Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

How to Fill Out Form 990

Understanding Form 990

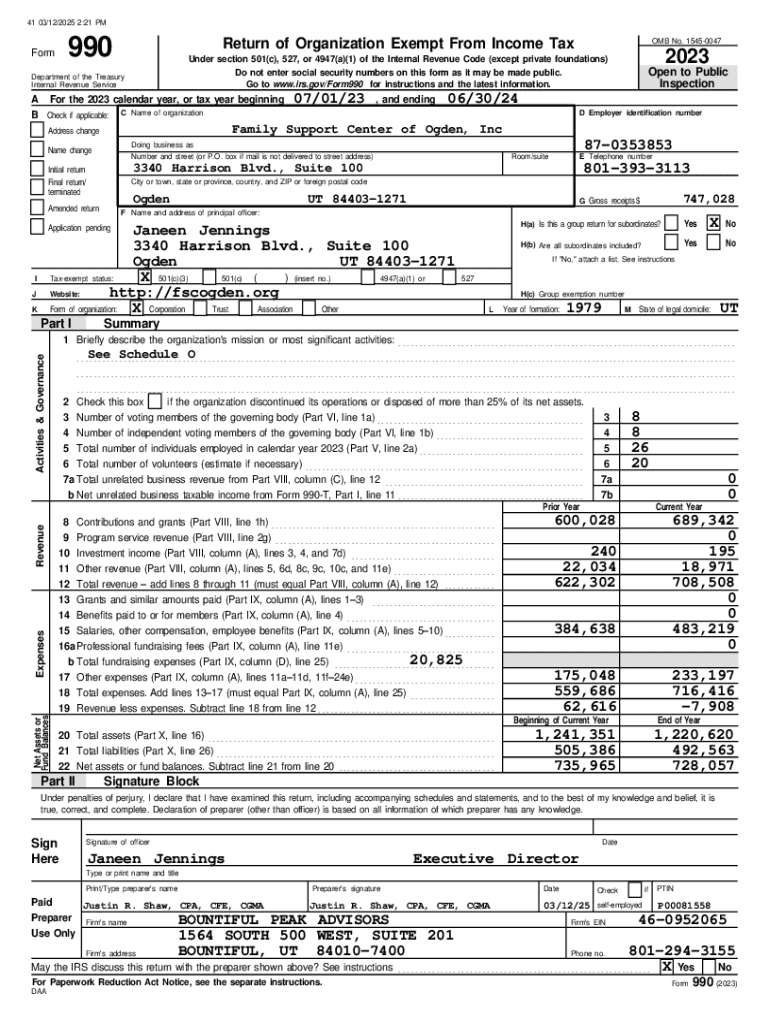

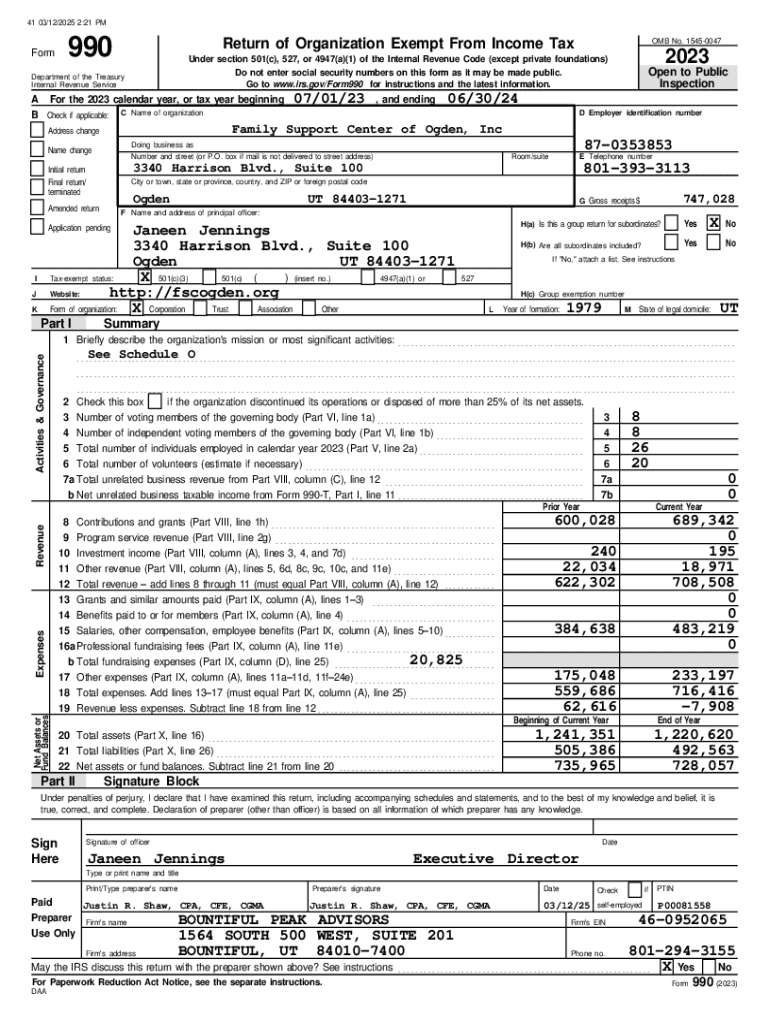

Form 990 is a vital document for tax-exempt organizations in the United States, allowing them to report financial information to the IRS. The form serves multiple purposes: it provides a clear view into the financial activities of these organizations, promoting transparency and public accountability. By requiring organizations to disclose their financial operations, Form 990 plays an essential role in maintaining the trust between the organizations and their stakeholders, from donors to beneficiaries.

The significance of Form 990 goes beyond mere compliance with tax regulations; it fosters a culture of openness. By making financial data publicly available, Form 990 enables potential donors, government organizations, and the general public to evaluate the efficiency and integrity of non-profits. As such, its importance cannot be overstated in the context of organizational governance and operational transparency.

Who needs to file Form 990?

Not all organizations are required to file Form 990. Typically, tax-exempt organizations with gross receipts of $200,000 or more, or total assets of $500,000 or more, must file this form. However, many smaller organizations may qualify to file Form 990-EZ or even the 990-N, also known as the e-Postcard. Identifying which category your organization falls into is the first step in the filing process.

Key features of Form 990

Form 990 comprises several distinct sections designed to capture a wide array of information about the organization's governance, financial health, and operational achievements. Understanding these sections is crucial for completing the form accurately. Initially, the form requires basic organization information, including its governance structure and mission statement.

Subsequent sections demand a comprehensive overview of the organization's financial operations, detailing revenue sources, expenditures, and program services. There's also a focus on governance and management practices, which illustrates how the organization ensures compliance with IRS regulations. Different organizations might face unique reporting requirements or relevant adjustments, making familiarity with these elements essential for all involved in the filing process.

