Get the free Full Doc Home LoansBrighten Empower

Get, Create, Make and Sign full doc home loansbrighten

How to edit full doc home loansbrighten online

Uncompromising security for your PDF editing and eSignature needs

How to fill out full doc home loansbrighten

How to fill out full doc home loansbrighten

Who needs full doc home loansbrighten?

Understanding Full Doc Home Loans: A Comprehensive Guide

Understanding full doc home loans

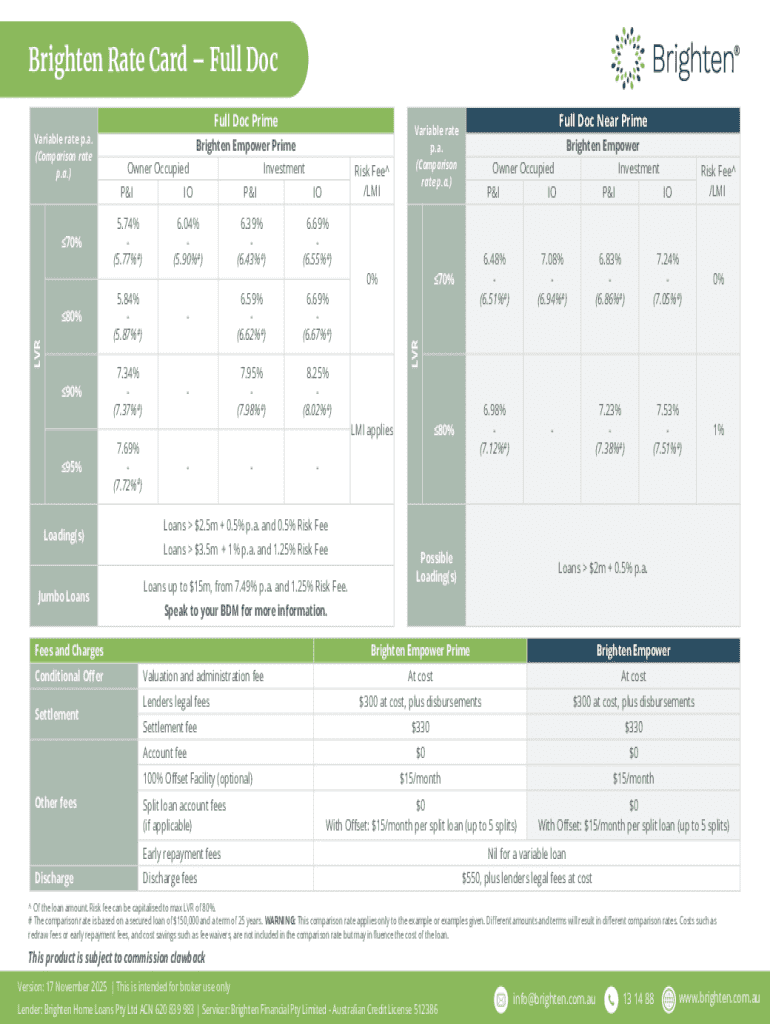

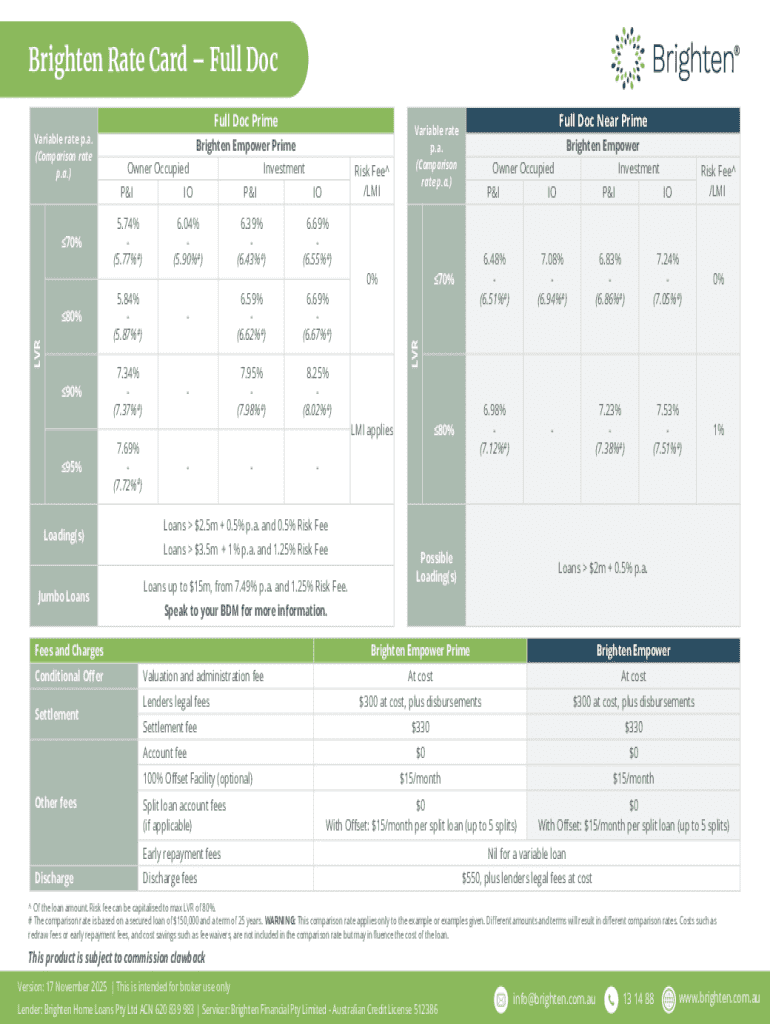

Full doc home loans are mortgage options tailored for borrowers who can provide comprehensive documentation of their financial status. These loans require a full disclosure of income, assets, employment, and debts, ensuring lenders can accurately assess the borrower's ability to repay. Unlike stated income or no-doc loans, full doc loans offer clarity and stability for both borrowers and lenders.

Key features of full doc loans include stricter eligibility requirements, such as extensive income documentation, and typically lower interest rates compared to alternative lending options. This creates a more favorable lending environment for qualified borrowers, who are usually employed with regular income and have a solid credit history.

Why choose a full doc home loan?

Opting for a full doc home loan comes with significant advantages for borrowers, especially those who possess stable and verifiable income streams. These benefits include better loan terms, favorable interest rates, and an overall streamlined approval process. This scenario often applies to individuals with traditional employment backgrounds or those whose income is reflected under single touch payroll systems.

