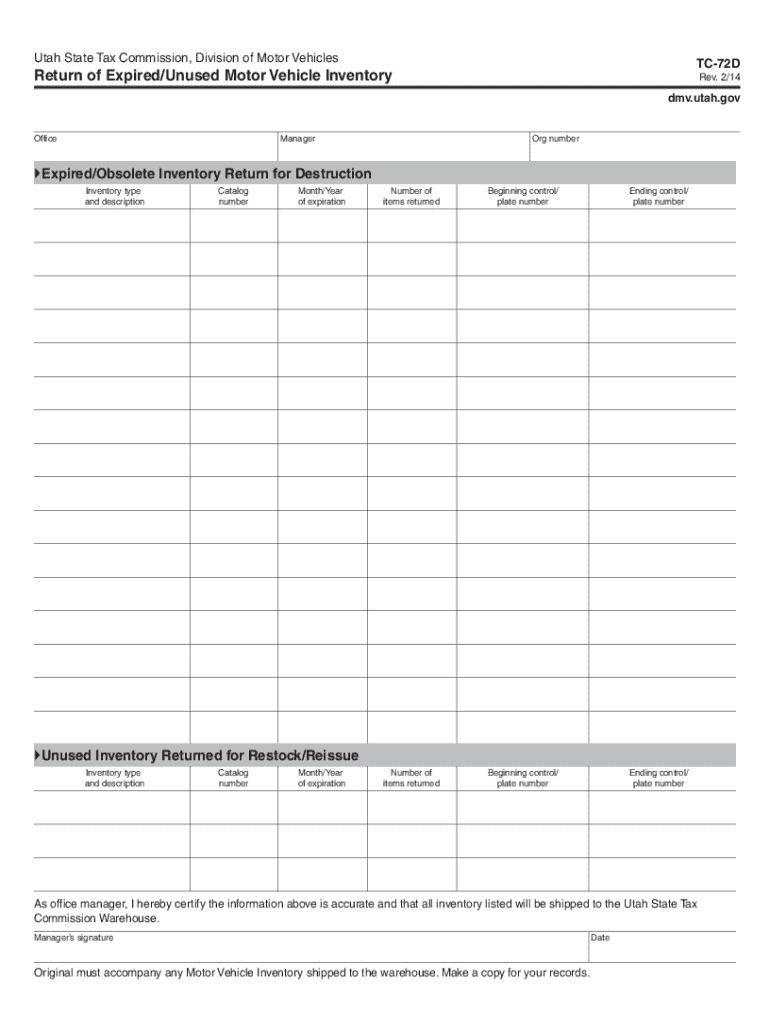

Get the free TC-72D Return of Expired/Unused Motor Vehicle Inventory. Forms & Publications

Get, Create, Make and Sign tc-72d return of expiredunused

How to edit tc-72d return of expiredunused online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-72d return of expiredunused

How to fill out tc-72d return of expiredunused

Who needs tc-72d return of expiredunused?

