Get the free Elderly Tax Exemption Worksheet

Get, Create, Make and Sign elderly tax exemption worksheet

Editing elderly tax exemption worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out elderly tax exemption worksheet

How to fill out elderly tax exemption worksheet

Who needs elderly tax exemption worksheet?

Elderly Tax Exemption Worksheet Form: A Comprehensive Guide

Understanding the elderly tax exemption

The elderly tax exemption is designed to alleviate some of the financial burdens faced by seniors, providing significant tax breaks which can help enhance their quality of life. Tax benefits for seniors not only serve as a form of recognition for their contributions throughout their working lives but also as a crucial support system, helping them navigate the increasing costs of living and healthcare as they age.

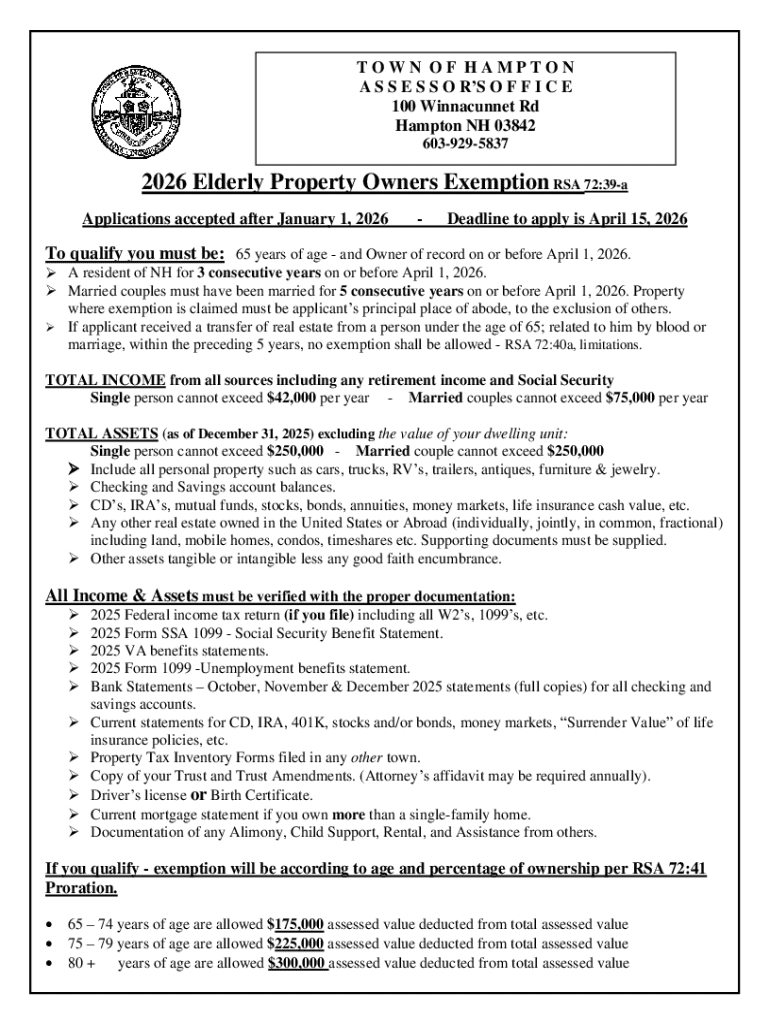

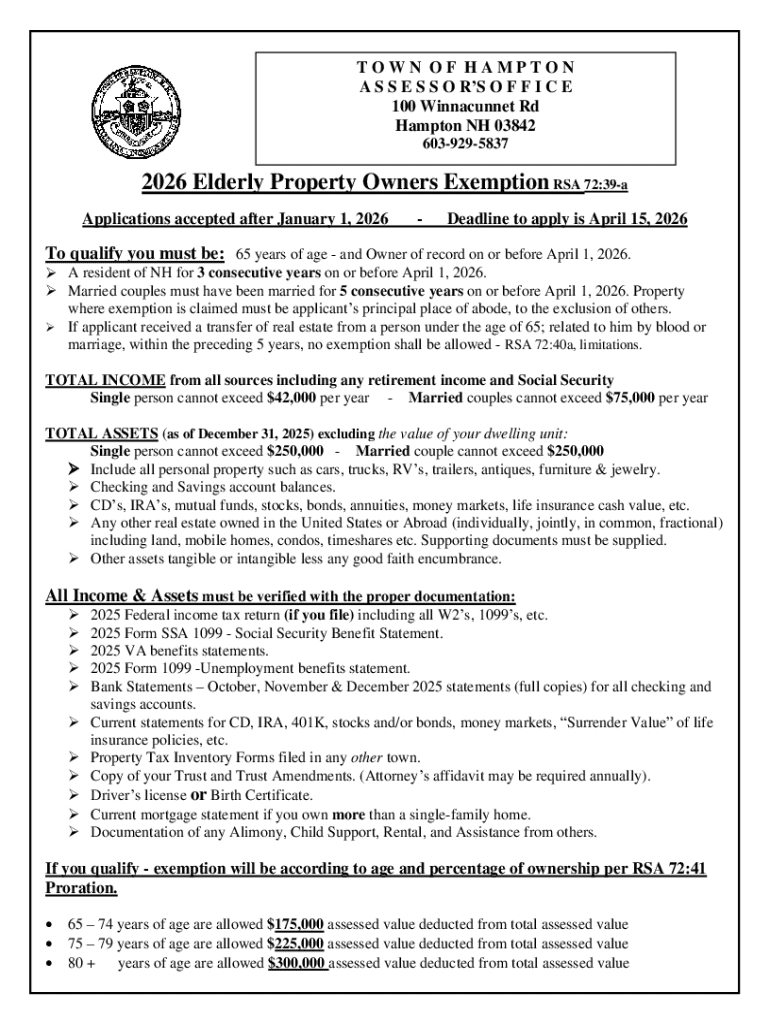

Eligibility criteria

To qualify for the elderly tax exemption, several criteria must be met. First, individuals typically need to be at least 65 years old. Additionally, income plays a critical role in eligibility—candidates must often remain below a certain income threshold, which varies by state. Furthermore, residency status is also important; applicants generally must be residents of the state providing the exemption.

