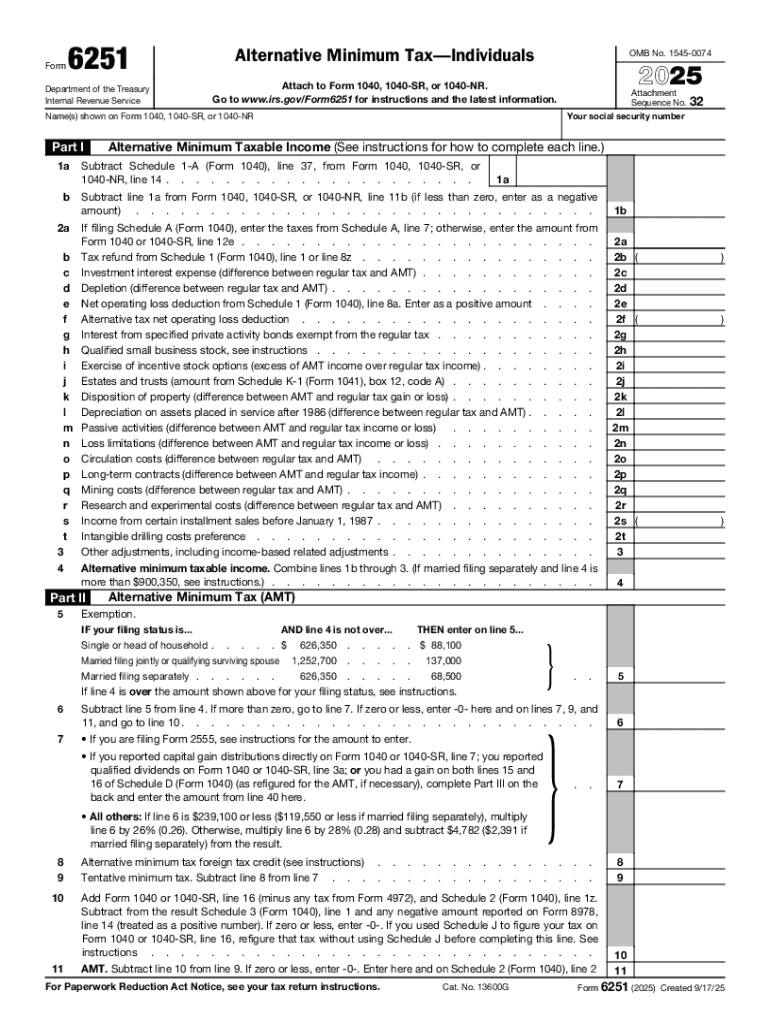

IRS 6251 2025-2026 free printable template

Get, Create, Make and Sign IRS 6251

How to edit IRS 6251 online

Uncompromising security for your PDF editing and eSignature needs

IRS 6251 Form Versions

How to fill out IRS 6251

How to fill out 2025 form 6251

Who needs 2025 form 6251?

Understanding the 2025 Form 6251 for Alternative Minimum Tax (AMT)

Understanding Form 6251: An overview of the Alternative Minimum Tax (AMT)

