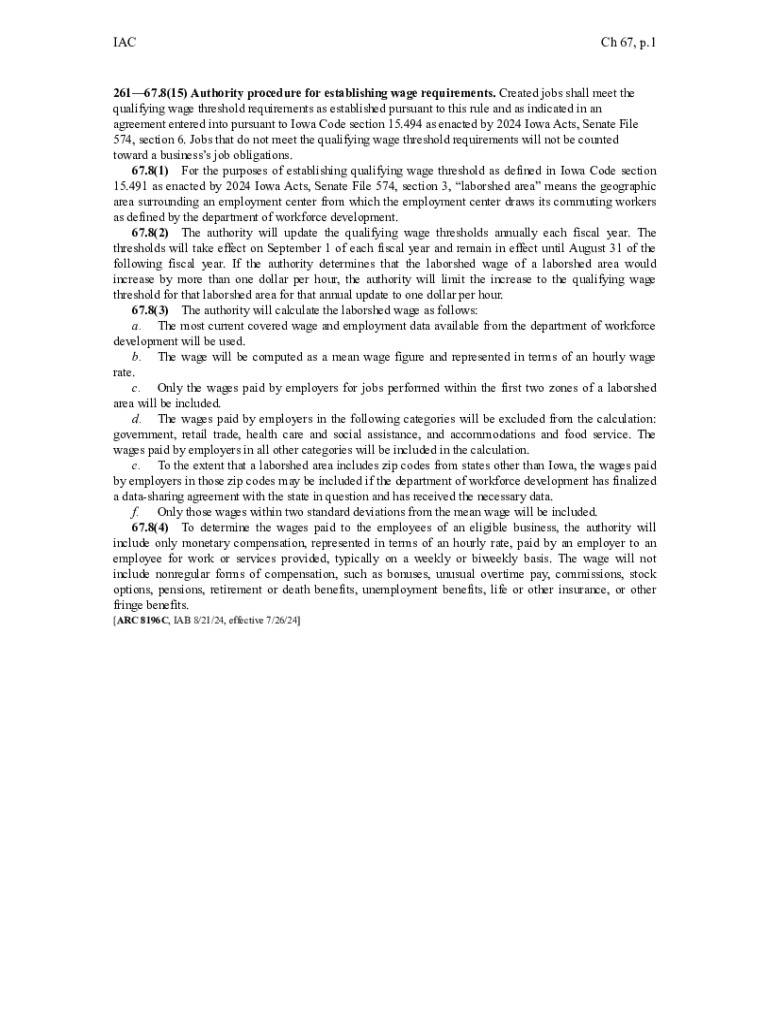

Get the free 8(15) Authority procedure for establishing wage requirements

Get, Create, Make and Sign 815 authority procedure for

How to edit 815 authority procedure for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 815 authority procedure for

How to fill out 815 authority procedure for

Who needs 815 authority procedure for?

