Comprehensive Guide to the Box 3 ik heb Form in the Netherlands

Understanding Box 3 Tax in the Netherlands

Box 3 tax refers to the taxation on savings and investments in the Netherlands, representing one of the three boxes that categorize income for tax purposes. Specifically, it covers the assets people hold, such as cash savings, investments, and real estate, which do not generate regular income. Understanding Box 3 is crucial for individuals to navigate their financial responsibilities and ensure compliance with Dutch tax laws.

Box 3 plays a vital role in the Dutch tax system as it ensures that wealth accumulated through savings and investments is appropriately taxed. This mechanism allows the tax office to measure an individual's net worth and levy a tax on the deemed income derived from these assets, rather than taxed based on actual earnings. It's essential for taxpayers to grasp the components of Box 3, so that they can prepare accurately for their annual income tax return.

Tax applies to net wealth above a certain threshold.

The rate of taxation and allowances can change annually.

Different assets are valued differently for tax purposes.

How Box 3 Tax Works

Box 3 tax operates as a wealth tax, which means that it assesses individuals based on the total value of their assets minus any liabilities. The Dutch government determines the regulations that dictate how wealth tax is calculated, primarily focusing on net assets held as of January 1st of each tax year.

The calculation of Box 3 tax involves understanding the difference between actual returns from investments and fixed yield rates established by the tax office. Each year, a fixed percentage is assumed as the yield on your assets for tax purposes, and tax-free allowances are applied to reduce the taxable amount. These calculations can impact your overall tax obligation, making it essential for taxpayers to stay informed about any changes in regulations and rates.

Citizens need to account for total gross assets and liabilities as of January 1.

A specific tax rate applies to the taxable amount after deductions.

Tax-free allowance changes may impact overall tax responsibility.

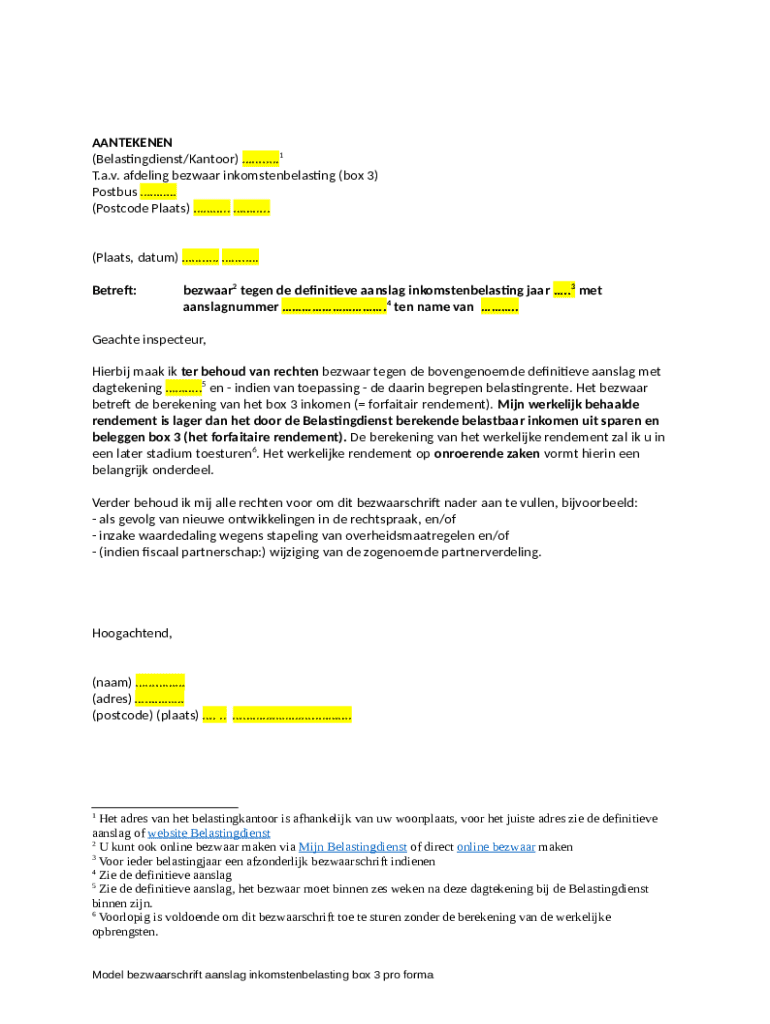

Filling Out the 'ik heb' Form

The 'ik heb' form is a document used in the Netherlands to declare assets and liabilities for Box 3 taxation purposes. Completing this form accurately is critical for ensuring compliance with the tax office while avoiding penalties associated with underreporting or misreporting financial information.

