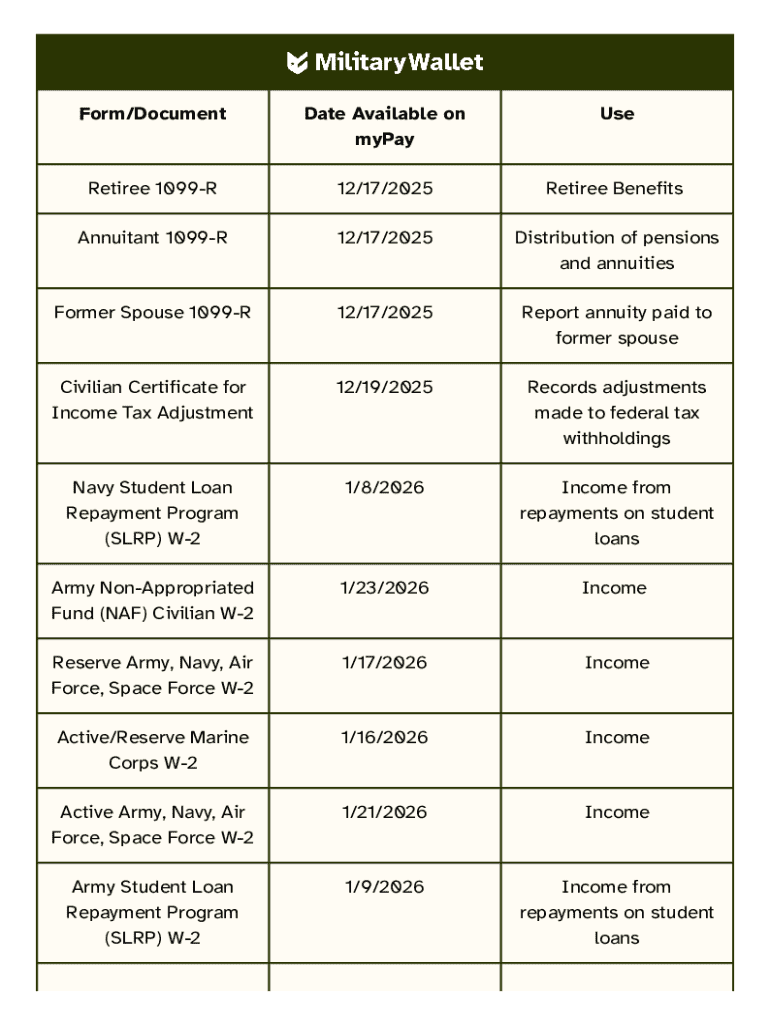

Get the free Retired and Annuitant Pay Tax Information

Get, Create, Make and Sign retired and annuitant pay

Editing retired and annuitant pay online

Uncompromising security for your PDF editing and eSignature needs

How to fill out retired and annuitant pay

How to fill out retired and annuitant pay

Who needs retired and annuitant pay?

Everything You Need to Know About the Retired and Annuitant Pay Form

Understanding the retired and annuitant pay form

The Retired and Annuitant Pay Form is a crucial document for individuals transitioning into retirement. This form serves as the primary means by which retired federal employees and annuitants receive their retirement benefits. Its accuracy and completeness can significantly influence the seamless payment of benefits, ensuring retirees maintain financial stability in their post-employment years.

This form is not just a bureaucratic necessity; it represents the culmination of years of service and a pathway to financial security during retirement. Using a platform like pdfFiller helps individuals manage this process efficiently, offering benefits such as ease of access, editing capabilities, and secure storage.

Who needs the retired and annuitant pay form?

The retired and annuitant pay form is primarily intended for former federal employees, military personnel, and individuals receiving pensions from certain government agencies. Eligibility criteria vary, but generally, individuals must have been employed in a qualifying position and have successfully transitioned into retirement.

Situations requiring this form include those who have recently retired, individuals changing their payment method, or those updating personal information for direct deposits. It's essential to clear up any misconceptions; some individuals incorrectly assume they are automatically enrolled in a retirement plan, which is not always the case.

