Get the free FORM N-2 - SEC EDGAR Filings Search Alert

Get, Create, Make and Sign form n-2 - sec

Editing form n-2 - sec online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form n-2 - sec

How to fill out form n-2 - sec

Who needs form n-2 - sec?

SEC Form N-2: A Comprehensive Guide for Filers

Understanding SEC Form N-2

SEC Form N-2 is a crucial document required for closed-end investment companies. It serves as the registration statement for these funds, detailing essential financial and operational information that helps both regulators and investors understand the fund's structure and risk profile.

The N-2 form is important for ensuring transparency and accountability in investment practices. It guides investors through the complexities of investment strategies and outlines the fund's objectives, making it easier to assess their suitability.

Who Needs to File Form N-2?

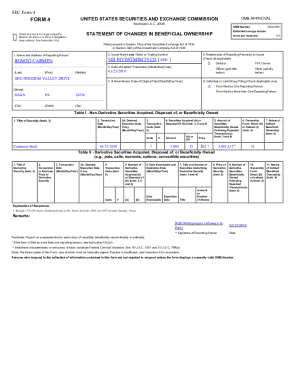

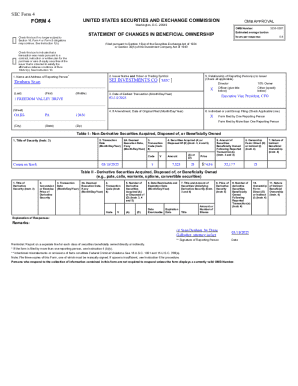

The requirement to file SEC Form N-2 primarily falls on closed-end investment companies. These funds, as established entities in the investment landscape, must disclose comprehensive details to their stakeholders. Fund managers and issuers also play a significant role in the filing process, ensuring that all required components of the form are accurately completed.

Certain exemptions can apply, especially for funds that do not fall into the traditional closed-end category. For example, open-end funds and mutual funds may not need to file this specific form, although they must comply with other SEC regulations.

Compliance guidelines for Form N-2 filers

Filing SEC Form N-2 involves adhering to specific deadlines that depend on the fund's size, structure, and operational complexity. Generally, an initial filing must be submitted before the fund commences operations, with subsequent updates required annually or as significant changes occur. Larger funds may find themselves facing more stringent compliance schedules.

Staying updated on regulatory changes affecting the N-2 form is vital for filers. Recent amendments have adjusted specific reporting requirements, and it is recommended that fund managers regularly review these changes to avoid penalties. Keeping abreast of anticipated future modifications can further smooth the compliance process.

Step-by-step instructions for completing SEC Form N-2

Completing SEC Form N-2 can be daunting, but breaking it down into manageable sections can simplify the process. Each section requires specific information that contributes to the overall understanding of the fund's mechanics. This includes summarizing investment objectives, elucidating strategies, and detailing risk exposure.

Common pitfalls include inaccuracies in financial statements and omission of risk factors. To avoid these errors, careful attention to detail is essential. Fund managers should consider utilizing digital tools to enhance form accuracy and ensure that all required components are appropriately filled out.

Tools and resources for effective form management

Leveraging digital solutions such as pdfFiller can streamline the management of SEC Form N-2. pdfFiller provides users the capability to edit documents online, ensuring accuracy and compliance with regulatory requirements. It's an essential tool for fund managers looking to enhance efficiency in their filing processes.

Additionally, team collaboration features available on pdfFiller facilitate simultaneous work on the N-2 form. The ability to share, comment, and track changes not only increases productivity but also minimizes errors that could arise from miscommunication or lack of information.

Navigating the e-signing process

Obtaining electronic signatures for SEC Form N-2 is streamlined with tools such as pdfFiller. Compliance with e-sign laws must be ensured, which includes consent from all parties involved in the signature process. pdfFiller simplifies this step significantly, allowing seamless e-signature integration within the document management workflow.

Secure document management is paramount when handling sensitive information. Fund managers should implement best practices to safeguard data during and after the signing process, ensuring that compliance and privacy are maintained throughout.

Analyzing how closed-end investment companies are impacted by Form N-2

Accurate and timely filings of SEC Form N-2 can have significant financial implications for closed-end investment companies. Inaccuracies in the filings can deter investors, lead to regulatory penalties, and negatively affect market performance. Past case studies highlight instances where improper submissions resulted in investor dissatisfaction and subsequent declines in capital inflow.

Conversely, companies that maintain rigorous compliance and provide transparent information often see increased investor confidence and market enthusiasm. The relationship between transparent filings and investor sentiment is vital, reinforcing the need for accurate and prompt completion of Form N-2.

Future outlook on Form N-2 regulations

Anticipations regarding SEC Form N-2 suggest an evolving regulatory landscape. Upcoming regulations may tighten requirements regarding disclosures, risk factor explanations, and financial reporting. This evolution reflects increasing scrutiny from regulators aimed at protecting investors and ensuring the integrity of the market.

Furthermore, technological advancements are projected to continue influencing how forms like N-2 are filed. The use of digital platforms enhances accessibility and user experience, allowing fund managers to adapt quickly to changes and ensure compliance.

Frequently asked questions about SEC Form N-2

New filers often have questions surrounding the nuances of SEC Form N-2. Common misunderstandings include the scope of required disclosures and the implications of non-compliance. Addressing these queries helps create a clearer framework for fund managers and issuers navigating the regulatory environment.

Expert answers typically emphasize the importance of accuracy and thoroughness when completing Form N-2. Input from experienced fund managers can provide valuable insights, which help new filers avoid pitfalls and enhance their submission processes.

Related insights and industry trends

The dynamics of SEC Form N-2 filings are closely tied to broader market trends, particularly in the realm of closed-end funds. Current economic conditions, such as interest rates and inflation, can significantly influence fund advocacy strategies and investor participation. Monitoring these conditions is essential for effective fund management.

Successful filings often correlate with proactive engagement from fund managers. Being vigilant about updates, regulations, and market sentiment can help firms adapt their filings effectively and optimize their chances for success in competitive markets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form n-2 - sec to be eSigned by others?

How do I edit form n-2 - sec in Chrome?

How do I edit form n-2 - sec straight from my smartphone?

What is form n-2 - sec?

Who is required to file form n-2 - sec?

How to fill out form n-2 - sec?

What is the purpose of form n-2 - sec?

What information must be reported on form n-2 - sec?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.