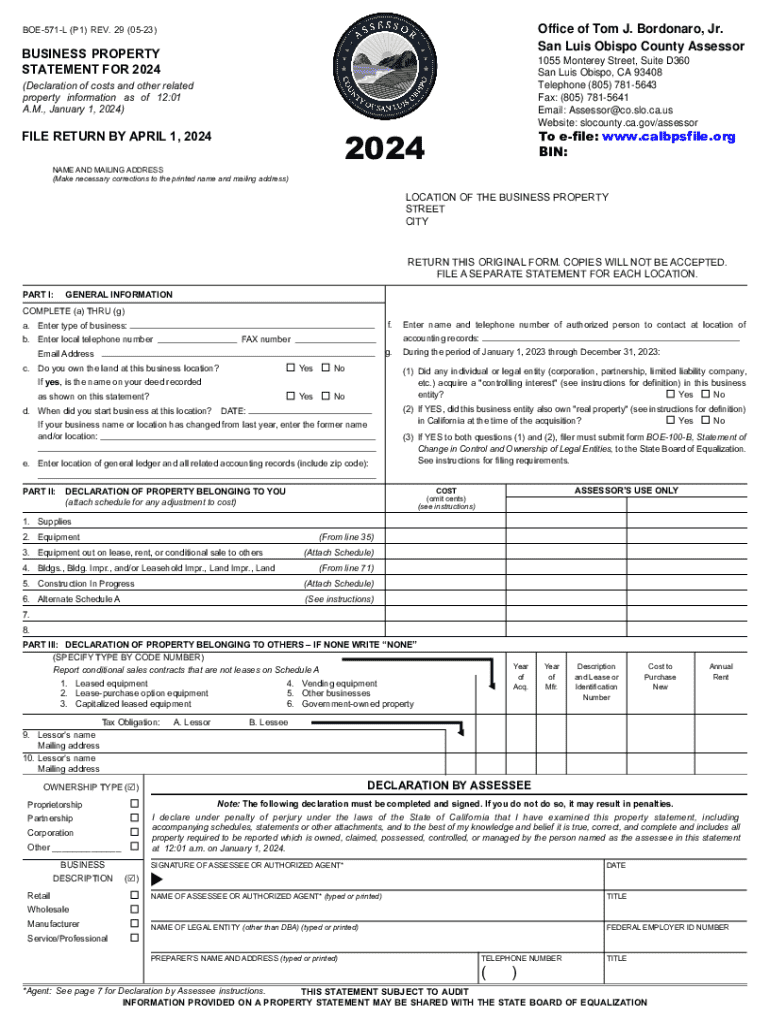

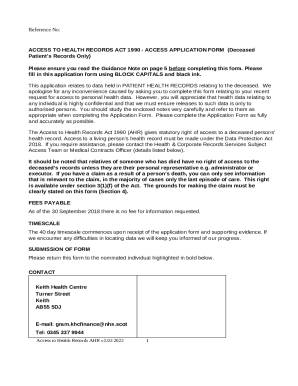

Get the free Business Property Statement 2024 - County of San Luis Obispo

Get, Create, Make and Sign business property statement 2024

Editing business property statement 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business property statement 2024

How to fill out business property statement 2024

Who needs business property statement 2024?

