IRS 13615 2025-2026 free printable template

Get, Create, Make and Sign 13615 form

Editing irs form vita pdf online

Uncompromising security for your PDF editing and eSignature needs

IRS 13615 Form Versions

How to fill out irs form volunteer vita

How to fill out form 13615 rev 10-2025

Who needs form 13615 rev 10-2025?

Form 13615 Rev 10-2025: A Comprehensive Guide

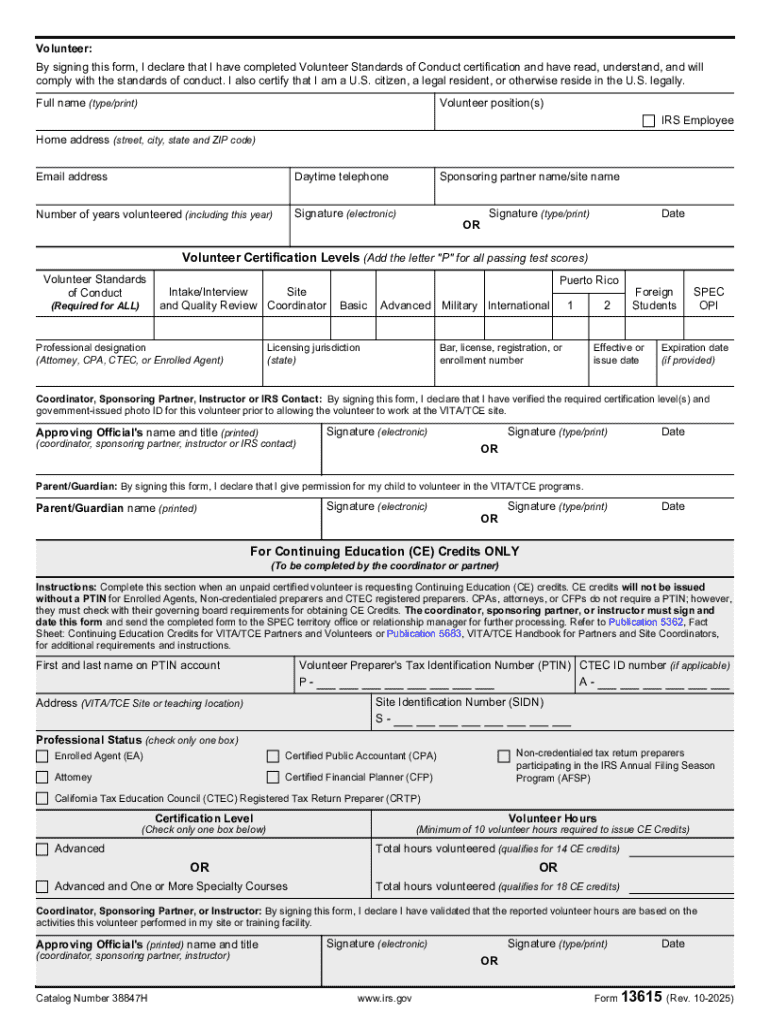

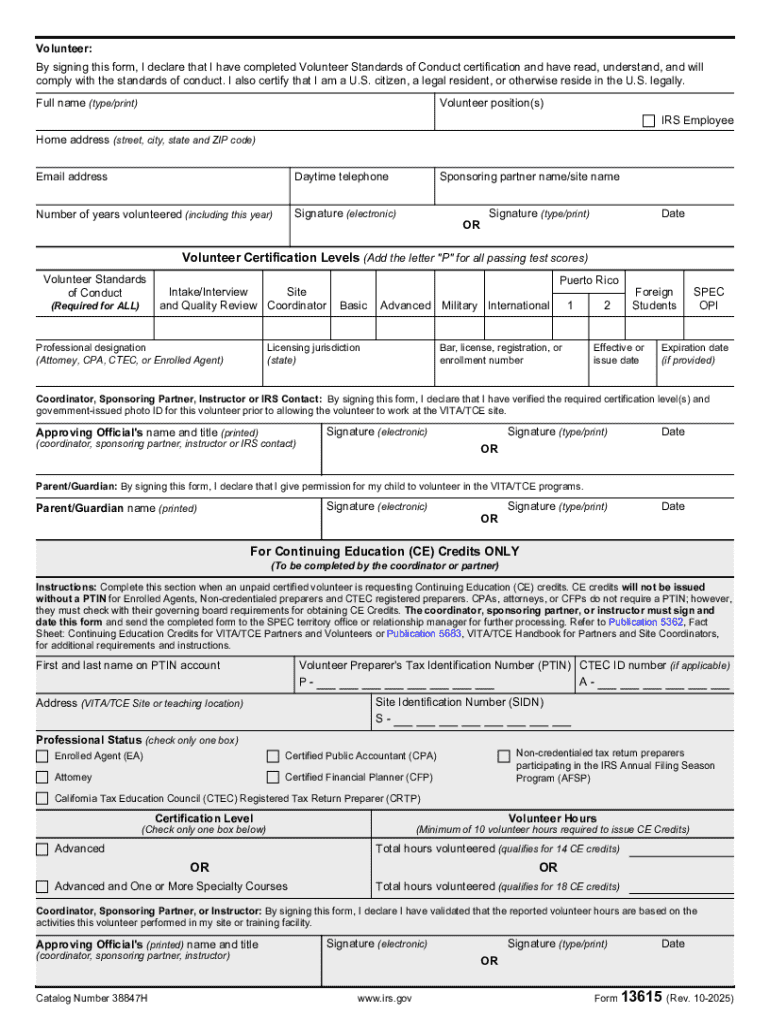

Overview of Form 13615 Rev 10-2025

Form 13615 Rev 10-2025, officially known as the Public Service Confirmation Agreement, is pivotal for those participating in volunteer programs related to legal services. This document serves to confirm an individual’s understanding and agreement to adhere to the volunteer standards of conduct. Additionally, it lays the groundwork for law students and other volunteers engaged in public service initiatives, ensuring they understand their obligations.

The significance of this form lies in its role as a foundational document for applicants and participants in IRS-supported public service programs. By signing this form, individuals affirm their commitment to uphold the high standards necessary to maintain public trust and integrity within the legal profession.

Who needs to use this form?

Form 13615 is targeted at a specific audience, particularly law students, legal interns, and professionals engaged in voluntary public service roles. Anyone intending to work under IRS programs aimed at providing legal assistance to underserved communities must complete this form as part of their onboarding process. It acts not only as a guideline for conduct but also as a commitment to uphold the values of public service.

Key changes in the 10-2025 revision

The latest revision of Form 13615 introduces several critical updates from previous versions. These include refined language that clarifies obligations, updated volunteer standards, and specific reminders pertinent to program participants. Furthermore, the 10-2025 version emphasizes the importance of adhering to laws governing public service, thereby enhancing the document's overall clarity and effectiveness.

Step-by-step instructions for accessing Form 13615

To get started with Form 13615 Rev 10-2025, accessing the document online is your first step. Here’s how you can find it effortlessly.

After locating the form, downloading it is a straightforward process. Follow these steps to acquire the PDF file.

Utilizing pdfFiller’s interactive features streamlines the entire process of handling Form 13615.

Filling out Form 13615

Filling out Form 13615 requires careful attention to detail. Understanding the various fields will ensure complete and accurate submissions essential for your public service commitment.

Being mindful of common mistakes can prevent unnecessary setbacks. Here’s what you should watch for when filling out the form.