Individuals need to fill out the 'ik heb' form based on their specific financial situation, which includes disclosing personal information, providing an overview of assets, listing liabilities, and declaring any additional income sources. This structured approach helps the tax office assess your financial position accurately.

Personal Information: Name, address, and tax identification number.

Overview of Assets: Cash savings, investments, property value.

Declaration of Liabilities: Outstanding debts, mortgages.

Additional Income Sources: Any income not included in Box 1 or 2.

Box 3 Tax: Calculation Examples

To illustrate how Box 3 tax is calculated, it is beneficial to consider examples. For instance, a single taxpayer may have a net asset value after allowances that results in a particular taxable amount, which is then subjected to the fixed yield rate. By using the fixed rates set by the tax office, one can determine their total tax liability.

Couples usually file jointly which can affect the overall calculation due to shared assets and combined allowances. Different factors such as changes in investments or liabilities during the year can directly influence the Box 3 tax obligation, making proactive management of financial affairs essential.

Example 1: A single person with assets valued at €100,000 and a tax-free allowance of €50,000 would have a taxable amount of €50,000.

Example 2: A couple with combined assets valued at €200,000 minus liabilities of €30,000 would calculate their net wealth as €170,000.

Tax obligations depend on the tax-free allowance and the fixed yield rate applied by the tax office.

Common Mistakes to Avoid When Filling Out the 'ik heb' Form

When completing the 'ik heb' form, it is crucial to avoid common mistakes that could lead to tax complications or penalties. One prevalent error is underreporting assets, which can occur if individuals overlook less-obvious investments such as shares or secondary properties. Ensuring all assets are listed is essential for accurate reporting.

Another common misstep is incorrectly declaring liabilities. For homeowners, failing to include mortgage debt can result in inflated asset values, which may prompt audits from the tax office. Misinterpretation of tax-free allowances is also frequent; individuals must be clear on what qualifies for exemptions to ensure they report accurately.

Double-check all assets to avoid omission.

Clearly declare all liabilities to ensure accurate net wealth calculation.

Familiarize yourself with current tax-free allowances and their implications.

Frequently Asked Questions on Box 3 and the 'ik heb' Form

Individuals often have questions about the implications of the 'ik heb' form and Box 3 taxation. For instance, what happens if there is an error on the submitted form? Generally, it's vital to contact the tax office promptly to rectify mistakes, thereby minimizing potential penalties.

Furthermore, many wonder whether they can amend their 'ik heb' form after submission. Yes, revisions are possible, though specific procedures must be followed to ensure that changes are processed correctly without causing confusion with the tax office. Understanding how Box 3 affects the overall income tax return can clarify overall financial obligations.

Contact the tax office immediately for correcting form errors.

Amendment procedures vary; follow official guidelines.

Refer to Box 3 implications while considering your total tax return.

Tools and Resources for Box 3 Tax and 'ik heb' Form Management

Utilizing effective tools for managing the Box 3 tax process, including the 'ik heb' form, is essential for accurate taxation. Resources like pdfFiller offer functionalities tailored for document management, allowing users to create, edit, and sign forms seamlessly. These interactive tools help individuals manage their financial information efficiently.

pdfFiller provides a cloud-based platform where you can easily find templates, collaborate on form filling, and sign documents electronically. Its user-friendly interface ensures that users can navigate their financial obligations with confidence and accuracy, making tax season more manageable.

Interactive tools available for document creation and edits.

Collaborative features that simplify teamwork on financial documentation.

eSigning capabilities for quick and secure authorization.

Best practices for managing your Box 3 tax documents

To ensure smooth administration of Box 3 documents and the 'ik heb' form, individuals can adopt several best practices. First, organizing your financial information is crucial. Maintaining systematic records of assets, liabilities, and other relevant financial documents can provide clarity and ease when filling out forms.

Keeping abreast of changes in tax regulations is another best practice; the tax landscape can shift, affecting Box 3 tax implications. Additionally, regular reviews and updates of submitted forms ensure that your financial status is accurately represented. This proactive approach minimizes surprises during tax time.

Systematically categorize all financial information for easy access.

Stay informed about tax regulation changes that apply to Box 3.

Conduct regular reviews of submitted forms for accuracy.