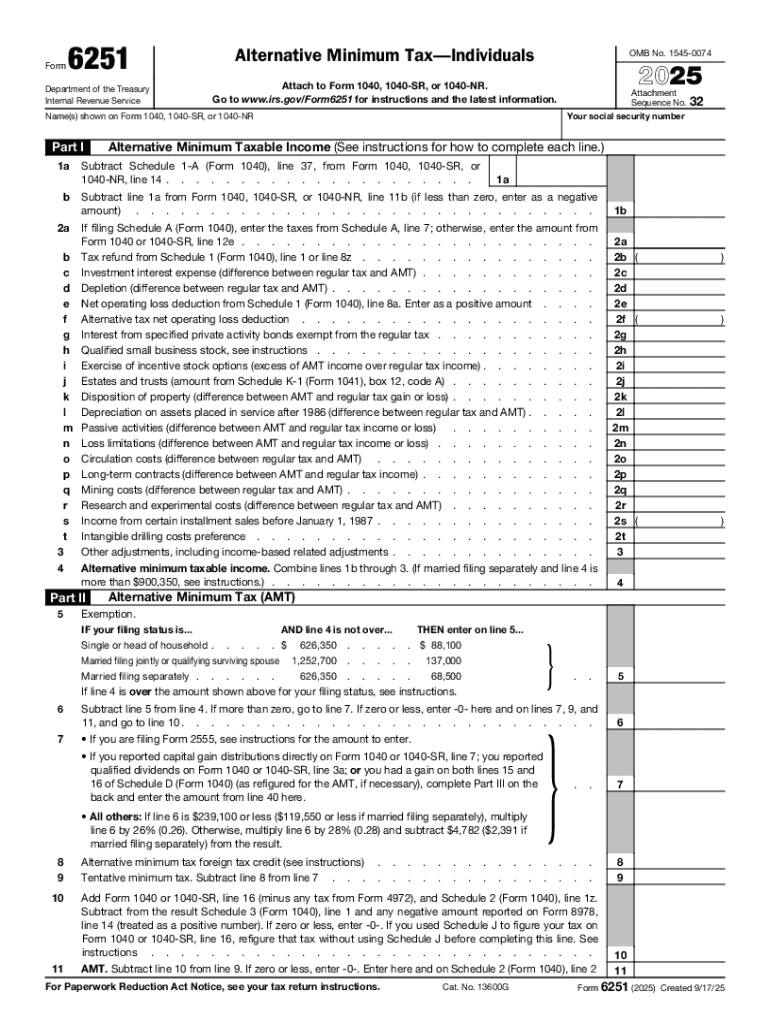

Form 6251 serves as the primary mechanism for taxpayers to calculate their Alternative Minimum Tax (AMT) liability. The AMT was established to ensure that high-income earners pay a minimum amount of income tax, regardless of the deductions they take. Form 6251 is essential for accurately reporting any AMT owed, which can differ significantly from ordinary income tax calculations.

Filing Form 6251 is vital for qualifying taxpayers, as it determines whether the AMT applies based on income, deductions, and preference items. Unlike conventional tax calculations—where various deductions and credits can reduce taxable income—the AMT disregards many of these benefits. Consequently, understanding the differences is key to accurate tax reporting.

Who needs to file Form 6251 in 2025?

In 2025, not every taxpayer will need to file Form 6251. Generally, individuals with a higher income that exceeds the specified thresholds will trigger the requirement to file. Specifically, if your adjusted gross income (AGI) exceeds certain limits—currently projected to be around $200,000 for single filers and slightly lower for joint filers—it's critical to assess whether AMT applies.

Other factors can also necessitate filing, including certain types of tax preference items like tax-exempt interest. High-income earners, individuals with substantial capital gains, or those who claim various deductions may find themselves subject to AMT calculations. Special considerations also exist for corporations, primarily regarding how they classify income and deductions.

Key components of Form 6251

Form 6251 comprises several sections that require careful attention. Each section helps capture specific taxable income details along with AMT adjustments. Key aspects include preference items, various lines to report additional income, and adjustments to taxable income that differ from standard reporting.

A line-by-line approach helps in navigating Form 6251. Common adjustments include tax-exempt interest from private activity bonds and depreciation adjustments. Understanding these adjustments is crucial as failure to recognize them may lead to an incorrect AMT calculation, impacting overall tax liabilities.

How to calculate AMT using Form 6251

Calculating AMT can seem daunting, but it follows a structured process outlined in Form 6251. Initially, you will need to calculate your regular taxable income and add back adjustments related to any preference items. This adjusted figure is referred to as Alternative Minimum Taxable Income (AMTI).

From there, apply the AMT tax rates, which are currently set at 26% and 28% for taxable income over certain thresholds. Importantly, the AMT exemption amount, which reduces your AMTI, must also be taken into consideration during this calculation. Using worksheets provided with Form 6251 can greatly simplify this process. An example will illustrate typical scenarios, making the calculation method clearer.

What triggers the AMT?

Several factors can lead to an AMT liability, often stemming from the unique tax rules associated with the AMT. Tax deductions that are common under regular tax filing, such as state and local tax deductions, can push taxpayers into AMT territory if they exceed certain amounts. Also, certain credits and alternative income sources can heighten AMT obligations.

Understanding these triggers is critical for effective tax planning and compliance. It's important to regularly review your tax deductions and investments to gauge their potential impact on AMT status. For instance, high-income earners may need to recalibrate their investment strategies to avoid an unfavorable tax situation.