Key benefits of the elderly tax exemption

The elderly tax exemption provides essential financial relief for seniors. By reducing taxable income, eligible seniors can retain more of their hard-earned money, often leading to substantial tax savings. This exemption can play a pivotal role in budgeting for essentials like groceries, medications, or healthcare.

For instance, if an eligible senior has a taxable income of $30,000, and the exemption allows them to deduct $5,000, they would only pay taxes on $25,000, leading to lower overall tax liability. This translation of tax benefits into real-world savings can significantly enhance the financial stability of older adults.

Impact on accessing other benefits

Moreover, the elderly tax exemption can influence eligibility for various state-assisted programs, including healthcare subsidies and housing assistance. Having a lower taxable income not only makes seniors eligible for more benefits but can also create a pathway for support systems designed specifically to assist the aging population.

Detailed guide to the elderly tax exemption worksheet form

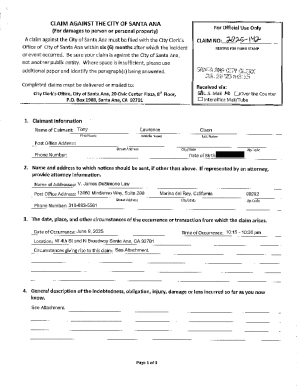

The elderly tax exemption worksheet form is a crucial tool for claiming this benefit. Its purpose is to simplify the application process, ensuring that seniors can easily understand and provide the necessary information required by the tax authorities.

Overview of the worksheet form

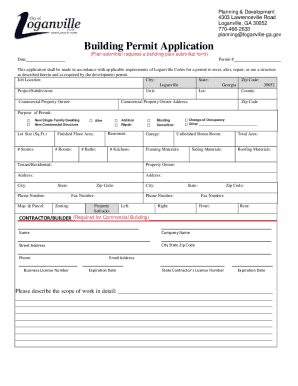

You can typically obtain the elderly tax exemption worksheet form through state tax authority websites or directly at your local tax office. Understanding the structure of this form is essential for securing your exemption efficiently.

Step-by-step instructions for completion

Common errors to avoid

Seniors should be cautious about misreporting income or overlooking some required details. Failing to include all income sources or ignoring specific sections can lead to delays or rejection of the exemption claim.

Submitting your elderly tax exemption worksheet

Once the form is completed, you must submit it promptly. There are various submission methods available—many states now offer online submissions, which can be faster and more efficient than traditional paper filings.

Available submission methods

Deadlines and important dates

It is crucial to be aware of the tax season timeline. Late submissions can result in penalties or denial of exemptions, causing unnecessary stress during tax time. Be proactive and submit your forms as soon as possible to avoid these outcomes.

FAQ: Frequently asked questions

Many seniors have questions about their eligibility status and specifics regarding the completion of the elderly tax exemption worksheet form. This section can help clarify those queries.

Clarifications on eligibility

What to do if you receive a notice from the tax authority

If you receive a notice, it is essential to respond promptly and understand the instructions outlined. Seeking assistance from tax professionals may help navigate any complications.

Utilizing pdfFiller for your tax needs

pdfFiller is a powerful tool that simplifies the process of preparing your elderly tax exemption worksheet form. With features designed to enhance document preparation, users can edit PDFs easily, streamlining the data entry process.

Features to enhance document preparation

Collaboration tools for teams

PdfFiller also offers collaborative features that enable real-time document sharing and feedback, making it suitable for families or caregivers assisting seniors. Additionally, robust security and access control options ensure that personal tax information remains confidential.

Additional support and resources

Navigating tax regulations can be daunting. Many seniors benefit from seeking professional assistance when preparing their elderly tax exemption worksheet form, particularly if unique financial situations arise.

Contacting tax professionals for assistance

Exploring online resources

State tax websites often provide comprehensive information regarding exemptions available to seniors, as well as details on completing the elderly tax exemption worksheet form accurately. Seniors may also benefit from community forums that offer peer support and shared experiences.

Interactive tools for visual learners

For those who prefer visual guides, resources like infographics can simplify complex information. Seeing the workflow for filling out the elderly tax exemption worksheet can demystify the process.

Checklist for document preparation

Having a downloadable and printable checklist can streamline the document preparation process, ensuring that seniors understand what information is necessary to fulfill the requirements.

User testimonials and success stories

First-hand accounts from seniors reveal the positive impact of the elderly tax exemption on their lives. Many report feeling a considerable weight lifted off their shoulders thanks to the financial relief this benefit provides.

Moreover, those who utilized pdfFiller during their exemption form process often highlight the ease of editing and submitting forms electronically, which significantly streamlined their experience and helped avoid common pitfalls encountered during traditional paper submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in elderly tax exemption worksheet without leaving Chrome?

Can I edit elderly tax exemption worksheet on an Android device?

How do I fill out elderly tax exemption worksheet on an Android device?

What is elderly tax exemption worksheet?

Who is required to file elderly tax exemption worksheet?

How to fill out elderly tax exemption worksheet?

What is the purpose of elderly tax exemption worksheet?

What information must be reported on elderly tax exemption worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.