Using pdfFiller not only simplifies filling out the form but also enhances efficiency through its unique features.

Editing and signing the form

Composing a legally binding document necessitates precision, and pdfFiller’s editing capabilities facilitate this process.

The electronic signing process is simple yet secure, ensuring your validation of the Form 13615.

Collaboration is vital in situations where input from multiple stakeholders is necessary. Here’s how pdfFiller makes sharing easy.

Managing your Form 13615

Efficient document management is key when dealing with forms such as 13615. Employing effective strategies helps maintain organization.

Tracking changes and maintaining version control is crucial for compliance and accountability.

Lastly, sharing and sending the completed Form 13615 is simplified through pdfFiller’s integrated tools.

Frequently asked questions (FAQs) about Form 13615

Navigating the intricacies of Form 13615 can raise various questions. Here are some general inquiries that commonly arise regarding usage and purpose.

Moreover, troubleshooting specific issues can often be daunting. Here are solutions to common problems users may encounter.

Additional tools and resources on pdfFiller

While Form 13615 is essential for your public service involvement, pdfFiller offers a wealth of tools and related document templates that enhance your document management experience.

For personalized assistance, pdfFiller’s support and customer service resources are available to guide users through any uncertainties.

Hearing success stories can inspire confidence in the product’s efficiencies.

People Also Ask about irs volunteer conduct vita

What is the percent of federal income tax withheld?

How do I prove a dependent to the IRS?

What are NZ tax brackets 2022?

Does the IRS investigate dependents?

What certifications do I need to file taxes?

What does the IRS consider support for a dependent?

What is a VITA form?

What is the tax table for 2022?

Which volunteers must pass the VSC certification test?

What is Publication 15 with the IRS?

What is the tax bracket for 2022 in South Africa?

Does the IRS train tax preparers?

What are the 6 requirements for claiming a child as a dependent?

What constitutes practice before the IRS ing to Circular 230?

How do I get certified by the IRS?

How can I prove my dependents?

What is a 13615 form?

What is the wage bracket method?

What is the tax rate for income 2022?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete irs agreement vita tce online?

How do I make changes in unpaid 13615 please fillable?

Can I create an eSignature for the form irs vita fill in Gmail?

What is form 13615 rev 10-2025?

Who is required to file form 13615 rev 10-2025?

How to fill out form 13615 rev 10-2025?

What is the purpose of form 13615 rev 10-2025?

What information must be reported on form 13615 rev 10-2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.