Examples of AMT calculations using Form 6251

To clarify the AMT calculation process, the following hypothetical scenarios illustrate how different situations affect AMT obligations. For instance, consider a single filer with a substantial income who has significant deductions from state taxes and education credits, which will both affect the final tax owed. Constructing charts and tables to graphically represent AMT calculations against standard taxes will enhance understanding.

In another example, a married couple filing jointly with moderate income but extensive tax preference items can also see their AMT liabilities shift dramatically. The calculations will starkly differ from the regular tax computation, further emphasizing the complexity of navigating AMT considerations.

General tax planning tips for AMT

Despite its complexities, taxpayers can take proactive steps to mitigate AMT exposure. Year-round tax planning is crucial; monitoring your finances throughout the year rather than solely at tax season can prevent unexpected liabilities. This approach includes adjusting potentially over-deducted items and considering the tax implications of large investments.

Additionally, utilizing tools like pdfFiller can significantly streamline document preparation and management, allowing you to focus on strategic tax planning rather than administrative work. A robust document management strategy can also help capture deductions effectively, potentially safeguarding against unexpected AMT obligations.

Adjustments & amendments to Form 6251

After submitting Form 6251, errors may necessitate adjustments. Taxpayers can amend their forms using Form 1040X if they discover discrepancies that affect AMT calculations. The process may involve re-evaluating income levels, deductions, or external verification of income documentation.

Additionally, if adjustments lead to a refundable amount, ensuring all elements are accurately reported will facilitate a timely refund. It's pivotal for taxpayers to stay organized, maintaining copies of Form 6251 and related documents for accurate record-keeping.

PDF solutions for managing Form 6251

Utilizing pdfFiller provides an innovative solution for managing Form 6251 effortlessly. The platform allows users to fill out, edit, and eSign documents directly from a web browser, ensuring you can manage your tax forms from any location. This feature is particularly beneficial for individuals and teams seeking a comprehensive document creation solution.

Interactive tools available on pdfFiller enhance user experience by simplifying the process of document management. The ability to store documents securely in the cloud allows easy access and collaboration, meaning you can stay organized as you prepare your tax documentation.

Common mistakes to avoid when filing Form 6251

Although filing Form 6251 is critical for compliance, many taxpayers stumble due to common errors. One prevalent mistake is overlooking specific tax preference items, leading to inconsistencies in AMT calculations. Additionally, errors in checking AGI and failing to re-evaluate deductions can result in higher AMT liabilities.

To ensure accurate submissions, double-check all calculations before filing. Utilizing pdfFiller's comprehensive editing tools also enables you to review all components of the form thoroughly, reducing the likelihood of errors and providing peace of mind during tax season.

Future tax considerations: What to watch for beyond 2025

Keeping an eye on potential changes in tax laws is essential for anyone impacted by the AMT. Tax regulations evolve continuously, and amendments affecting income tax thresholds, deductions, and the AMT exemption amounts can significantly shift tax liabilities for individuals and corporations alike. Staying informed about upcoming tax proposals can better position you to manage your financial plans.

Active engagement with tax advisors and subscribing to IRS updates can ensure that you remain aware of changes impacting your AMT status. As taxpayers navigate future complexities, strategic planning will be essential for mitigating any adverse effects from new legislation.

People Also Ask about

Is Form 6251 required?

Do I have to calculate alternative minimum tax?

How do I know if I need to file Form 6251?

How do I know if I need to make an AMT adjustment to my investment income or expenses?

Do I need to file IRS Form 6251?

Who needs alternative minimum tax?

How do I know if I need to file AMT?

What is Form 6251 on tax return?

Who needs to fill Form 6251?

Do I need to attach Form 6251?

Why do I have to pay alternative minimum tax?

Who has to pay alternative minimum tax?

Do I need to file alternative minimum tax form?

Do I need to file alternative minimum tax?

Where do I find my alternative minimum tax?

What is Form 6251 for?

How can I avoid paying alternative minimum tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in IRS 6251?

Can I sign the IRS 6251 electronically in Chrome?

How do I fill out IRS 6251 using my mobile device?

What is 2025 form 6251?

Who is required to file 2025 form 6251?

How to fill out 2025 form 6251?

What is the purpose of 2025 form 6251?

What information must be reported on 2025 form 6251?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.