Get the free Identity Verification Disclosure NoticeUSA PATRIOT Act

Get, Create, Make and Sign identity verification disclosure noticeusa

Editing identity verification disclosure noticeusa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out identity verification disclosure noticeusa

How to fill out identity verification disclosure noticeusa

Who needs identity verification disclosure noticeusa?

Understanding the Identity Verification Disclosure Notice USA Form

Understanding identity verification disclosure

An identity verification disclosure notice is a critical document that establishes the identity of individuals or entities involved in financial and legal transactions. This notice is a key compliance mechanism designed to protect both institutions and customers by ensuring that proper identification is verified before any transactions are executed. This type of notice acts as a safeguard against activities such as fraud, money laundering, and terrorism financing, which are critical concerns for financial institutions in today's banking system.

Effective identity verification fosters trust and integrity within financial systems. By adhering to such measures, financial institutions not only comply with regulatory requirements but also enhance their reputation and reduce risks associated with illegitimate transactions.

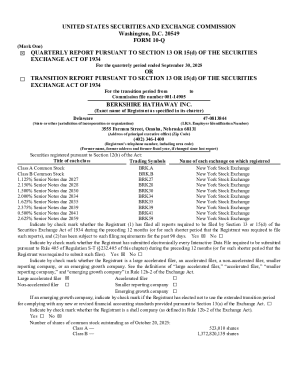

Legal framework and requirements

The legal framework governing identity verification disclosure notices is primarily shaped by the USA PATRIOT Act, enacted in 2001 to combat terrorism. This act incorporates provisions that require financial institutions and certain businesses to implement effective anti-money laundering programs, which include rigorous customer identification processes. These obligations compel financial institutions to collect identification information from customers before account creation or processing significant transactions.

In addition to the USA PATRIOT Act, various other regulations govern the identity verification processes, including the Bank Secrecy Act (BSA) and the Office of Foreign Assets Control (OFAC) regulations. These laws collectively ensure that institutions maintain detailed records all financial activities to prevent any illegal or suspicious transactions from occurring.