Common scenarios where a full doc loan is preferable include purchasing an investment property or buying a primary residence in a desirable market. In such instances, borrowers can capitalize on lower rates while also qualifying for better loan limits, positioning themselves strongly in a competitive landscape.

Essential documents required for full doc home loans

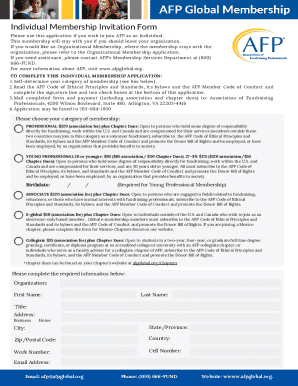

To apply for a full doc home loan, borrowers must prepare and provide a variety of documents that reflect their financial standing. A comprehensive checklist for a full doc loan application includes documents like personal identification, proof of income, employment verification, bank statements, and other asset documentation. Collecting these documents beforehand can significantly expedite the approval process.

For self-employed individuals, additional documents such as business financial statements are crucial. If income varies significantly throughout the year, borrowers might need to provide a history of income over the past 1-2 years. Unique situations, such as freelancing or having income derived from multiple sources, may necessitate tailored approaches to document submission.

Step-by-step process to apply for a full doc home loan

Successfully applying for a full doc home loan revolves around the accurate preparation of documents. Begin by organizing your paperwork efficiently; compiling financial records well in advance can reduce potential delays. Utilizing pdfFiller can simplify this process, allowing you to upload, edit, and manage your documents from a single platform, enhancing productivity.

When completing your loan application form, follow all instructions carefully, ensuring every section is filled out completely. Common pitfalls to avoid include incorrect figures, missing documentation, or ambiguous income reporting. Once your application is complete, submit it promptly and utilize the tracking features available through pdfFiller to monitor its progress.

