Get the free Case 13-11766

Get, Create, Make and Sign case 13-11766

How to edit case 13-11766 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out case 13-11766

How to fill out case 13-11766

Who needs case 13-11766?

Comprehensive Guide to the Case 13-11766 Form

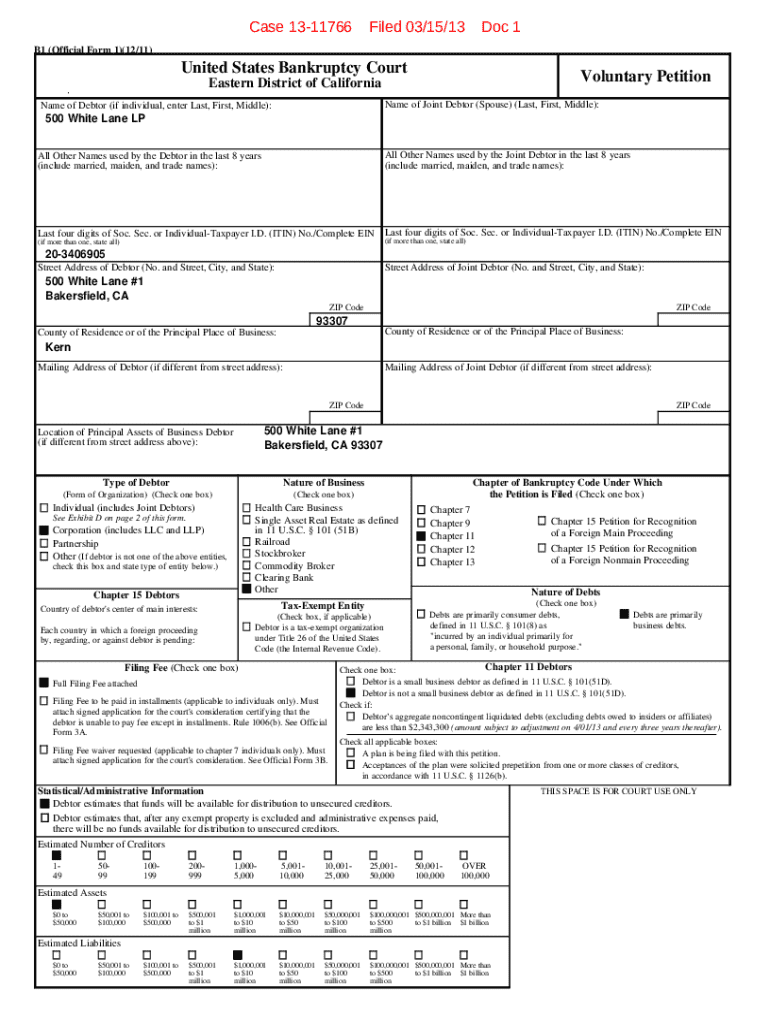

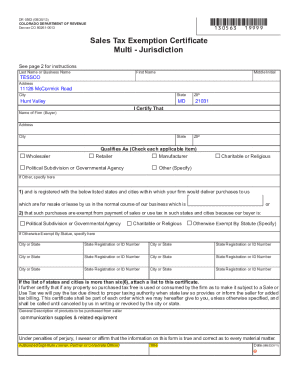

Overview of the case 13-11766 form

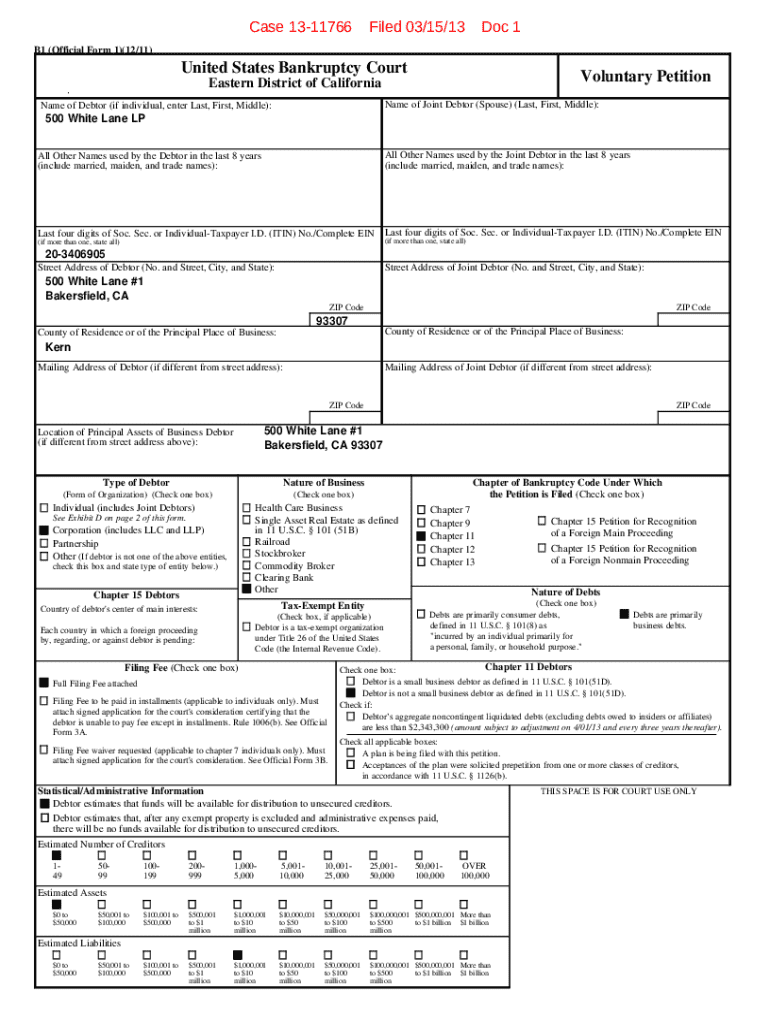

The case 13-11766 form is a specific legal document employed in the realm of bankruptcy proceedings, particularly under Chapter 13 of the U.S. Bankruptcy Code. This form serves to outline an individual's petition for bankruptcy, detailing their financial situation and proposed repayment plan to creditors. Accurate completion of this form is crucial as it lays the foundation for the bankruptcy court's evaluation and eventual approval of a repayment plan.