Types of identity verification notices

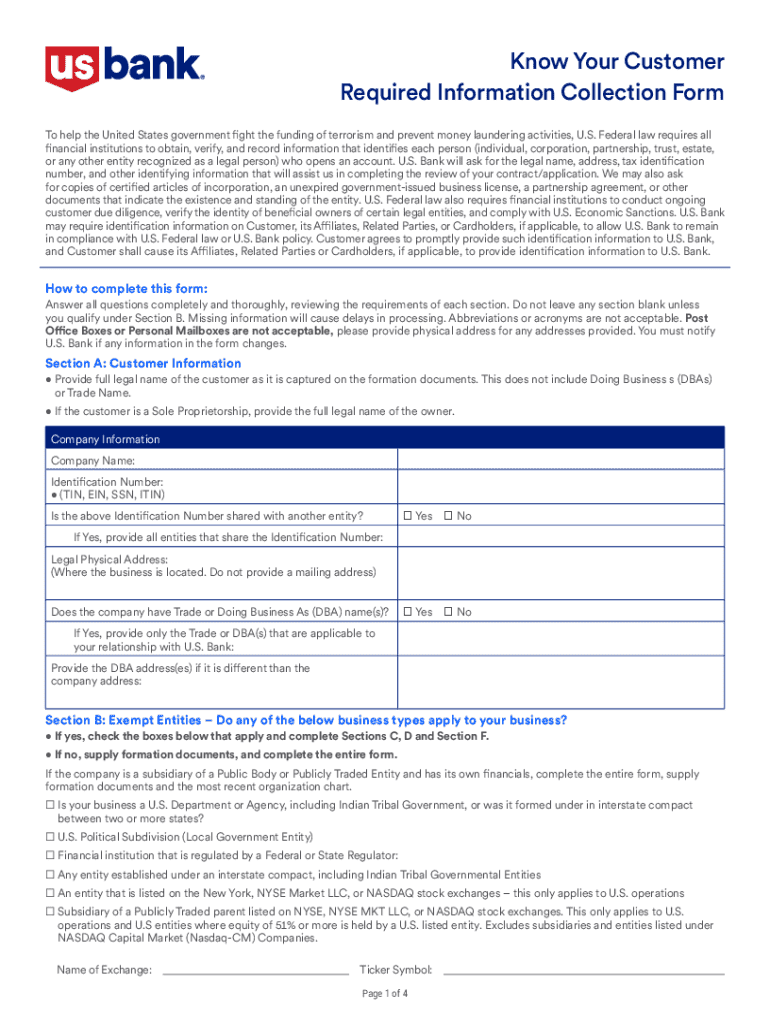

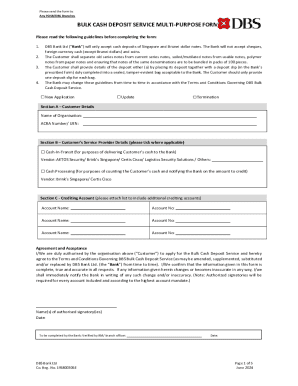

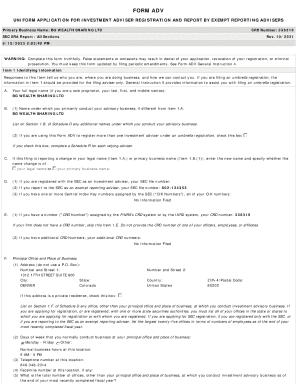

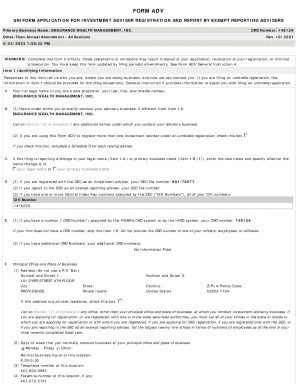

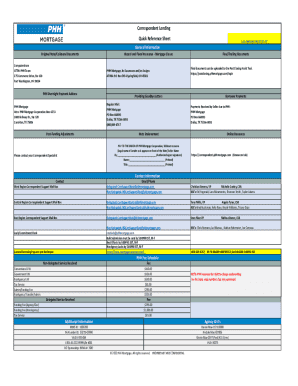

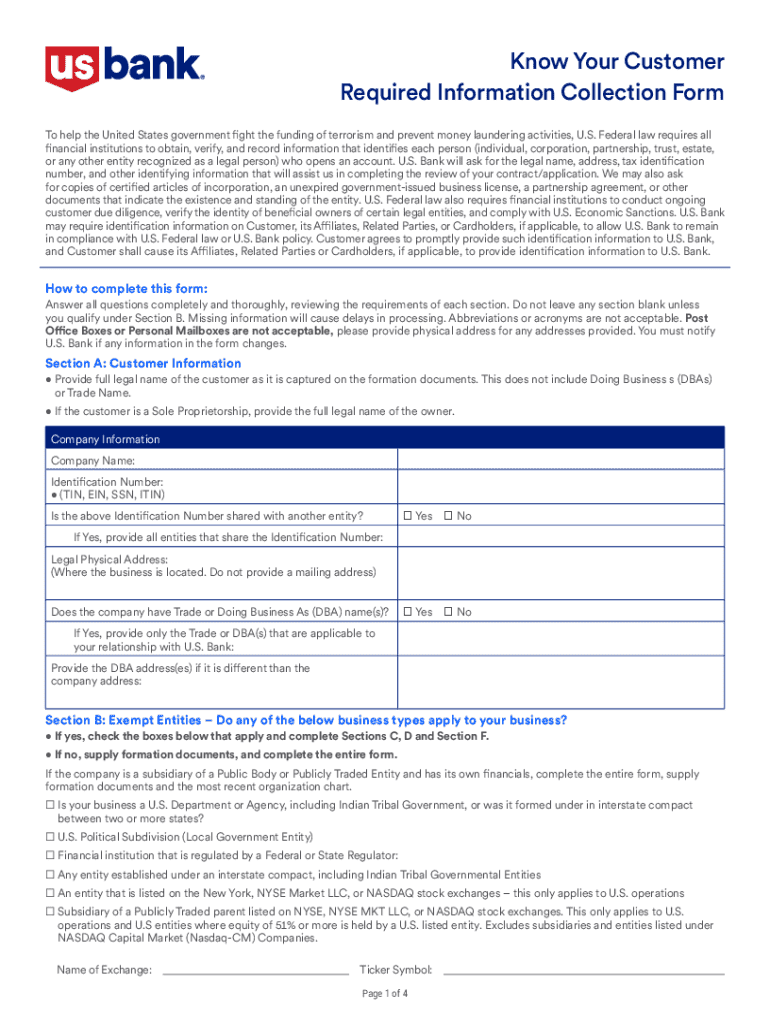

Both personal and business account procedures necessitate distinct approaches to identity verification disclosures. For individuals, the steps typically involve providing a government-issued identification, such as a driver’s license or passport, alongside additional information like Social Security numbers to verify identity.

For businesses, the requirements are more complex, often requiring documentation that substantiates the corporation's identity and its owners. Often, institutions may require articles of incorporation, partnership agreements, and any documents that clarify beneficial ownership, which are essential for regulatory compliance.

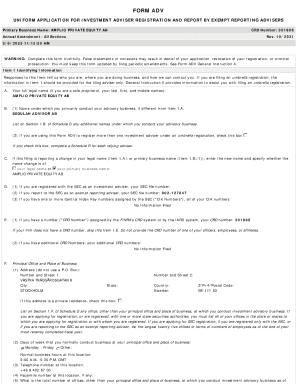

Filling out the identity verification disclosure form

Completing the identity verification disclosure form effectively is critical to prevent delays in processing. Here’s a step-by-step approach to filling out the form accurately:

Utilizing tools like pdfFiller can enhance the filling process. This cloud-based solution allows users to edit, fill out forms, and securely store documents, ensuring a smoother workflow.

Managing your identity verification disclosure notice

Editing and customizing your identity verification disclosure notice is essential for ensuring compliance. pdfFiller offers intuitive editing features that let users adjust the notice according to institutional requirements while maintaining acceptable formatting. This flexibility can mitigate risks associated with errors or omissions that could delay or jeopardize transactions.

Moreover, pdfFiller supports eSignature capabilities which provide a legally binding manner of signing documents online. This feature is beneficial for businesses requiring signatory approval from multiple stakeholders, enabling efficient collaboration and quick turnaround times.

Important considerations and best practices

As with any form or disclosure, there are common pitfalls that individuals and teams should be aware of. Frequently overlooked details include incorrect identification numbers, mismatched names, or incomplete documentation, which can lead to denials or unnecessary delays in processing.

