Get the free Fill Your Utah Tc 42 Template With EaseAll Utah Forms

Get, Create, Make and Sign fill your utah tc

Editing fill your utah tc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fill your utah tc

How to fill out fill your utah tc

Who needs fill your utah tc?

How to Fill Your Utah TC Form: A Comprehensive Guide

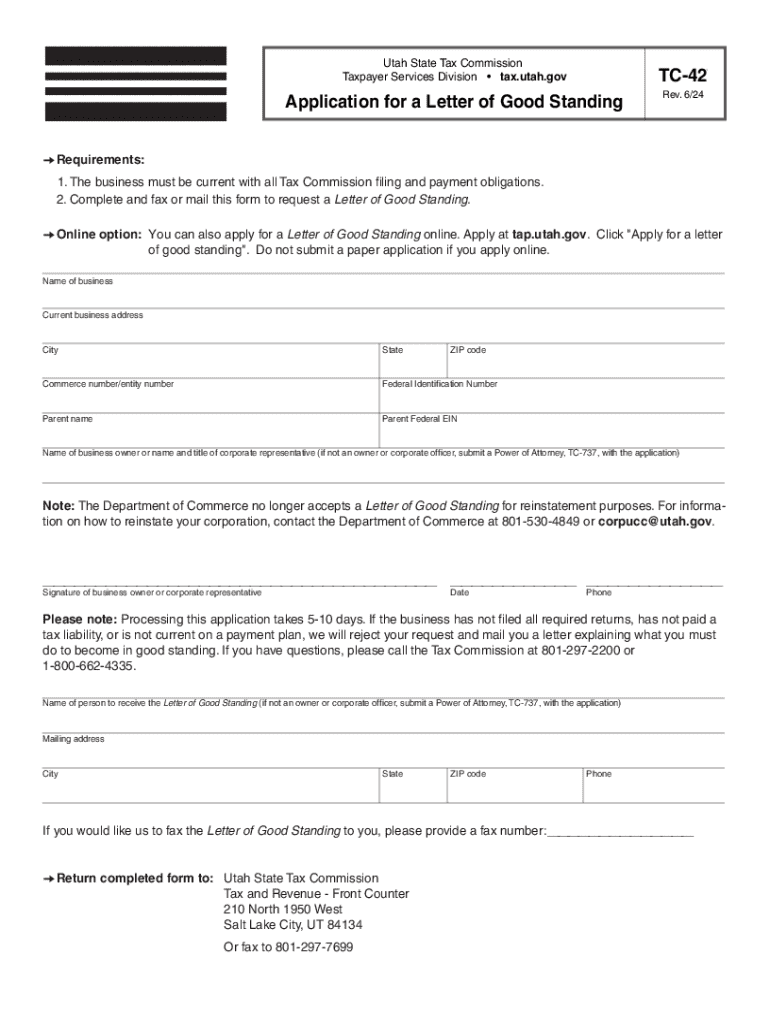

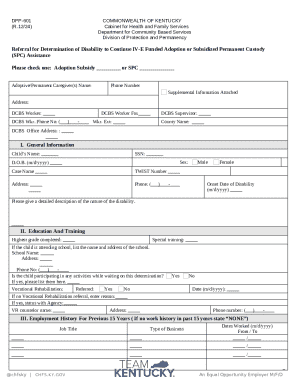

Understanding the Utah TC form

The Utah TC form is a critical document in the state of Utah, primarily used for tax filing purposes. It serves as a financial declaration that enables the state tax authority to assess and process taxes owed or refunds due on diverse income sources. Filling out this form correctly is paramount for ensuring compliance with tax laws and regulations in Utah.

Understanding the nuances of the Utah TC form is vital for individuals and businesses alike. It encapsulates key sections that guide taxpayers through the information required for accurate filing, ensuring that all relevant data is provided. Missteps in this form can lead to delays in processing, potential penalties, or loss of refunds.

Individuals required to fill the TC form include residents of Utah, non-residents with income from Utah sources, and those who qualify for specific tax credits. Understanding who needs to file is essential to avoid complications and to ensure full compliance with Utah's tax obligations.

Key components of the Utah TC form

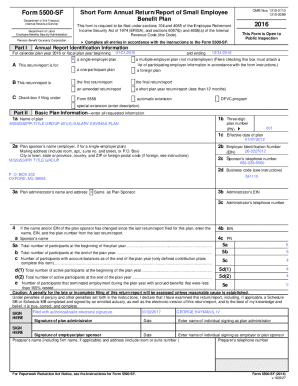

To efficiently fill your Utah TC form, it is crucial to grasp its essential components. The TC form is segmented into various sections, each designed to capture specific information about the taxpayer. Starting from the personal information section to financial and withholding details, every part needs to be filled accurately.

The primary sections of the TC form include:

Additionally, when filing, it's critical to include supporting documents such as W-2 forms, 1099s, and any other proof of income or deductions. These documents substantiate the entries made in the TC form and are essential for a smooth submission process.

Common mistakes to avoid include misreporting your income, failing to include necessary documents, or inconsistent information. Keeping a checklist can help ensure accuracy and completeness.

Step-by-step instructions to fill out your Utah TC form

Filling out your Utah TC form can seem daunting, but with a step-by-step approach, it can be a straightforward task. Here’s how to get started:

First, gather all necessary information. This includes your identification details, such as your full name and residential address, which should reflect your current information. Ensure your Tax Identification Number (TIN) is also ready — this is crucial for matching your submission with state records.

Next, fill out the form section by section:

After filling out each section, it’s wise to review your TC form for any inaccuracies. Double-check figures and ensure all supporting documents are attached. If you notice a mistake, you can easily correct it before submission by crossing out the error and writing the correct information nearby.