Business Property Statement 2024 Form: A Comprehensive Guide

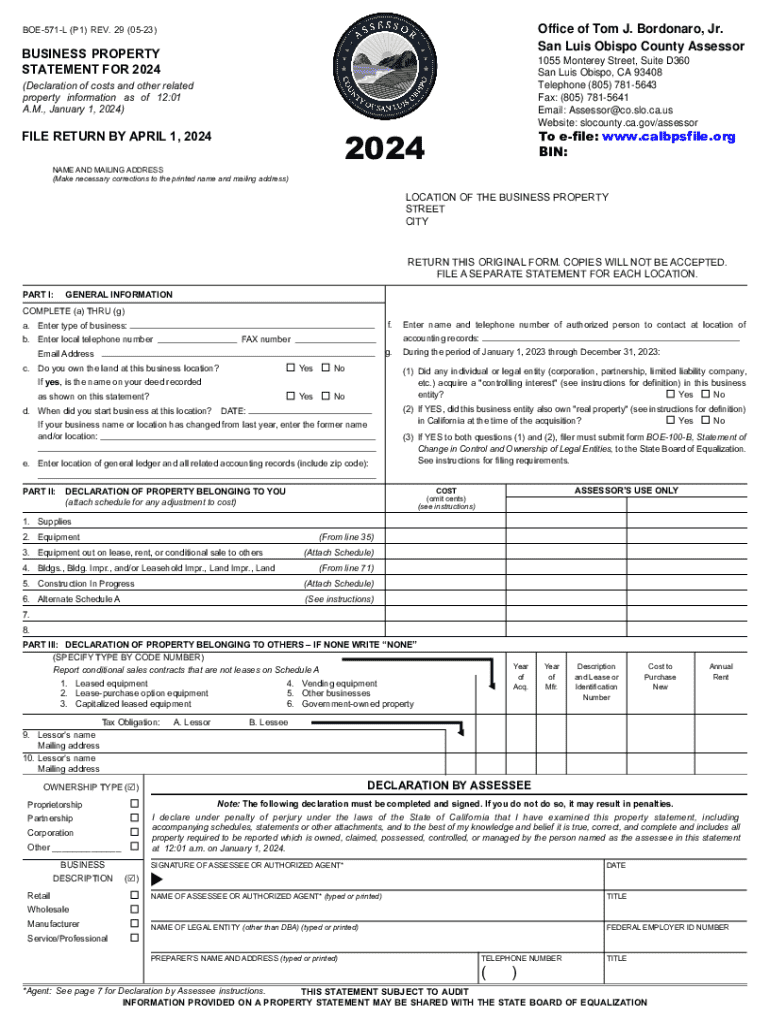

Understanding the business property statement

The Business Property Statement (BPS) is a critical document that businesses are required to submit annually, detailing all business-owned tangible property and equipment. This statement plays a vital role in local property taxation, as it provides essential information that helps assessors determine the taxable value of the business property.

In 2024, understanding and accurately completing the Business Property Statement is more important than ever due to enhanced regulations and the increasing scrutiny of property valuation. Businesses that fail to file correctly may face penalties, so staying informed about requirements is essential. Generally, any business that owns or leases property for commercial production or services needs to file this statement.

Key changes in the 2024 business property statement

For the 2024 filing period, there are significant changes in the Business Property Statement that businesses must navigate. Updated regulations have redefined several reporting requirements. New categories of personal property might be subject to taxation, and businesses need to ensure that they are compliant with the latest standards to avoid unexpected liabilities.

Moreover, the valuation methods have also changed. Assessors are utilizing more advanced tactics for property assessment, recognizing the market's fluctuations and adjusting evaluations based on current economic conditions. This shift emphasizes the necessity for businesses to be accurate and comprehensive in their reporting.

Step-by-step guide to filling out the business property statement

Filling out the Business Property Statement requires careful attention to detail. The form typically consists of various sections that document essential aspects of your business operations and assets. Understanding each section will help ensure that businesses file accurately.

Each Business Property Statement form begins with an overview, outlining which specific details are necessary for proper completion.

Section 1: Business information

In the first section, you'll need to provide primary business details such as your business name, physical address, and the type of business entity. This information is crucial for the tax assessment roll and ensures that your statement is linked to the correct business.

Section 2: Property details

Next, the statement requires detailed descriptions of different types of properties owned or leased. Here, businesses need to differentiate between real estate and personal property, and categorize assets accurately accordingly to avoid misrepresentation during valuation.

Common items to include are:

Section 3: Cost and value assessment

In this section, businesses need to evaluate their property costs accurately. It’s important to have a firm grasp of current market values and production costs. Businesses often make the mistake of undervaluing or overvaluing assets, leading to complications during auditing or tax assessments.

To avoid common pitfalls:

Section 4: Additional attachments

Finally, the Business Property Statement may require attachment of supporting documents such as invoices, prior tax returns, and property appraisals. These documents provide a clear picture of what a business owns and supports the figures reported on the form.

Helpful attachments include:

Utilizing pdfFiller to complete your business property statement

pdfFiller offers innovative solutions to streamline the completion of the Business Property Statement. The platform provides access to the latest 2024 Business Property Statement template, making it easy for businesses to start their filing process without delay.

One of the significant features of pdfFiller is its easy customization options, allowing users to edit fields quickly and accurately. Whether you need to insert additional properties or change the values, the user-friendly interface makes amendments straightforward.

Moreover, pdfFiller enhances collaboration through its eSigning capabilities, enabling team members to review and sign the document digitally without the hassle of printing and scanning.

Troubleshooting common issues

Completing the Business Property Statement can lead to complications if not handled appropriately. Common mistakes include inaccuracies in valuations and missing more critical property types. Navigating these issues requires careful attention.

For any issues encountered, businesses often have questions regarding specific line items on the form or the overall process. Here are frequently asked questions to help:

Should you require assistance, reach out to local tax assessors or accounting professionals well-versed in property taxation. They can provide invaluable guidance throughout the filing process.

Staying compliant: Best practices for filing

Filing your Business Property Statement by the deadline is key to remaining compliant. For the 2024 filing period, deadlines may vary by jurisdiction, so it is crucial to keep track of specific dates relevant to your locality.

Implementing a routine checklist can help ensure compliance. A checklist may include:

Ignoring these compliance measures can lead to penalties or revised tax assessments. Businesses should remain diligent in filing accurately to avoid complications.

Interactive tools for enhanced understanding

To provide additional support in navigating the Business Property Statement process, several interactive tools can enhance your understanding. Engaging with these resources can provide clarity and streamline preparation efforts.

Taking advantage of these resources can help businesses feel confident in their filing process and ensure compliance.

Conclusion of your filing journey

Successfully submitting the Business Property Statement is a crucial step for businesses in the 2024 filing period. By following the processes outlined in this guide and leveraging tools like pdfFiller, businesses can confidently approach their filing obligations.

Final reminders include double-checking all entries and ensuring that you have the necessary attachments. pdfFiller empowers users to streamline document management, making it simpler to format, sign, and track important filings effortlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business property statement 2024 online?

Can I create an eSignature for the business property statement 2024 in Gmail?

How do I edit business property statement 2024 on an Android device?

What is business property statement 2024?

Who is required to file business property statement 2024?

How to fill out business property statement 2024?

What is the purpose of business property statement 2024?

What information must be reported on business property statement 2024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.