Preparing for Form 990 submission

Before diving into the details of Form 990, it is essential to gather all necessary documents and financial records. This preparation includes compiling previous tax returns, statements of revenue, and financial statements reflecting the organization's activities during the reporting period. Ensuring accurate bookkeeping practices is paramount, as errors can lead to significant questions from the IRS or result in penalties.

Common documents to have on hand include payroll records, donor lists, and receipts for significant expenditures. Keeping these financial records well-organized helps in not only completing Form 990 accurately but also in defending against possible audits or inquiries from the IRS.

Understanding reporting periods and deadlines

Form 990 can correspond to either a fiscal year or a calendar year, depending on the organization's accounting practices. Understanding the chosen reporting period is crucial as it determines the filing deadline. Most organizations must file Form 990 by the 15th day of the 5th month after the end of their fiscal year unless an extension is granted, which can give an organization an additional six months.

Detailed guide to completing Form 990

Step-by-step breakdown of each section

Organization information (Part )

The first part of Form 990 requires vital organizational details, including the name, address, and mission of the organization. It also asks for information regarding the governance structures, such as the board of directors and any key governing policies. Addressing these areas not only fulfills IRS requirements but also enhances transparency.

Financial information (Part )

The financial section of Form 990 focuses on a detailed overview of the organization's revenue and expenditures. This section requires comprehensive reporting on all sources of income, such as contributions, grants, and program service revenue. It's critical to present a clear picture of financial health, as discrepancies could heighten scrutiny from the IRS.

