Get the free Car Insurance Claim Form Form Template

Get, Create, Make and Sign car insurance claim form

Editing car insurance claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out car insurance claim form

How to fill out car insurance claim form

Who needs car insurance claim form?

Your Comprehensive Guide to the Car Insurance Claim Form

Understanding car insurance claims

A car insurance claim is a formal request submitted to your insurer for financial compensation following an incident covered under your policy. Whether you've been involved in an accident, experienced theft, or faced vehicle damage due to a natural disaster, filing a claim is your key to recovery. Knowing when and how to file the claim can significantly impact the speed and efficiency with which you receive compensation.

Understanding the different types of car insurance coverage is crucial before initiating a claim. There’s liability coverage, which protects you from claims made against you for bodily injury or property damage caused to others; collision coverage, which handles damages to your vehicle resulting from a collision; comprehensive coverage for non-collision-related damages like theft or fire; and uninsured/underinsured motorist coverage, which provides protection if you're in an accident with someone who lacks adequate insurance. Familiarity with these terms will empower you to make the right decisions when the time comes to file your claim.

Preparing to file your claim

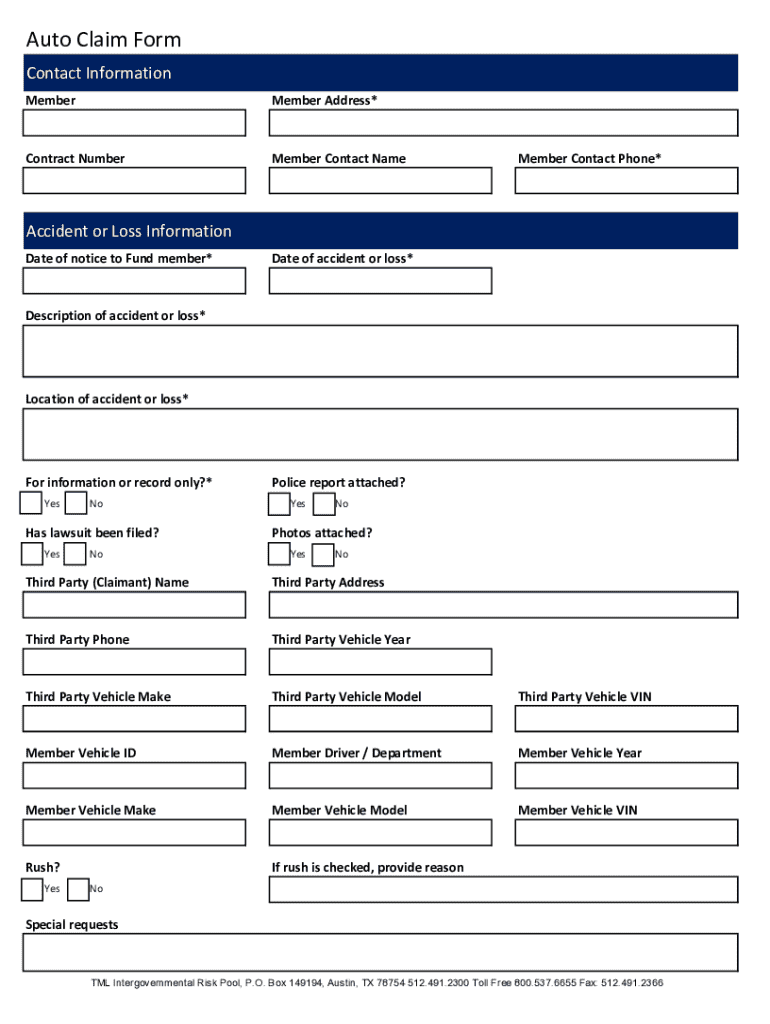

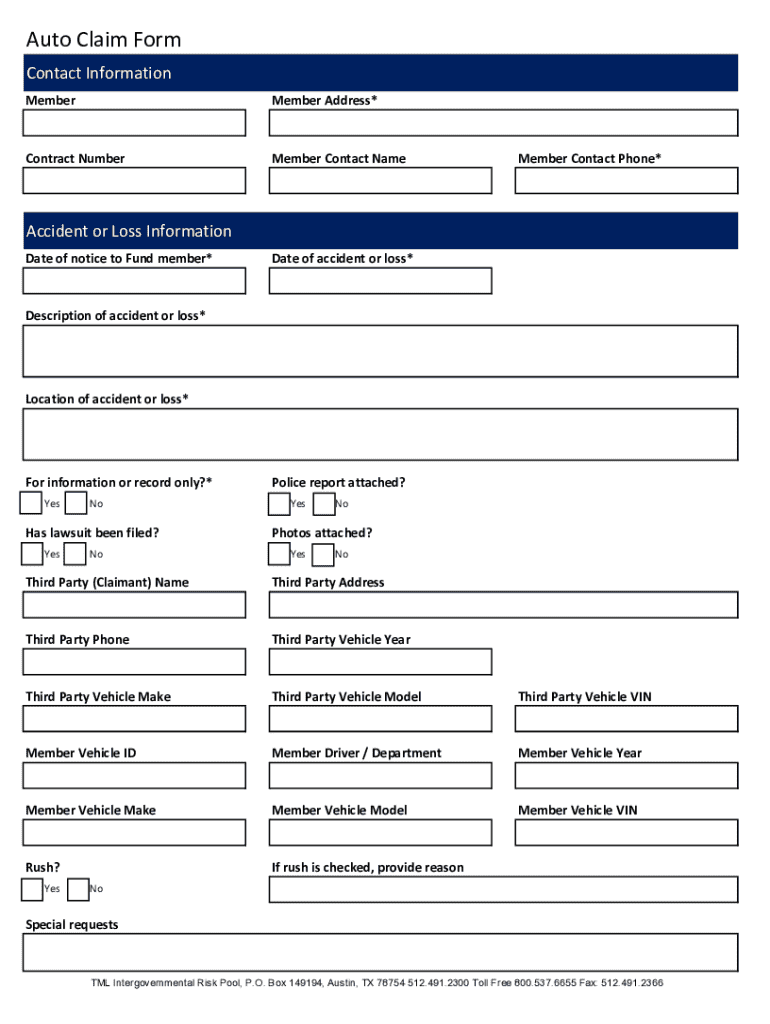

Before you dive into filling out the car insurance claim form, you should gather essential information to streamline the process. Start by locating your policy number, as it is crucial for identifying your coverage. Additionally, ensure you have details about the incident—specifically the date, time, and location of the event. Collecting contact information for other parties involved, such as witnesses or other drivers, can also prove beneficial.

In addition to basic information, certain documents will be indispensable. For example, a police report is crucial if your accident involved law enforcement. Photographic evidence of the damage can also strengthen your claim, while witness statements may provide additional support for your case. Organizing these materials in advance can save time during the submission process.

The car insurance claim process

When you sit down to fill out the car insurance claim form, approach it systematically. First, provide your personal information accurately, including your name, address, and policy number. Next, offer a detailed description of the incident, ensuring to capture all relevant facts without speculation or assumption. When discussing damages and injuries, be clear and precise to avoid any potential misunderstandings.

After completing the form, the next step is submitting your claim. Most insurers offer multiple submission methods: online, via mail, or in person. When submitting, it’s advised to double-check the form for any errors that might delay processing, such as incorrect fields or missing signatures. Once submitted, confirm receipt with your insurance company to ensure you're on track and to begin the formal processing of your claim.

After filing your claim

Once your car insurance claim form is submitted, the insurance company begins its review process. During this time, they will assess the information provided, cross-reference it with your policy, and determine your eligibility for coverage. This process can take anywhere from a few days to several weeks, depending on the claim’s complexity and the insurer's workload.

If you don’t hear back after a reasonable time, don’t hesitate to perform a follow-up. Most insurers allow you to track your claim status through their online platform or customer service channels. This is your opportunity to resolve any outstanding issues or inquiries about your claim’s progress. Remember, staying engaged after filing can help expedite your experience.