Best practices include ensuring all information is current and double-checking against the requirements list before submission. Keeping your documents organized, securely stored, and accessible can save a considerable amount of time and effort in any verification process.

External link disclaimers and notices

When navigating identity verification processes, it’s crucial to critically evaluate third-party information sources. Although some websites provide templates or guidance for filling out forms, the reliability of these resources can vary. Always cross-reference information with trusted legal and financial institutions to ensure compliance with current regulations.

FAQs about identity verification disclosure notices

One common concern individuals have is what to do if their identity verification disclosure form is denied or flagged for clarification. In such cases, promptly contact the institution, ensuring any additional information or documentation required is provided swiftly to expedite resolution.

Furthermore, if circumstances change, such as a new address or legal name, it's essential to update your disclosure information at the earliest opportunity to maintain compliance and avoid future processing issues.

For businesses - additional documentation needs

For different business structures, specific documentation is required. Limited Liability Companies (LLCs), Corporations, and Partnerships must submit varying levels of information. This often includes resolutions or statements from managing members or owners elucidating who has the authority to act on behalf of the business.

Moreover, depending on the state of incorporation or operation, additional requirements may exist. Consulting an attorney or a compliance professional can provide valuable guidance in understanding both universal and localized obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit identity verification disclosure noticeusa from Google Drive?

How do I fill out the identity verification disclosure noticeusa form on my smartphone?

How do I edit identity verification disclosure noticeusa on an Android device?

What is identity verification disclosure noticeusa?

Who is required to file identity verification disclosure noticeusa?

How to fill out identity verification disclosure noticeusa?

What is the purpose of identity verification disclosure noticeusa?

What information must be reported on identity verification disclosure noticeusa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.