Gathering necessary information

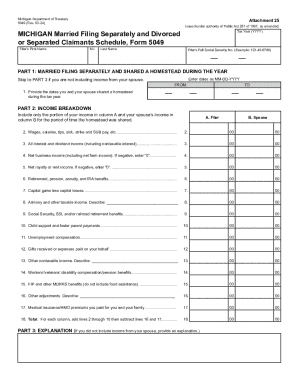

When preparing to fill out the retired and annuitant pay form, it's crucial to gather all necessary personal information. This typically includes your full name, Social Security Number, and retirement date. These details serve as critical identifiers in the processing of your retirement benefits.

Financial details are also essential, particularly information required for direct deposits. For instance, you will need to provide your bank account number, routing number, and any associated details specific to your financial institution. Preparing relevant documents such as identification, proof of retirement, and prior employment records can streamline the process.

Step-by-step instructions for filling out the form

Filling out the retired and annuitant pay form can be straightforward when approached methodically. Start by identifying the correct sections that apply to your situation, typically laid out in a clear, structured manner. It's essential to read through all sections carefully to ensure no detail is overlooked.

As you proceed, input the requested data accurately. Pay special attention to details like your Social Security Number and bank information, as errors here can lead to delays in processing. Common mistakes include transposing numbers or leaving blank spaces where information is required; avoid this by double-checking your entries before submission.

Editing and customizing the form with pdfFiller

pdfFiller offers several features that simplify the editing and management of the retired and annuitant pay form. The drag-and-drop functionality allows you to conveniently upload and position documents or images directly onto your form. For example, if you need to add additional notes or annotations, you can easily do so without needing to print or scan the document.

Once edits are complete, you can securely save your files with the option to store them in the cloud. This ensures that your information is not only accessible wherever you are but is also stored in a secure environment, protecting your personal data from unauthorized access.

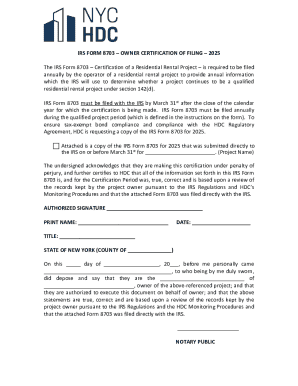

Signing the retired and annuitant pay form

Signing the retired and annuitant pay form is a critical step that can no longer be overlooked with the introduction of electronic signatures. pdfFiller facilitates this process, providing eSignature options that are legally binding and secure. You can create your eSignature directly in the platform, ensuring you meet all compliance requirements.

To add your eSignature, simply navigate to the designated area on the form, follow the prompts to create your signature, and then place it directly where required. This not only expedites the submission process but also adds an extra layer of convenience as you do not need to print, sign, and scan the document.

Submitting the retired and annuitant pay form

Once your form is fully completed and signed, it needs to be submitted for processing. pdfFiller provides multiple submission methods to ensure that you can choose the one that suits you best. Whether you prefer online submission, mailing your form, or delivering it in person, options are available depending on agency guidelines.

It is essential to note the timeline for processing your submission, as this can vary significantly based on the method chosen. Typically, online submissions are processed faster than those submitted by mail. Be proactive about checking submission timelines to align your expectations with processing capabilities.

Tracking and managing your submission

Keeping track of your retired and annuitant pay form submission is a vital part of the process. By using pdfFiller, you can easily track the status of your submission through the platform. This feature allows you to monitor whether your document has been reviewed or if any additional information is required.

Furthermore, pdfFiller offers the capability to manage notifications and updates pertaining to your submission. If any issues arise or additional documentation is required, you'll be alerted directly through the platform. If you run into any difficulties, pdfFiller provides robust customer support to assist you with your queries.

Frequently asked questions (FAQs)

Even with comprehensive guidelines, occasional issues can arise when filling out the retired and annuitant pay form. If you encounter any problems, it’s essential to refer to the troubleshooting section of pdfFiller or contact their support for assistance. Common issues may include delays in processing or inconsistencies in payment details.

In cases where you notice payment discrepancies, keep documentation of all submissions and correspondence. This can assist in resolving issues more effectively. Additionally, pdfFiller offers a variety of resources on their platform that provide further guidance regarding form submissions and associated concerns.

