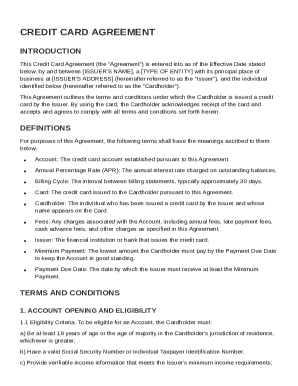

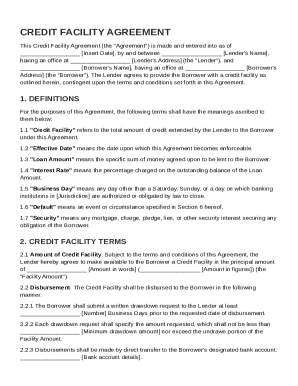

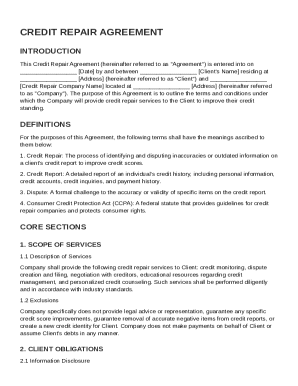

Get the free New York State E-File Signature Authorization for Tax Year 2025

Get, Create, Make and Sign new york state e-file

Editing new york state e-file online

Uncompromising security for your PDF editing and eSignature needs

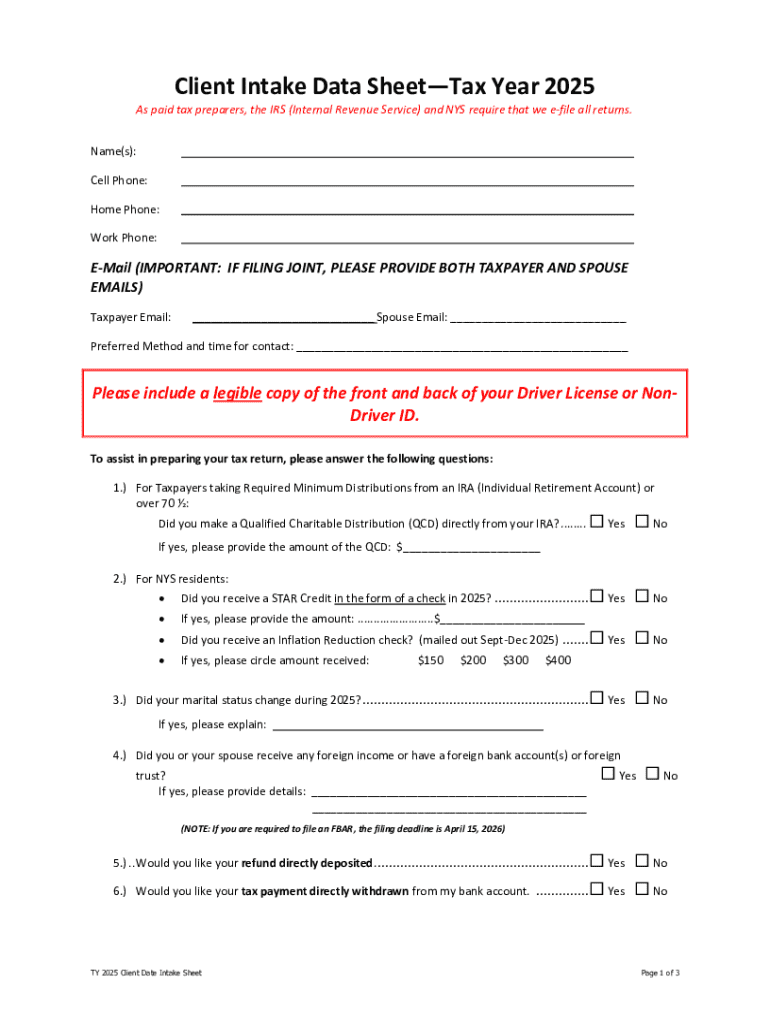

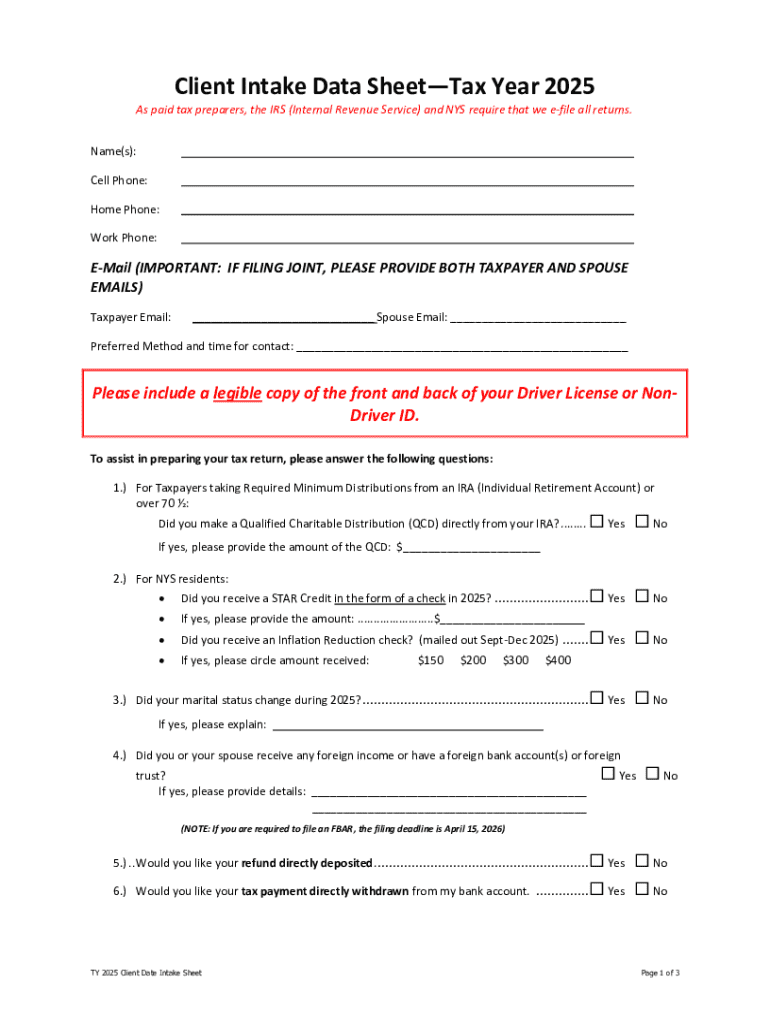

How to fill out new york state e-file

How to fill out new york state e-file

Who needs new york state e-file?

New York State E-File Form: A Comprehensive How-to Guide

Understanding New York State E-File Forms

E-filing has revolutionized the way individuals and businesses in New York State file their taxes, offering a convenient alternative to traditional paper filing. Defined as the electronic submission of tax documents to the state tax department, e-filing streamlines tax processes and reduces the environmental impact of paperwork.

Among the numerous benefits of e-filing, speed is paramount; e-filed returns can be processed much quicker, leading to faster refunds. Furthermore, e-filing minimizes the chances of human error, as many online services automatically check for inconsistencies and errors in submissions. This method is highly recommended for anyone looking to simplify their tax filing experience.

But who should use New York State e-file forms? Generally, all taxpayers are encouraged to e-file, especially if you expect to receive a refund or if you have straightforward tax situations. Whether you’re a first-time filer or a seasoned pro, e-filing can save you time and hassle.

Types of New York State E-File Forms

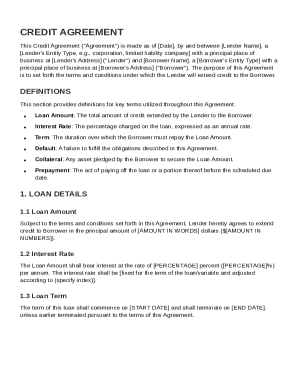

New York State provides a variety of e-file forms catering to different taxpayer categories, including personal income tax and business taxes. Understanding which forms you need is crucial to ensure compliance and avoid potential penalties.

How to prepare your New York State E-File Form

Preparation is key when dealing with New York State E-File forms. Following a structured process ensures everything is in order before submission.

Start by gathering all necessary documents, including income statements like W-2s and 1099s, as well as deduction records, including receipts and previous tax returns. This foundational step sets you up for accurate calculations.

