tax rate calculation

How to fill out 2025 tax rate calculation

Who needs 2025 tax rate calculation?

2025 Tax Rate Calculation Form: A Comprehensive Guide

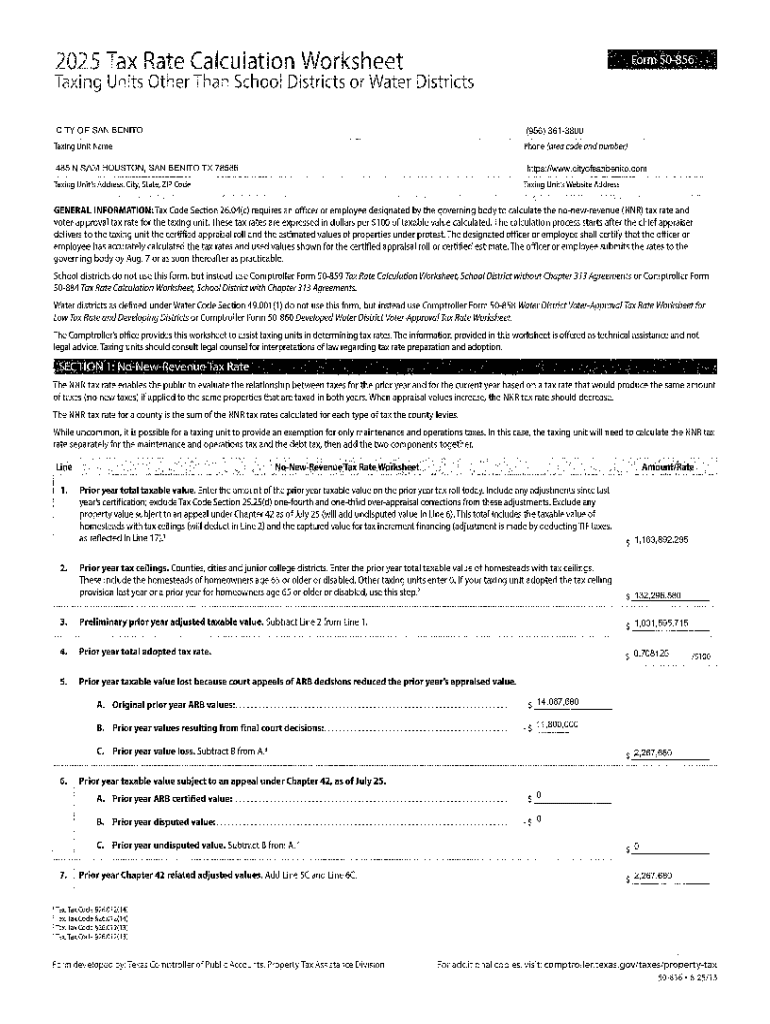

Overview of the 2025 tax rate calculation form

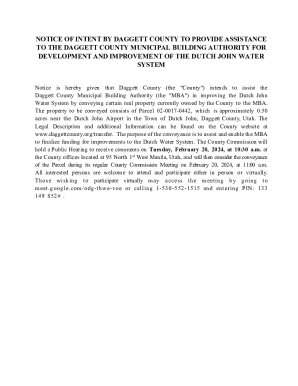

Accurate tax calculations are crucial for both individuals and businesses to ensure compliance with tax laws and to prevent overpayment. The 2025 tax rate calculation form incorporates several key updates that address the current economic landscape. Notably, adjustments to income thresholds and deductions may affect tax liability. Understanding how these tax rates are determined will help taxpayers make informed financial decisions.

Accessing the 2025 tax rate calculation form

Individuals looking to access the 2025 tax rate calculation form can conveniently find it online. The form is available through multiple channels, including the IRS website and dedicated tax preparation platforms. However, utilizing pdfFiller streamlines the process with a user-friendly cloud-based solution that enhances accessibility.

To start, users should create an account on pdfFiller, which allows them to access the form from anywhere, whether at home or on-the-go. This means you can work on your tax calculations anytime you need to, making tax season much less stressful.

Key components of the 2025 tax rate calculation form

The 2025 tax rate calculation form is structured into several essential sections, each playing a vital role in determining an individual's overall tax obligation. Understanding these components is crucial for accurate reporting and maximizing potential tax benefits.

The interplay between these components is vital. For instance, knowing how to leverage deductions may lead to substantial tax savings, thereby affecting the final tax rate applied.

