Get the free wv state tax withholding form

Get, Create, Make and Sign wv state tax withholding

Editing wv state tax withholding online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wv state tax withholding

How to fill out west-virginia-state-tax-withholding-tax-information

Who needs west-virginia-state-tax-withholding-tax-information?

West Virginia State Tax Withholding Tax Information Form: A Comprehensive How-To Guide

Understanding West Virginia State Tax Withholding

State tax withholding is the process by which employers deduct a portion of an employee's wages to cover their income tax liability. In West Virginia, this is crucial for both employees and employers, ensuring that individuals contribute to state revenues while avoiding large tax bills at year-end.

By accurately withholding state taxes, employees can manage their tax liabilities effectively, while employers fulfill their legal obligations and help maintain compliance with state tax regulations. The withholding process plays a vital role in effective budget management for both parties.

Eligibility for Withholding

Determining who needs to withhold tax in West Virginia depends on the nature of employment. Generally, employers are responsible for withholding for their employees, whereas independent contractors handle their own tax obligations. It's essential to classify workers correctly, as misclassification can lead to penalties.

For employees, all full-time workers are required to have state taxes withheld, while part-time workers can also be subject to withholding if their earnings meet certain thresholds. Seasonal workers, too, may have withholding requirements based on the duration and nature of their employment.