Common issues with car insurance claims

Despite following all proper procedures, issues can arise during the claims process. Understand the potential reasons for claim denials, such as not adhering to deadlines, lack of documentation, or claims not falling within the scope of your policy. If your claim is denied, take a deep breath—this is not the end. You have the right to appeal the decision and request a detailed explanation from your insurer.

When disputing a claim, document your communications extensively, including names, dates, and the content of conversations. Keeping everything organized will provide a solid foundation for your appeal. Remember, a firm but cordial approach can significantly affect the outcome.

Claiming for special circumstances

Some scenarios can complicate the claims landscape, such as hit-and-run incidents, theft, or natural disasters impacting your vehicle. Each of these scenarios might necessitate additional steps or documentation. For instance, in a hit-and-run, ensure a police report is filed immediately, while for theft, detailed descriptions of the vehicle and any stolen property are essential.

As a policyholder, you should also be aware of your rights when filing a claim. Many states have regulations protecting consumer rights within the insurance landscape, and understanding these can help you navigate complexities. Staying informed is key to ensuring equitable treatment during the claims process.

Interactive tools for claim management

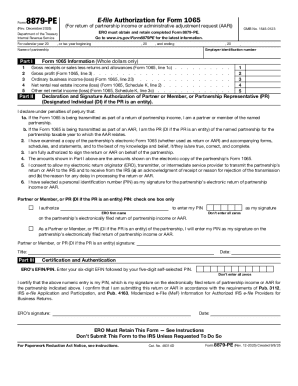

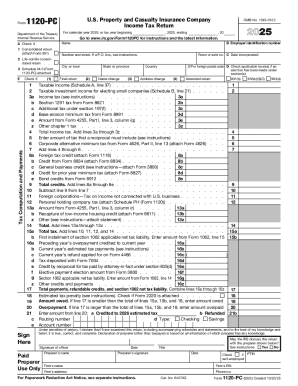

In today’s digital landscape, utilizing online tools can simplify your claims experience greatly. For example, pdfFiller provides a user-friendly platform for effortlessly filling out the car insurance claim form. You can easily edit, eSign, and collaborate with team members to complete your documentation efficiently. This accessibility means no more dealing with paper forms or scanning documents endlessly.

Moreover, tracking and storing your insurance documents digitally can provide peace of mind. With platforms like pdfFiller, organizing your files in an easily retrievable format ensures you can access necessary documents from anywhere when you need them most. This level of preparation can make all the difference in prompt claims processing.

Final tips for a smooth claims experience

To make the claims process smooth and efficient, consider these best practices: First, report the incident to your insurer promptly, adhering strictly to your policy's guidelines regarding notification. Detailed documentation should accompany your report, including photographs, witness statements, and any relevant police reports. Clear and open communication channels with your insurer can also facilitate quicker resolutions.

After a claim is resolved, it’s important to reflect on how the experience may affect your future premiums. In some cases, filing a claim may result in increased rates upon renewal. Therefore, consider reviewing your coverage periodically to ensure it aligns with both your needs and how the claims experience may impact your financial planning moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify car insurance claim form without leaving Google Drive?

How do I fill out the car insurance claim form form on my smartphone?

Can I edit car insurance claim form on an Android device?

What is car insurance claim form?

Who is required to file car insurance claim form?

How to fill out car insurance claim form?

What is the purpose of car insurance claim form?

What information must be reported on car insurance claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.