Step-by-step guide to filling out the 2025 tax rate calculation form

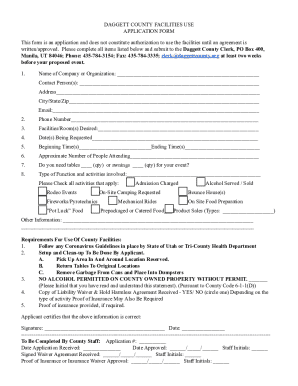

Filling out the 2025 tax rate calculation form requires careful preparation and attention to detail. First, gather all necessary documents before beginning the form, including identification documents and income statements such as W-2s or 1099s.

Next, follow these detailed instructions for each section of the form:

Common mistakes to avoid include misreporting income amounts, missing applicable deductions, and overlooking updated tax rules that may impact your calculations.

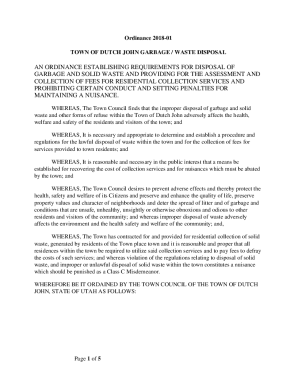

Editing and customizing the 2025 tax rate calculation form

pdfFiller provides extensive editing tools that allow users to customize their 2025 tax rate calculation form as needed. These features enable you to annotate the document, add comments for collaborators, and change field types or formats to better suit your needs.

Collaboration is made easier by pdfFiller, as users can invite team members to access and contribute to the form simultaneously. This seamless communication can significantly speed up the completion of tax-related documentation.

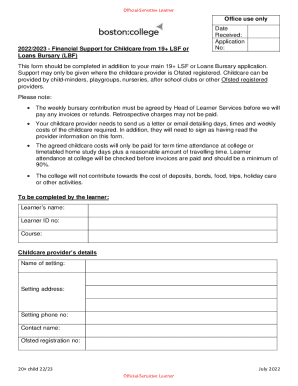

eSigning your 2025 tax rate calculation form

The eSigning process for the 2025 tax rate calculation form is straightforward with pdfFiller. Users can easily set up signatures, add signers, and manage the order in which signatures are obtained. This electronic method not only saves time but also enhances security and ensures the integrity of your document.

Understanding how to effectively implement eSigning can aid in expediting the submission process, allowing users to meet deadlines without the stress of traditional paper forms.

Submitting the 2025 tax rate calculation form

Submitting the 2025 tax rate calculation form comes with specific guidelines. Users need to decide between electronic submission via platforms like pdfFiller or traditional paper submission. Each method has its advantages and drawbacks. Electronic submission is quicker and reduces the likelihood of lost forms, whereas paper submission may provide a tangible record.

Deadlines for submission must be noted carefully; failing to meet these can result in penalties or fees. Staying organized is key during tax season.

Managing your tax documents after submission

After submitting the 2025 tax rate calculation form, it is crucial to manage your tax documents efficiently. pdfFiller offers secure cloud storage solutions that allow users to save their documents safely. Ensuring easy access to your tax materials can expedite handling potential follow-ups or future queries from tax authorities.

Additionally, users can generate reports and access historical data as needed. This is especially useful for individuals who want to track financial growth over the years or for businesses that need to analyze tax trends.

FAQs about the 2025 tax rate calculation form

Several common questions arise when dealing with the 2025 tax rate calculation form. Addressing these queries can elevate users' understanding and execution of tax submissions. Queries often include details about specific deductions, filing statuses, and rates.

When encountering issues, users can consult expert resources or tools provided by pdfFiller to troubleshoot effectively.

Additional tools and resources

Beyond the standard form, users can benefit from interactive tax calculators that provide an estimation of potential tax obligations. These tools serve as a preliminary step before calculations on the 2025 tax rate calculation form. Furthermore, understanding recent changes in tax laws can equip users with knowledge to make the best financial decisions.

Links to official tax law documents and guidance can help users navigate complex regulations, ensuring compliance and maximization of benefits. Working with tax professionals, particularly those using pdfFiller, can also enhance accuracy and reduce the stress often associated with tax time.

Best practices for future tax calculations

Effective tax planning requires keeping records organized throughout the year. By utilizing pdfFiller, users can maintain a digital record of important documents which simplifies tax preparation. Regularly updating this information ensures that nothing vital is misplaced.

Additionally, staying informed about changes in tax regulations can lead to better financial planning. Continuing to utilize tools offered by pdfFiller will empower both individuals and teams in managing tax documents efficiently for years to come.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 2025 tax rate calculation in Gmail?

How do I edit 2025 tax rate calculation straight from my smartphone?

How do I fill out 2025 tax rate calculation using my mobile device?

What is tax rate calculation?

Who is required to file tax rate calculation?

How to fill out tax rate calculation?

What is the purpose of tax rate calculation?

What information must be reported on tax rate calculation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.