Your comprehensive guide to the TC-72D return of expired/unused form

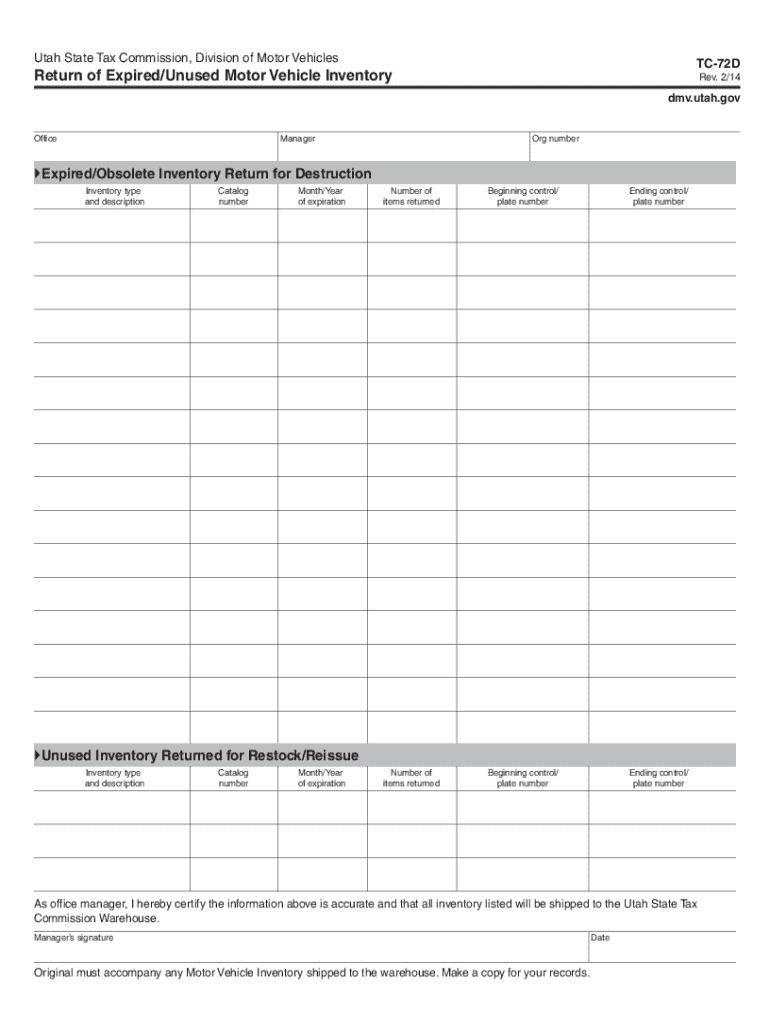

Understanding the TC-72D form

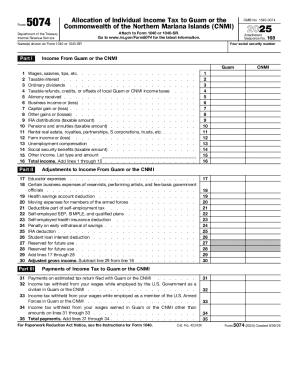

The TC-72D form, specifically designed for use in the state of Utah, pertains to the return of expired or unused tax documents and forms. This document plays a crucial role in ensuring compliance with state tax laws and regulations. Whether you're an individual or part of a team managing financial documentation, understanding the TC-72D form is essential for keeping your records accurate and up-to-date.

The primary purpose of the TC-72D form is to facilitate the reporting and return of any documents that are no longer valid due to expiration or have not been utilized within the required timeframe. By returning these forms, individuals and organizations can prevent potential penalties related to erroneous tax filings and maintain clear communication with the taxation authorities.

Identifying expired or unused TC-72D forms

Recognizing an expired TC-72D form is vital for compliance and accurate record-keeping. An expired TC-72D generally refers to any form that has surpassed its validity period as indicated by state guidelines. It’s crucial to refer to these guidelines regularly to ensure all documentation is current.

Determining whether your TC-72D form is unused can be straightforward. If you find that the form hasn’t been filled out or submitted within the specified timeframe, it is deemed unused. This can happen due to various reasons, including changes in financial status or oversight in document management.

Step-by-step guide to returning a TC-72D

Submitting a TC-72D form requires careful preparation and accurate completion of the required paperwork. To begin, gather all necessary information that is pertinent to your personal and financial situation, including your name, address, tax identification number, and details specific to the forms you are returning.

Additionally, ensure you have all supporting documentation ready. This might include previous filings, correspondence with tax authorities, and any additional verification needed to accompany your TC-72D form during submission. By being thorough in this preparation, you can avoid common pitfalls down the line.

Once you've gathered all the information, proceed to fill out the TC-72D return form. Focus on key sections such as the reason for return, the type of documents being returned, and your contact details. Tip: always cross-reference your entries with the original documents to ensure consistency.

After completing the form, it’s vital to review it for common mistakes. Misinterpreting the instructions provided with the TC-72D can lead to rejection. Failing to include required attachments or providing incorrect information are the primary reasons for delays or rejections in processing.

Submission process for the TC-72D return

Once your TC-72D return form is filled out, it’s time to submit it. There are several methods you can use, depending on your convenience. The preferred method is online submission through platforms like pdfFiller, which provides a streamlined experience. Alternatively, you can submit it via mail or in-person at specified state offices in Salt Lake City.

It is essential to keep track of submission deadlines. Utah tax laws often impose strict timelines for when a TC-72D form must be submitted. Any delays could incur penalties, so it’s advisable to mark these dates on your calendar ahead of time.

After you submit your TC-72D form, you should expect a processing period. The timeline can vary, so be patient. During this time, the tax authority will review your documents and, depending on their findings, may reach out with additional questions or confirm receipt of your submission.

Tools and features to optimize your TC-72D process on pdfFiller

Utilizing pdfFiller for your TC-72D return streamlines the documentation process significantly. Its interactive editing tools allow you to modify your documents easily, ensuring that all information is correct and up-to-date before submission. You can directly edit, annotate, and sign PDFs, simplifying the usually cumbersome paperwork.

The eSignature feature enhances the completion process by allowing you to sign documents digitally. This means quicker turnaround times and the comfort of knowing your documents are secured with encryption measures, catering to security reasons inherent in financial documentation.

Collaboration features on pdfFiller further enhance your experience, especially for teams. You can invite team members to review and sign documents collaboratively. This not only saves time but also provides a clear framework for tracking changes and comments, ensuring all parties are kept informed throughout the process.

Frequently asked questions (FAQs) about TC-72D returns

When dealing with tax documentation, questions often arise. Can I use an expired TC-72D form? The answer is no—a form is only valid if submitted within its designated timeframe. If your TC-72D form is rejected, the first step is to review the reasons stated by the tax agency and rectify any issues accordingly.

It’s important to be aware of penalties associated with late submissions. Utah tax laws enforce strict compliance, and late submissions could lead to penalties or additional scrutiny. Correcting mistakes on a submitted TC-72D can also be a concern; it is usually done by submitting a revised form along with any necessary explanations.

Expert tips for efficient document management

Managing forms such as the TC-72D effectively requires organization and proactive measures. Establish a consistent filing system, which includes both digital and physical copies of important documents. Utilize folders and labels to categorize forms, ensuring easy access when needed, especially as deadlines approach.

Staying organized includes regularly reviewing your documents to prevent expirations. Set reminders for important dates related to your forms and use technology to help manage your workflows. Leveraging cloud-based solutions like pdfFiller can further alleviate concerns about missing deadlines or losing track of necessary paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tc-72d return of expiredunused directly from Gmail?

How can I modify tc-72d return of expiredunused without leaving Google Drive?

How can I fill out tc-72d return of expiredunused on an iOS device?

What is tc-72d return of expiredunused?

Who is required to file tc-72d return of expiredunused?

How to fill out tc-72d return of expiredunused?

What is the purpose of tc-72d return of expiredunused?

What information must be reported on tc-72d return of expiredunused?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.