Maximizing your experience with pdfFiller

Maximizing your experience with pdfFiller extends beyond just filling out the retired and annuitant pay form; it provides a wealth of document management features useful throughout your retirement planning journey. The platform not only allows for seamless collaboration with teams working on shared documents but also ensures you have access to additional tools that enhance workflow and efficiency.

Explore other functionalities like bulk upload options or the ability to save templates for forms frequently used. pdfFiller empowers users to save time while ensuring accuracy and compliance with regulatory requirements, ultimately fostering a better overall experience.

Security and compliance considerations

In today's digital world, security and compliance are paramount, especially when dealing with sensitive information like retirement benefits. pdfFiller employs robust privacy and security measures to safeguard your data throughout the form-filling process. Using this platform means that your documents are kept compliant with all relevant retirement payment regulations, ensuring peace of mind for users.

The added bonus of choosing a cloud-based platform like pdfFiller is the ability to access your documents securely from anywhere. This not only enhances convenience but also ensures that your important information remains protected through encrypted servers.

Supporting templates and tools

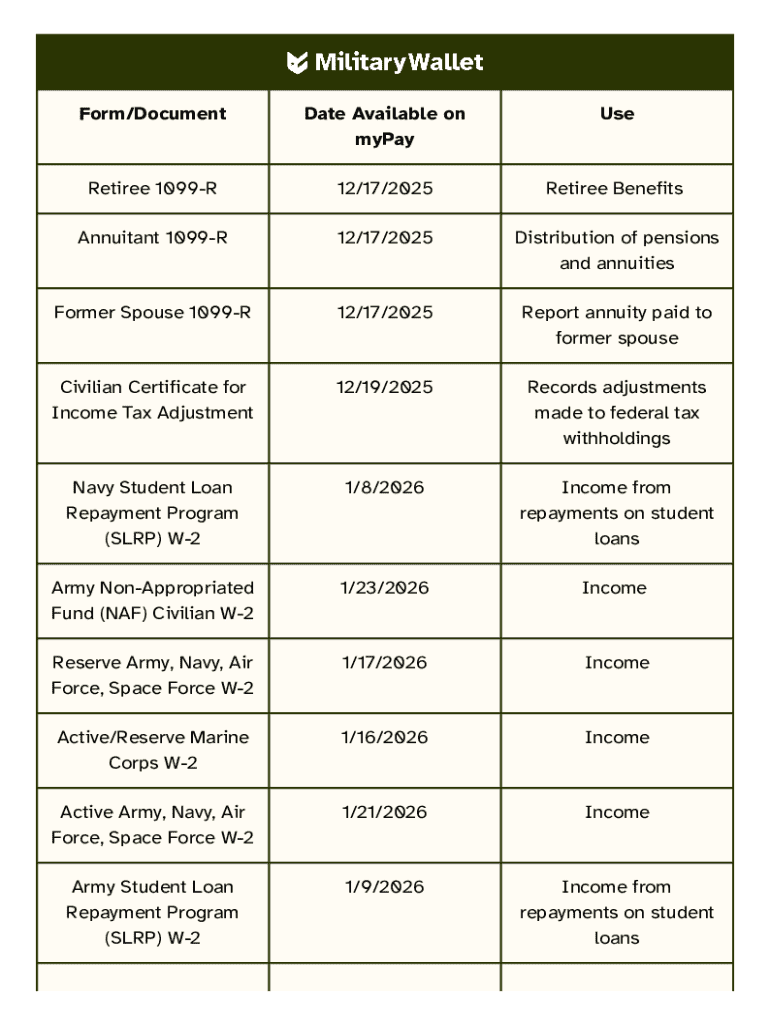

To enhance your experience further, pdfFiller provides a range of supporting templates and tools that relate to the retired and annuitant pay form. This includes templates specifically designed for various retirement types, tax forms, and even spreadsheets for budgeting post-retirement.

Using these interactive tools, users can prepare and customize documents relevant to their retirement planning needs. Engaging with this variety of resources ensures that users can streamline document preparation and enhance their overall planning experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get retired and annuitant pay?

How do I make changes in retired and annuitant pay?

How do I edit retired and annuitant pay straight from my smartphone?

What is retired and annuitant pay?

Who is required to file retired and annuitant pay?

How to fill out retired and annuitant pay?

What is the purpose of retired and annuitant pay?

What information must be reported on retired and annuitant pay?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.