Understanding the 815 authority procedure for form

Understanding the 815 authority procedure

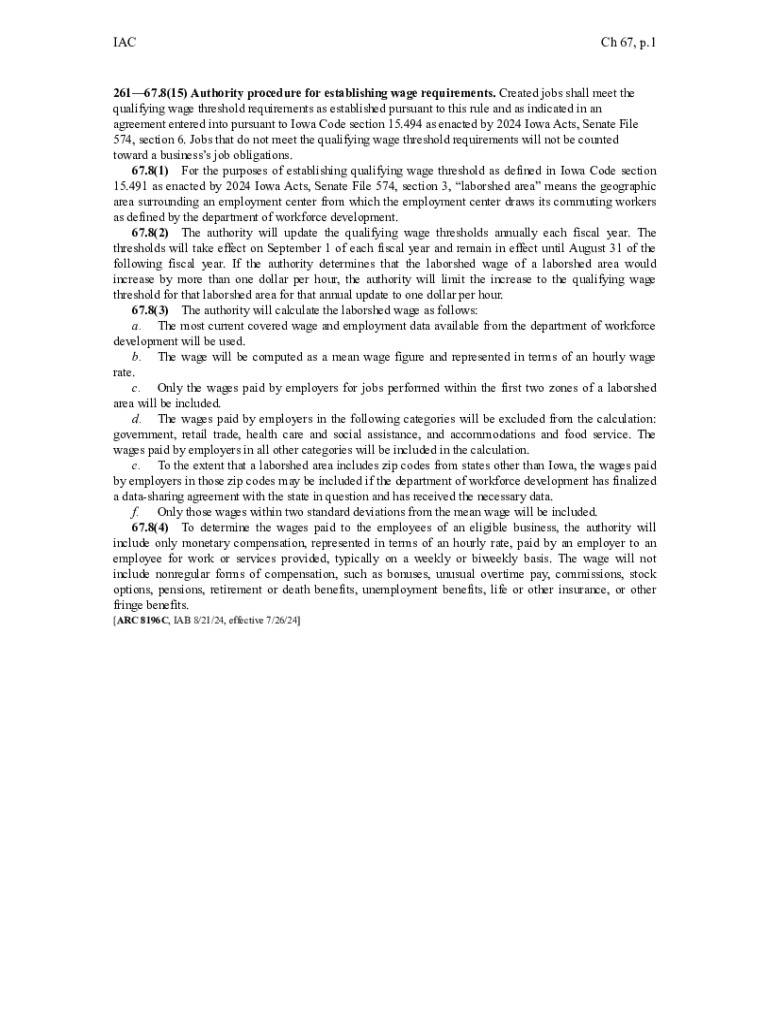

The 815 authority procedure governs specific form protocols that are vital for regulatory compliance in various sectors. In essence, the 815 authority refers to a legal framework that outlines how forms should be administered and processed within designated contexts. It plays a pivotal role in ensuring that organizations adhere to standardized practices when submitting, using, and managing forms.

The main purpose of the 815 authority procedure is to streamline processes, enhance transparency, and ensure proper documentation in compliance-related undertakings. This authority is applicable across different layers of government and various sectors where systematic form handling is pivotal. Compliance with the 815 authority procedure not only facilitates efficient workflows but also helps in avoiding potential legal repercussions.

Navigating the 815 authority form

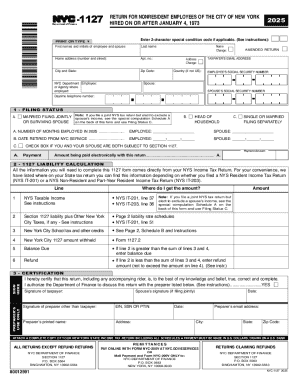

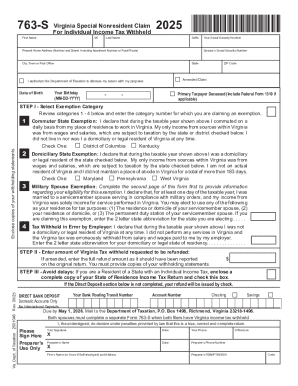

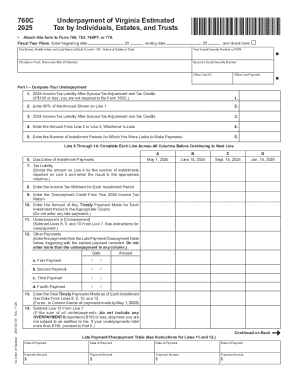

The 815 authority form is structured to capture essential information needed for compliance processing. Understanding its layout is critical for proper completion. The form typically includes sections covering applicant details, specific requests, and necessary compliance declarations. Each part of the form must be filled out meticulously to avoid complications.

Formatting conventions are also crucial when completing the form. Using the correct font sizes, paper margins, and spacing helps maintain professionalism and clarity. Failure to adhere to these guidelines can lead to delays or rejections during the review process. Common pitfalls when filling out the form include incomplete sections, incorrect data, and neglecting to sign the form, all of which can thwart the purpose of compliance.