Program service accomplishments (Part )

In this section, organizations must articulate their mission and the impact of their programs. Effectively communicating the accomplishments not only fulfills requirements but also enhances donor confidence. Highlighting specific programs and their outcomes demonstrates accountability and strategic success.

Governance, management, and disclosure (Part )

Form 990 requires a detailed disclosure of governance practices, such as board composition and conflict of interest policies. Transparent reporting can positively impact how stakeholders perceive the organization. This section aims to establish credibility and showcase adherence to ethical standards in management.

Compliance and internal controls (Part )

Part V focuses on compliance with IRS regulations and the internal controls the organization has in place. Demonstrating commitment to regulatory standards is not only crucial for legal compliance, but it is also a strong signal of responsible governance.

Tips for ensuring accuracy and completeness

Common mistakes to avoid

One of the most common pitfalls in completing Form 990 is failure to check for consistency among figures reported in different sections. Another frequent issue is neglecting to provide all required signatures or additional explanations where needed. This lack of thoroughness can lead to inquiries or delays from the IRS.

To avoid these mistakes, organizations should implement a robust internal review process before submission. It's often beneficial to have a second set of eyes review the information to ensure that the details are complete and accurate.

Using technology to streamline the process

Utilizing tools such as pdfFiller can dramatically ease the Form 990 completion process. pdfFiller provides a user-friendly platform to edit, eSign, and manage documents securely in a cloud-based environment. These features are particularly advantageous for teams working remotely, where collaboration is key.

What to do after filing Form 990

Keeping records of your submission

Once Form 990 has been submitted, retaining copies of the completed form and all supporting documentation is crucial. These records not only serve as a reference for future filings but are also essential in the event of an IRS audit. The organization should establish a systematic filing and retrieval process to ensure that important documents are readily accessible.

Responding to IRS inquiries

If the IRS reaches out with questions regarding the submitted Form 990, it’s vital to respond promptly and accurately. Preparing for potential inquiries by having detailed records and explanations at the ready can significantly simplify this process. Working with a tax professional or an adviser who specializes in non-profit compliance can also provide further peace of mind.

Frequently asked questions (FAQs) about Form 990

What is a pro forma IRS Form 990?

A pro forma IRS Form 990 is a draft or template version of the Form 990 that substitutes for a final version used for strategic planning or internal review purposes. It is not submitted to the IRS but may help organizations prepare and review financials before the actual filing.

How to amend a submitted Form 990?

To correct an error in a submitted Form 990, organizations must file Form 990X, the Amended Return. This form allows organizations to correct any errors or make necessary adjustments to previously filed returns, ensuring compliance with IRS regulations.

Special circumstances for smaller organizations

Smaller organizations may qualify to file a streamlined version known as 990-EZ, which has simpler reporting requirements. Organizations with gross receipts of less than $200,000, or total assets under $500,000, use this form to meet their filing requirements sans the full complexity of Form 990.

Support and resources for Form 990 filers

External resources and guides

The IRS provides a wealth of resources for Form 990 filers, including publication updates that detail changes and best practices for completion. Engaging with these materials can foster understanding of the regulations governing Form 990 and how they apply to specific organizational contexts.

Utilizing the pdfFiller community

Connecting with the pdfFiller community can also be advantageous. The platform hosts forums where users exchange tips, share experiences, and offer guidance on navigating various tax forms, including Form 990. Leveraging community knowledge can make a tangible difference in successfully completing the filing process.

Interactive tools and enhancements

Interactive templates available on pdfFiller

pdfFiller offers a range of interactive templates designed specifically for Form 990. These templates are friendly to use and allow organizations to input data directly into the form fields. Moreover, they ensure that the format remains compliant with IRS requirements, facilitating a smoother filing experience.

Features for collaborative document management

The collaborative document management features provided by pdfFiller allow teams to work together effectively on Form 990. Whether sharing comments, suggestions, or revisions, maintaining a cohesive workflow becomes significantly more manageable, leading to better accuracy and increased efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 990?

How do I make edits in form 990 without leaving Chrome?

Can I create an electronic signature for signing my form 990 in Gmail?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.