Next, determine your filing status. Options include single, married filing jointly, married filing separately, head of household, or qualifying widow(er). Each status affects tax rates and benefits, so choose carefully based on your circumstances.

Finally, calculate your taxable income. Utilize New York’s tax tables and deduction guidelines to arrive at figures that allow for precise filing. This process may seem daunting, but it becomes manageable when broken into these clear steps.

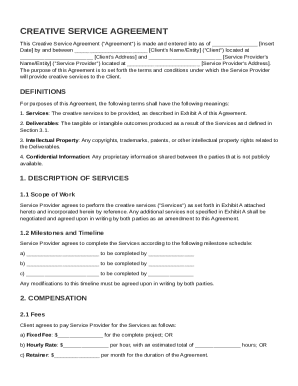

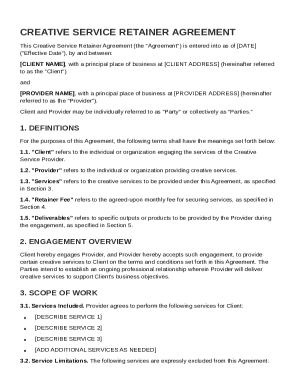

Using pdfFiller for E-Filing Your New York Forms

pdfFiller emerges as a reliable platform for managing New York State e-file forms. It stands out due to its array of features designed to simplify the e-filing experience.

To illustrate how pdfFiller enhances the e-filing process, here’s a quick walkthrough: Start by creating a new document, then upload your e-file form. Utilize the editing features to fill in your details accurately. If needed, add an electronic signature, finalize the document, and you're ready to submit. The whole experience encapsulates convenience and security, tailored for today’s fast-paced environment.

Common mistakes and how to avoid them

Even with the digital ease that e-filing provides, taxpayers can still make mistakes that delay processing times or trigger audits. It’s vital to be aware of common pitfalls to ensure a successful filing.

To guarantee accurate submissions, adhere to best practices. These include double-checking entries and utilizing pdfFiller's built-in validation tools. Such diligence can save you from the hassle of corrections and potential penalties.

Resources for New York State E-File Forms

The New York State Tax Department offers multiple resources to aid taxpayers in understanding e-filing requirements. Utilize their website to access an array of forms and publications that outline necessary procedures.

Additionally, the state provides a robust FAQ section that answers common e-filing queries. If further assistance is needed, taxpayers can contact support services for dedicated help with their submissions.

Language assistance for e-filing

Understanding the e-filing process is crucial for successful submissions, especially for non-English speakers. Recognizing the diversity in New York, the state ensures that resources are available in multiple languages.

This emphasis on accessibility helps bridge gaps and provides every taxpayer the means to comply with New York State’s tax requirements.

Exploring E-Filing Options Beyond New York

While New York State offers a sophisticated e-filing system, it’s interesting to compare its processes with those of neighboring states. Each state has unique requirements and forms, leading to variations in the e-filing experience.

Understanding these differences can be beneficial for individuals who have income streams across state lines, allowing for smoother compliance and tax planning.

Staying updated: New York tax filing changes

Tax policies are continually evolving, and it’s essential for taxpayers to stay informed regarding recent changes in filing guidelines. Each year, the New York State Tax Department updates its regulations and thresholds, which may affect how and when individuals should file their taxes.

These updates can include changes in income tax rates, new credits, or alterations to existing deductions. Being aware of these adjustments allows for more informed filing decisions and can potentially maximize your tax benefits.

Connect with the pdfFiller Community

Engaging with the pdfFiller community can elevate your e-filing experience. Participate in user forums and discussion boards to share insights and solutions related to e-filing.

Provide feedback on your experiences with pdfFiller’s tools, and suggest features that would enhance usability. Collaboration within the community ultimately leads to improved functionality, benefiting all users, especially in the realm of managing New York State e-file forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get new york state e-file?

How can I edit new york state e-file on a smartphone?

How do I fill out new york state e-file on an Android device?

What is New York State e-file?

Who is required to file New York State e-file?

How to fill out New York State e-file?

What is the purpose of New York State e-file?

What information must be reported on New York State e-file?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.