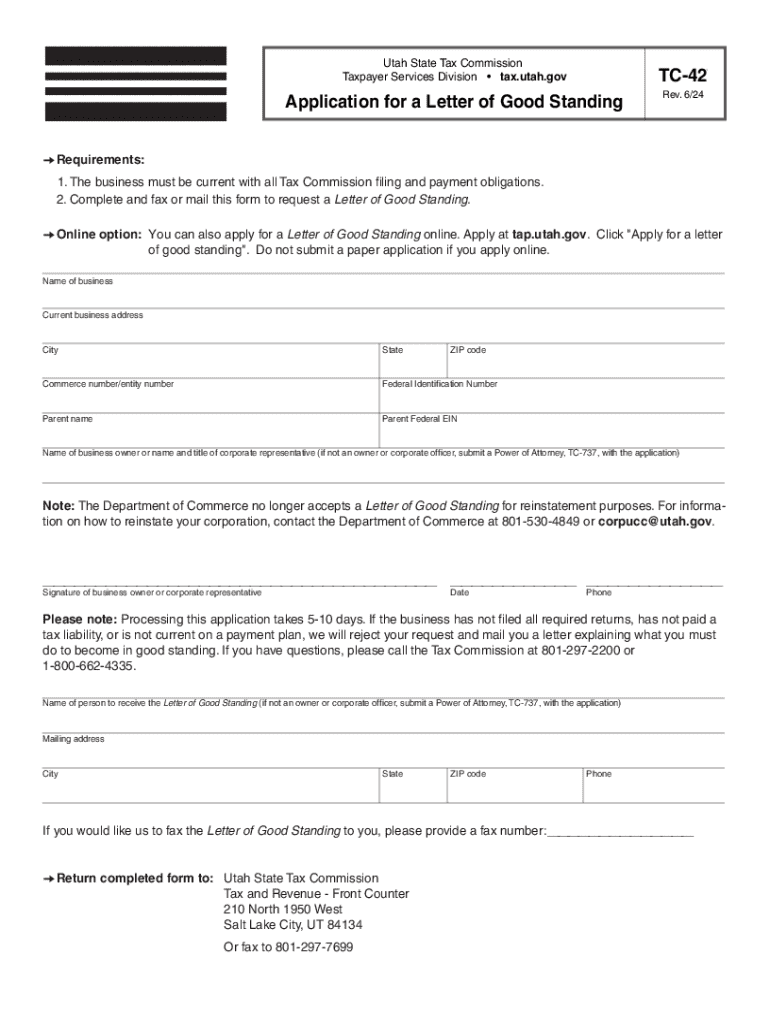

Submitting your Utah TC form

Once you've completed your TC form, the next step is submission. There are several methods available to submit your form, providing convenience and flexibility.

The two primary submission methods are:

It’s crucial to pay attention to deadlines. The TC form must be submitted by April 15th to align with most tax submission deadlines. Late submissions can lead to penalties, so plan accordingly.

To keep track of your submission status after sending it, you can check the Utah state tax website or contact their support for updates. This is especially important during tax season when processing times can vary.

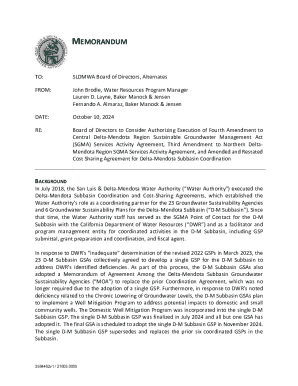

Editing and managing your TC form with pdfFiller

Using pdfFiller offers numerous benefits when it comes to managing your Utah TC form. It empowers users to edit their PDFs, ensuring that any changes can be made quickly and efficiently without the hassle of starting from scratch.

Editing a TC form in pdfFiller is a straightforward process:

Collaboration is another strong feature of pdfFiller. If you're working within a team to complete the TC form, sharing and collaborating in real-time can significantly enhance efficiency. You can add comments, suggestions, and changes directly within the document, making it easier for teams to stay aligned.

eSigning your Utah TC form

In the digital age, eSigning your Utah TC form is essential. This not only streamlines the submission process but also adds an extra layer of security and authenticity.

Using pdfFiller, here’s how to eSign your TC form:

It’s important to ensure that your eSignature is valid. This means adhering to the signature requirements of Utah and ensuring that it matches your real signature wherever possible. Valid eSignatures are legally binding in many cases, ensuring that your document holds up under scrutiny.

Frequently asked questions (FAQs)

Filing your Utah TC form can lead to numerous questions. Here, we’ve compiled some common queries and troubleshooting tips for common issues.

Common questions about the Utah TC form include:

For further assistance, individuals can utilize resources like local tax offices or online support from the Utah tax authority. Engaging with these resources not only helps in resolving issues but also ensures compliance with ever-changing tax laws.

Success stories and user testimonials

Many users have shared their experiences with the Utah TC form process, highlighting how pdfFiller has simplified their journey. From seamless editing to user-friendly eSigning options, the platform has made filing taxes much more manageable.

Success stories highlight:

Incorporating user testimonials illustrates the value of utilizing pdfFiller, particularly in a landscape focused on efficiency and adaptability. As users navigate the tax landscape in Utah, having a reliable solution can make all the difference.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in fill your utah tc without leaving Chrome?

Can I create an eSignature for the fill your utah tc in Gmail?

How do I complete fill your utah tc on an iOS device?

What is fill your utah tc?

Who is required to file fill your utah tc?

How to fill out fill your utah tc?

What is the purpose of fill your utah tc?

What information must be reported on fill your utah tc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.