Step-by-step instructions for completing the 815 authority form

Completing the 815 authority form requires a systematic approach. The first step involves gathering all necessary information and documents, which may include identification, tax forms, and other relevant records. Accurate compilation of this data is vital. It can be beneficial to create a checklist of items needed before proceeding to the next steps.

Next, when filling out the form, it is important to break down each section, ensuring clarity and accuracy in your responses. Modern tools such as pdfFiller enhance this process by providing interactive features, allowing users to easily fill forms and make corrections. It’s advisable to take your time while completing each section to prevent any errors from occurring.

Editing and managing the 815 authority form

Editing and managing the 815 authority form effectively is key to ensuring compliance and accuracy. pdfFiller offers various editing tools designed to streamline this process. Users can add notes or comments directly onto the form, thereby retaining clarity on specific edits. The eSignature feature is particularly handy for obtaining necessary approvals, ensuring that all modifications are officially recognized.

In addition, practicing good document management techniques is essential for maintaining organized records. Keeping versions of the document up to date allows for tracking changes and ensures that the correct version is always in use. Regular audits can help users stay compliant and up to date with legal requirements.

Troubleshooting common issues with the 815 authority form

While completing the 815 authority form, users may face several common challenges. One frequent issue is misinterpreting sections, leading to incomplete or incorrect submissions. Having a clear understanding of each field's requirements can mitigate these issues. If errors are discovered post-submission, promptly following up with the relevant office is crucial to resolve discrepancies.

For further assistance, users can consult FAQs or instructional resources that address common queries about the form. Using pdfFiller's support features can also help users to efficiently resolve issues as they arise.

Related content and resources

Understanding other forms and procedures related to the 815 authority is essential for comprehensive compliance practice. These include regulations such as 815 CMR 2.00 concerning state grants and federal awards, as well as 815 CMR 3.00 which outlines the Ready Payment System. Familiarizing yourself with these related resources helps to contextualize the 815 authority within broader compliance frameworks.

Furthermore, being aware of fiscal year memos and guidance documents can provide additional insights that enhance users' engagement with the form and its implications. These resources are critical to ensuring a well-rounded understanding of regulatory requirements.

Understanding the implications of non-compliance

Non-compliance with the 815 authority procedure can lead to several negative repercussions. Organizations risk facing potential financial penalties, administrative sanctions, and increased scrutiny from regulatory bodies. This is particularly critical within environments where strict adherence to compliance is mandatory, as deviations can compromise both funding eligibility and operational integrity.

Case studies reveal that organizations experiencing non-compliance often encounter substantial setbacks that could have been easily avoided through proper documentation. These real-world examples highlight the necessity of maintaining accuracy and thoroughness in every submission.

Additional templates and forms in the 815 authority family

The 815 authority encompasses a range of related forms aimed at various types of compliance. Familiarization with these forms can provide significant advantages, such as ensuring all necessary documentation is submitted correctly. Exploring linked forms can simplify the compliance process and prevent redundancy.

Accessing these templates through platforms like pdfFiller ensures that users are equipped with necessary resources that are regularly updated, maintaining alignment with the latest regulatory standards.

Best practices for using pdfFiller in compliance processes

pdfFiller enhances the efficiency of document creation and management through its array of features tailored for compliance processes. Leveraging cloud-based functionalities allows teams to collaborate seamlessly, as documents can be shared and accessed from anywhere with an internet connection.

Teams should take advantage of pdfFiller’s capabilities, such as electronic signatures and collaborative editing, to streamline their workflows. This not only saves time but also minimizes the likelihood of errors, fostering a culture of precision and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 815 authority procedure for online?

Can I create an eSignature for the 815 authority procedure for in Gmail?

How do I fill out 815 authority procedure for using my mobile device?

What is 815 authority procedure for?

Who is required to file 815 authority procedure for?

How to fill out 815 authority procedure for?

What is the purpose of 815 authority procedure for?

What information must be reported on 815 authority procedure for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.