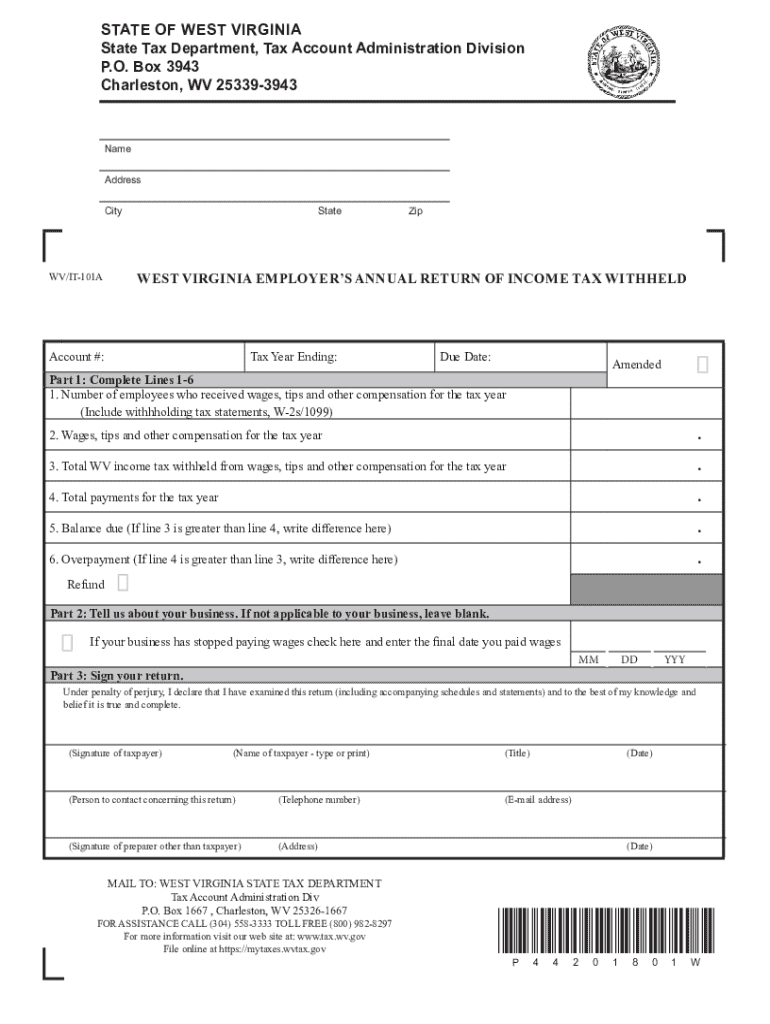

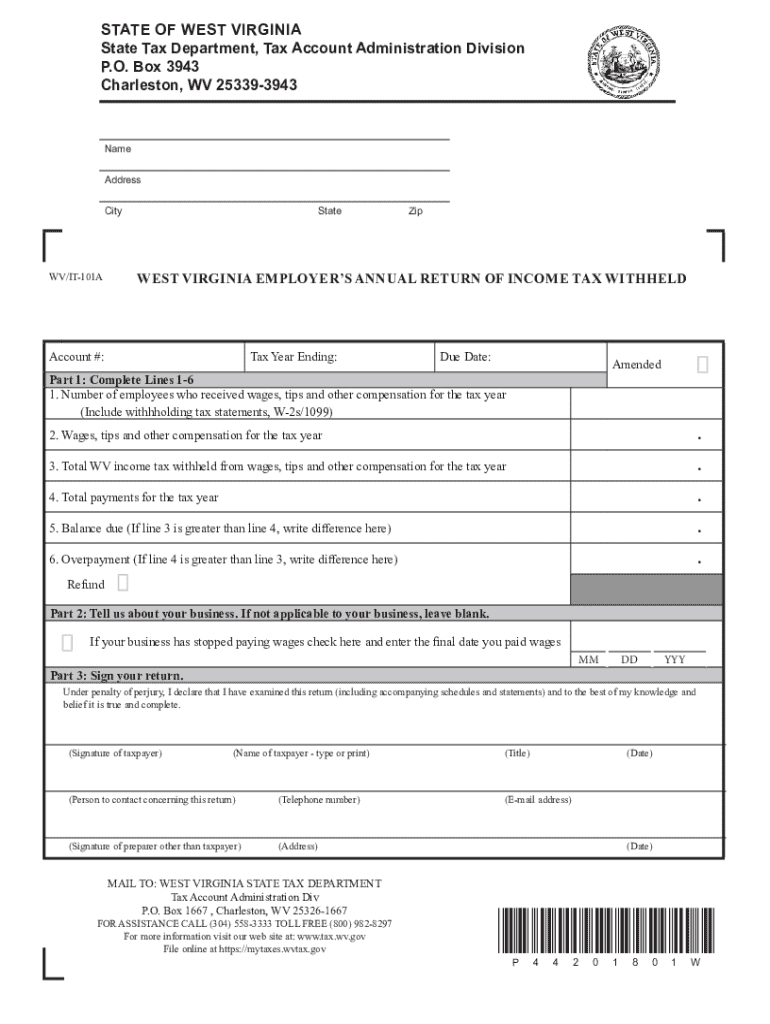

Overview of the West Virginia State Tax Withholding Tax Information Form

The West Virginia State Tax Withholding Tax Information Form is crucial for both employees and employers to effectively manage tax liabilities. This form collects important personal information and allowances that affect the amount of tax withheld from wages. Completing it accurately ensures that the correct amount is withheld, preventing any surprises come tax season.

Filling out this form is not only a best practice; it's a requirement. Submission deadlines typically align with new employment or changes in tax status. Not withholding the correct amount can lead to financial penalties and complications for both employees and employers.

Step-by-step guide to completing the form

Completing the West Virginia State Tax Withholding Tax Information Form can seem daunting, but breaking it down into manageable steps simplifies the process. Here’s how to proceed.

Step 1 is to gather necessary information. You’ll need your Social Security number, employer information, and details regarding your tax filing status. This initial step is critical to ensure accuracy in later sections.

Next, in Step 2, fill out the form meticulously. The Personal Information Section requires your name and address. In the Withholding Allowances, you will declare the number of allowances you’re claiming based on your situation. Additional Withholding Options offer flexibility for those who wish to withhold more than the standard amount.

Step 3 reminds you to thoroughly review your form. Double-check your Social Security number and the allowances section, as mistakes here can alter your tax withholding entirely. Common pitfalls include incorrect figures or missing fields.

Finally, in Step 4, submit the form. You can typically do this electronically through your employer's payroll system or as a physical document. Be mindful of deadlines to ensure compliance and proper withholding practices.

Managing your withholding information

Managing your withholding information is essential for both your financial planning and compliance with West Virginia tax laws. Regularly reassessing your withholding status can help prevent over- or under-withholding, thereby impacting your paycheck and tax return.

If you experience significant life events, such as marriage, a new job, or the birth of a child, it's wise to update your withholding status. Keeping your personal information current, such as an address change or a name change, can be done easily through your employer or directly on the form.

FAQs about West Virginia withholding tax

Frequently asked questions often revolve around common withholding concerns. If you find yourself questioning whether you're withholding the correct amount, it may be beneficial to consult with a tax professional or utilize state resources.

For example, if you over-withhold taxes, you may receive a refund when you file your state tax return; however, you should also consider whether that situation is ideal for your budgeting. Additionally, understanding how to calculate the correct amount is essential to avoid financial hiccups.

Benefits of using pdfFiller for withholding forms

Using pdfFiller to manage your West Virginia State Tax Withholding Tax Information Form provides several benefits that enhance efficiency and accuracy. With seamless editing options, users can easily modify their forms in real-time, making it convenient to keep information up-to-date.

Moreover, pdfFiller includes eSigning capabilities, allowing for quick and legally binding signatures, thus reducing delays in document processing. Furthermore, teams can take advantage of collaborative features to work together effortlessly on their forms and ensure accuracy.

The cloud-based management aspect of pdfFiller allows for accessing documents from anywhere, at any time, making it an invaluable tool in today’s mobile-driven world.

Compliance and legal information

Understanding the legal framework surrounding withholding in West Virginia is key for both employers and employees. This includes knowledge of pertinent state regulations that dictate correct withholding practices. Employers should stay current on laws administered by the West Virginia Tax Division to avoid costly missteps.

Noncompliance can lead to serious repercussions such as financial penalties and interests due on tax discrepancies. Thus, familiarity with compliance measures is essential to safeguard against any unforeseen liabilities.

User testimonials

Success stories from users of pdfFiller demonstrate how the platform has revolutionized document management, particularly regarding tax forms. Users appreciate the intuitive design that streamlines the process of completing and submitting the West Virginia State Tax Withholding Tax Information Form.

Many have highlighted the efficiency gained through collaborative tools that enable teams to work together in real-time, ensuring accuracy and adherence to deadlines. Such testimonials underscore the value of utilizing pdfFiller for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find wv state tax withholding?

How do I edit wv state tax withholding online?

Can I edit wv state tax withholding on an iOS device?

What is west-virginia-state-tax-withholding-tax-information?

Who is required to file west-virginia-state-tax-withholding-tax-information?

How to fill out west-virginia-state-tax-withholding-tax-information?

What is the purpose of west-virginia-state-tax-withholding-tax-information?

What information must be reported on west-virginia-state-tax-withholding-tax-information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.