Case studies: real-life examples

Exploring real-life case studies can help illustrate how full doc home loans work in practice. For instance, a self-employed borrower seeking a prime loan may utilize one year of financials to secure favorable terms. The process for them often involves compiling accurate financial records, showcasing consistent income, and articulating their business model effectively to lenders.

In another example, a business owner utilizing their director's wages had to present solid tax returns and business credit history to qualify for a full doc loan. Such cases demonstrate the necessary steps taken, the potential barriers faced, and how strategic documentation ultimately leads to successful lending experiences.

FAQs about full doc home loans

A frequently asked question among potential borrowers is, 'What if I have limited credit history?' While strong credit scores are beneficial, some lenders consider alternative credit assessments, allowing borrowers with limited history a chance to qualify. Similarly, applying with a co-signer can enhance your application’s credibility if your income documentation raises concerns.

Another essential topic is understanding the differences between full doc loans and other types, such as stated income or no-doc loans. Full doc loans demand meticulous documentation that fosters a greater degree of lender trust. As a result, they offer better rates and terms, evidenced by a lower risk for lenders, making them the preferred choice for many serious buyers.

Tools and calculators for assessing eligibility

Assessing eligibility for a full doc home loan requires a clear understanding of your financial landscape. Utilizing mortgage calculators available on pdfFiller can help borrowers evaluate their affordability and estimate potential monthly payments. This step not only helps in determining loan capacity but also assists in evaluating your debt-to-income ratios, which are critical during the application process.

Interactive tools on pdfFiller provide users with an efficient way to prepare and submit their documents. From eSigning to securely sharing documents with lenders, these features enhance the borrowing experience, helping streamline the cumbersome process of gathering and submitting paperwork.

Refinancing strategies using full doc home loans

Refinancing with full doc loans opens avenues for significant savings on existing loans. The main steps involve evaluating current mortgage rates, preparing necessary financial documentation, and applying through a favorable lender. Consider scenarios such as those who may want to leverage lower interest rates or remove private mortgage insurance (PMI) by refinancing into a full doc loan.

Cash-out refinancing is another strategy gaining traction among borrowers. For instance, individuals using directors' wages could refinance their properties, allowing them to cash out equity. This can fund other investments or renovations, ensuring borrowers maximize the benefits of owning their property while adjusting their financial obligations as necessary.

Troubleshooting common issues

In the event of an application denial, understanding key reasons can help address shortcomings. Common causes for denial include poor credit history, incorrect documentation, or unverified income. By proactively addressing these issues, borrowers can enhance their profiles before reapplying.

Additionally, navigating potential delays in processing requires awareness of typical timelines, along with proactive communication with your lender. Utilizing pdfFiller’s document tracking features can provide visibility into your application status, ensuring all parties involved are aligned and informed.

Leveraging pdfFiller for your full doc loan journey

pdfFiller enhances the full doc loan journey by streamlining document management and providing essential tools that improve efficiency. Users can easily edit PDFs, eSign necessary documents, and collaborate on forms directly within the platform, transforming the traditionally cumbersome process into a more organized and user-friendly experience.

With a secure cloud-based environment, pdfFiller ensures that sensitive information remains protected throughout the document handling process. This level of security not only enhances user confidence but aligns seamlessly with the need for confidentiality that comes with managing sensitive financial information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send full doc home loansbrighten to be eSigned by others?

How do I complete full doc home loansbrighten online?

Can I create an eSignature for the full doc home loansbrighten in Gmail?

What is full doc home loansbrighten?

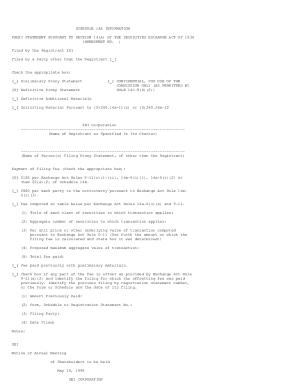

Who is required to file full doc home loansbrighten?

How to fill out full doc home loansbrighten?

What is the purpose of full doc home loansbrighten?

What information must be reported on full doc home loansbrighten?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.