Get the free (Decedent) STATE OF OHIO COUNTY OF - Affidavit Forms

Get, Create, Make and Sign decedent state of ohio

Editing decedent state of ohio online

Uncompromising security for your PDF editing and eSignature needs

How to fill out decedent state of ohio

How to fill out decedent state of ohio

Who needs decedent state of ohio?

Decedent state of Ohio form: A comprehensive guide

Understanding decedent state of Ohio forms

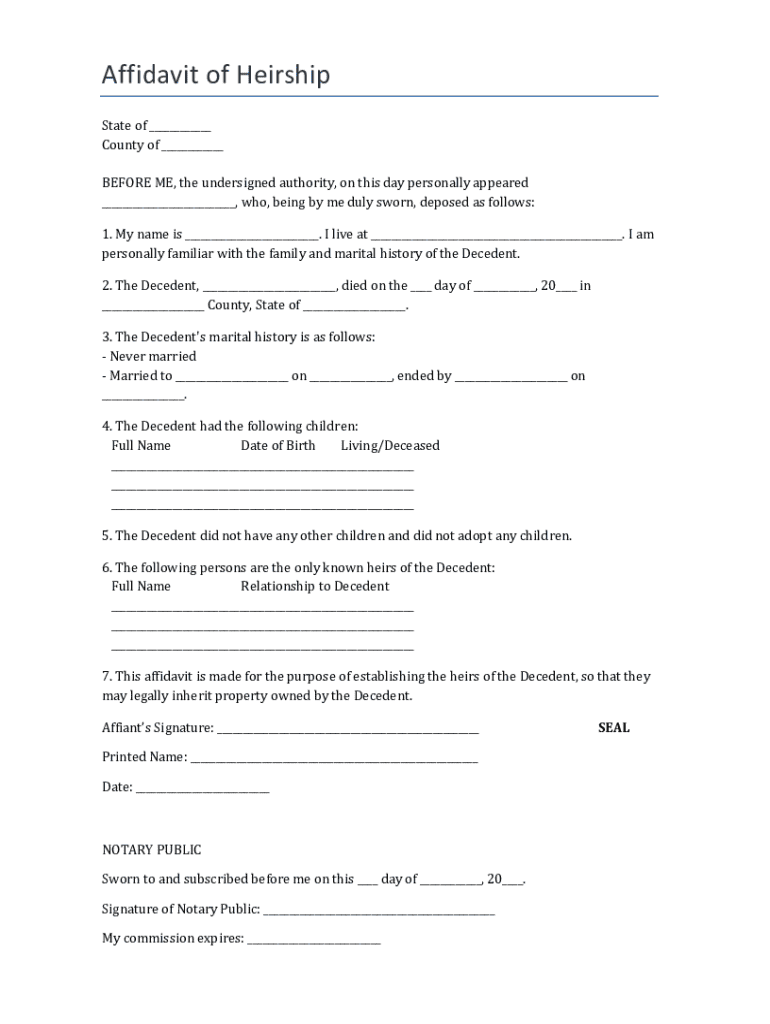

In Ohio, a decedent refers to a person who has passed away, and handling their estate typically requires the completion of various legal forms. These 'decedent state of Ohio forms' are essential for estate management, ensuring that the deceased's assets are distributed according to their wishes and the laws governing the state. The probate process in Ohio can be complex, involving court oversight to validate the will and ensure equitable distribution among heirs or beneficiaries.

Accurate and timely completion of these forms is crucial. Failure to provide the correct information can delay the probate process and potentially lead to legal issues that may complicate the distribution of the estate. Therefore, understanding each form and its requirements is imperative for executors and administrators managing a deceased person's estate.

Key decedent forms in Ohio

Ohio's probate process includes several essential forms that the executor of an estate must complete. Each of these forms plays a specific role in the overall management of the estate. Here’s an overview of the primary forms you’ll need to consider:

Step-by-step guide to completing a decedent state of Ohio form

Completing decedent forms in Ohio can be streamlined by following a clear step-by-step approach:

It's worth noting common pitfalls to avoid while filling out these forms, such as missing signatures, failing to list all assets, or not adhering to Ohio's specific legal guidelines.

Interactive tools for managing decedent forms

To optimize the process of completing decedent forms, several online tools can assist. One of the standout solutions is pdfFiller, which streamlines the business of form management seamlessly.

With pdfFiller, you can efficiently edit, sign, and collaborate on decedent forms in a user-friendly environment. Here are some valuable features offered by pdfFiller specifically for handling decedent state of Ohio forms:

Common issues and how to resolve them

Even experienced administrators may face challenges when completing decedent forms in Ohio. Here are common issues and strategies for resolving them:

Additionally, FAQs regarding the decedent estate process can address specific concerns, including how to navigate unforeseen circumstances and ensuring compliance with Ohio probate court requirements.

Finalizing and submitting your forms

Once forms are completed, it’s essential to finalize them before submission. This involves a thorough review for accuracy and completeness, ensuring no details have been overlooked.

In Ohio, you have the option to submit forms electronically through the probate court's online systems or via conventional mail. Familiarize yourself with the specific submission methods for the court that will handle your case.

After submission: What to expect

Once your decedent forms are submitted, it’s important to know what follows. The timeline for processing decedent forms in Ohio can vary, but generally, you can expect a review period of a few weeks.

Be prepared for potential follow-up communications from the probate court, which may request additional documentation or clarification on submitted forms. It's vital to respond swiftly to any such requests to facilitate smooth progress through the probate process.

Navigating the probate court system

Understanding the court system's layout is crucial after submitting your decedent forms. Familiarize yourself with what to expect from probate proceedings, including potential hearings and interactions with justices, judges, or magistrates regarding your case.

Every probate office will have specific guidelines for communication. Knowing these guidelines can ensure your inquiries and follow-up questions are addressed promptly, assisting in smooth estate management and minimizing any frustrations.

Leveraging technology for estate management

Utilizing a robust document management solution like pdfFiller can substantially enhance your experience during estate management. With its cloud-based features, pdfFiller offers flexibility and accessibility, meaning you can manage decedent forms from any location.

This technology empowers executors and teams involved in the probate process to collaborate effectively, making document handling and review far more efficient. By streamlining the documentation process, you can focus your efforts on ensuring that the decedent’s wishes are honored without being bogged down by administrative tasks.

Stay organized: Tips for estate executors

Being organized is essential when managing a decedent's estate. Keeping all documentation in order not only helps in adhering to deadlines but also makes communication with the probate court more effective.

By staying organized, executors can help alleviate some of the stress associated with the probate process, ensuring that the estate is managed smoothly and in accordance with state laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my decedent state of ohio directly from Gmail?

How do I fill out the decedent state of ohio form on my smartphone?

How do I edit decedent state of ohio on an iOS device?

What is decedent state of ohio?

Who is required to file decedent state of ohio?

How to fill out decedent state of ohio?

What is the purpose of decedent state of ohio?

What information must be reported on decedent state of ohio?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.