The significance of filling out the case 13-11766 form accurately cannot be overstated. Incomplete or incorrect information can lead to delays, rejections, or even legal repercussions. This form is frequently utilized in legal settings by individuals seeking to reorganize their debts while retaining their assets, making clarity and precision paramount in its completion.

Key elements of the case 13-11766 form

The case 13-11766 form consists of several critical sections, each designed to capture different aspects of the filing party's financial and legal circumstances. Understanding the structure of this form is essential for accurate completion.

Section 1 of the form gathers basic information such as the debtor's name, address, and contact information. This section also requires the identification of the trustee assigned to the case. Section 2 focuses on financial disclosure, necessitating detailed information about the debtor's income, expenses, and any outstanding debts. Lastly, Section 3 highlights the legal obligations of the debtor, including any agreements made with creditors and the proposed terms of the repayment plan.

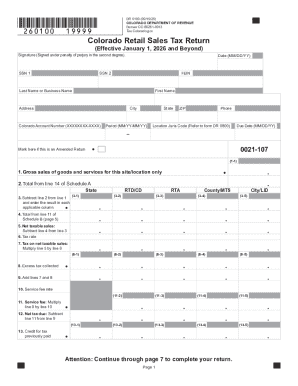

Step-by-step guide to completing the case 13-11766 form

Completing the case 13-11766 form requires careful preparation and attention to detail. Here’s a step-by-step guide to ensure a smooth process.

Step 1 involves gathering all necessary information and documentation. Prior to starting, collect recent pay stubs, tax returns, bank statements, and details of any debts. Organize these documents systematically to streamline the completion process. Step 2 focuses on filling out the form itself. Utilize clear language and double-check each entry for accuracy, as mistakes can lead to significant setbacks. Be mindful of commonly overlooked sections, such as secondary income sources or potential exemptions.

Finally, Step 3 is crucial for avoiding errors. Review your submission thoroughly before filing. Cross-reference your numbers to ensure consistency, and address any discrepancies immediately to maintain transparency with the court.

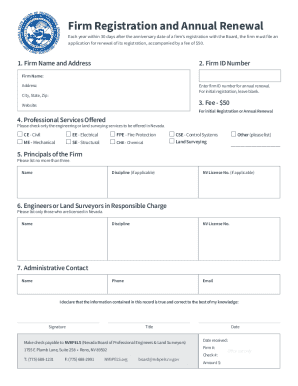

Editing and signing the case 13-11766 form

Once you've completed the case 13-11766 form, it's time to review and sign it. One effective way to edit the form is by using tools like pdfFiller, which allows for efficient online editing. Using this platform, you can make changes, add notes, and ensure your form is perfect before submission.

For legal validation, e-signature options are available. Digital signatures are not only secure but also streamline the submission process. The benefits of signing digitally include easy accessibility, eliminating the need for printing, and rapid submission.

Managing the case 13-11766 form with pdfFiller

Using pdfFiller to manage your completed case 13-11766 form offers numerous advantages. One of the primary benefits is the secure cloud storage that allows you to access your documents from anywhere. This means you can work on your form at your convenience, without worrying about losing important information.

Additionally, pdfFiller's collaboration tools enable teams to work on submissions simultaneously, making it easy to gather input from all stakeholders. The platform also tracks changes and maintains a version history, which can be invaluable for accountability and review.

FAQs about the case 13-11766 form

As you navigate the complexities of the case 13-11766 form, you may have several questions. Common inquiries include submission deadlines and the procedures involved in the filing process. It's essential to be aware that timelines can vary depending on the jurisdiction, so consult local court rules for specific deadlines.

If you discover a mistake after submission, the best practice is to contact the court immediately, as they may require additional documentation to rectify the situation. Seek assistance through legal hotlines or professional advisors if you encounter issues during the filing process.

Resources for further help with the case 13-11766 form

Various resources are available for individuals needing assistance with the case 13-11766 form. Legal assistance hotlines can provide immediate guidance, while pdfFiller's support resources offer comprehensive help within the platform. Additionally, engaging in community forums can provide insights from fellow users' experiences and practical tips they've learned along the way.

Importance of compliance when using the case 13-11766 form

Understanding the legal implications of improper completion is vital. Failing to comply with regulations can result in dismissed cases or penalties. Staying informed about any changes to case filing processes ensures that you remain compliant. pdfFiller plays a significant role in helping users understand and adhere to legal standards, providing them with the necessary tools and information.

By remaining proactive about updates in bankruptcy law and utilizing reliable document management solutions, individuals can navigate their financial challenges more effectively and ensure that their case 13-11766 form is processed smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the case 13-11766 in Gmail?

How do I fill out case 13-11766 using my mobile device?

Can I edit case 13-11766 on an Android device?

What is case 13-11766?

Who is required to file case 13-11766?

How to fill out case 13-11766?

What is the purpose of case 13-11766?

What information must be reported on case 13-11766?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.