Get the free 10-Q - Hillman Solutions Corp.

Get, Create, Make and Sign 10-q - hillman solutions

Editing 10-q - hillman solutions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 10-q - hillman solutions

How to fill out 10-q - hillman solutions

Who needs 10-q - hillman solutions?

10-Q - Hillman Solutions Form: A Comprehensive Guide

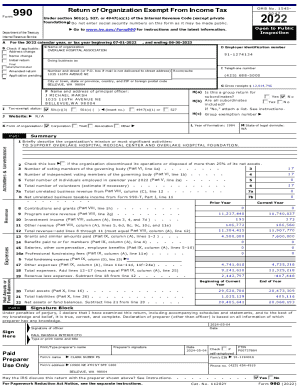

Understanding the 10-Q Form

The 10-Q form serves as a critical tool for publicly traded companies, including Hillman Solutions, as it provides a comprehensive overview of their financial health every quarter. This filing is essential for investors, regulators, and stakeholders to gauge a company’s progress and operational efficiency throughout the fiscal year.

Unlike the annual 10-K report, which delivers a detailed year-end summary including audited financial statements, the 10-Q is less exhaustive, focusing on quarterly data. Its streamlined format allows companies to relay pertinent financial information promptly, supporting transparency in the market.

Hillman Solutions: A Case Study

Hillman Solutions is a leading provider of fasteners, keys, and identification products. Founded over 50 years ago, the company has established a significant presence in hardware and retail sectors, driven by innovation and strong customer relationships. Their product portfolio is essential for various industries, making their financial health critical for a wide range of stakeholders.

The 10-Q form holds paramount importance for Hillman Solutions as it reflects ongoing financial performance, helping the company manage operations efficiently. Investors closely examine the 10-Q to assess Hillman’s growth trajectory, profit margins, and risk factors. Positive quarterly results can bolster shareholder confidence, while negative outcomes could lead to increased scrutiny from the market.

Key sections of a 10-Q filing

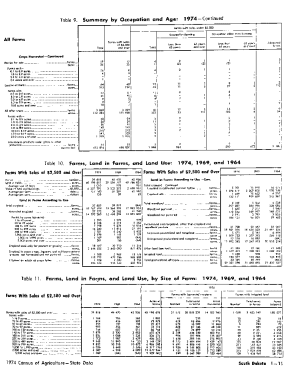

Within a 10-Q filing, several sections present vital financial data, each critical for understanding a company’s operational status. The financial statements section is composed of the balance sheet, income statement, and cash flow statement, all of which provide a snapshot of the organization’s fiscal condition.

The Management Discussion and Analysis (MD&A) section allows executives to explain the numbers, offering insights into trends and challenges. This narrative forms a bridge between raw data and real-world implications, guiding investors in their decision-making processes. It’s also common for companies like Hillman Solutions to detail their specific risk factors, which may pose threats to their profitability and stability.

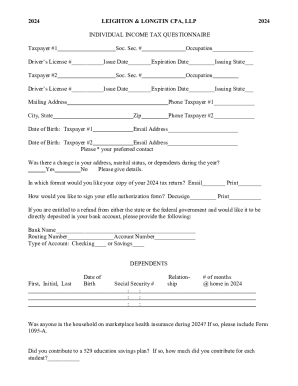

Step-by-step guide to completing the 10-Q form

Completing the 10-Q form begins with thorough preparation. Companies need to gather financial data from internal sources, ensuring the figures are accurate and timely. Collaboration between various departments, especially accounting and legal teams, is essential to ensure compliance with SEC regulations.

As companies fill out financial data, precision is crucial. This process typically involves asset valuations being double-checked against past reports and forecasts. It’s advisable for teams to adopt a multi-step verification process to enhance the reliability of the data provided.

Following data entry, a rigorous review and editing phase should ensue. Internal audits serve as a safety net before submissions. Tools that facilitate document collaboration can greatly assist in this phase, allowing team members to work efficiently together.

Finally, submitting the 10-Q form electronically involves adhering to strict SEC guidelines. Companies must be mindful of specific deadlines to avoid penalties.

Tools and resources for filing the 10-Q

Utilizing the right tools can simplify the 10-Q filing process significantly. pdfFiller emerges as an essential resource, offering features that streamline editing, collaboration, and e-signing of the 10-Q form. This platform allows teams to work together seamlessly, ensuring that all necessary changes are made efficiently and effectively.

In addition to pdfFiller, there are alternative tools that support financial reporting tasks. Each of these options handles document management differently, providing unique functionalities that may suit various team structures. Careful selection of the right tools can enhance filing accuracy and timeliness.

Common pitfalls and how to avoid them

Filing a 10-Q form can be rife with challenges, primarily due to the risk of misreporting financial data. Observing recent examples, some companies have faced severe consequences for presenting inaccurate figures. Such errors can lead to audit complications and even legal repercussions, demonstrating the importance of checks and balances in the data reporting process.

Equally concerning are delays in filing. Late submissions can trigger regulatory fines and damage credibility with investors. Companies should implement strategies to manage deadlines effectively, such as setting internal due dates ahead of the SEC deadline.

FAQs about the 10-Q form

Investors often have questions regarding the 10-Q form's filing frequency and its crucial role in investment decisions. Common queries include the timing of submissions and the consequences for incorrect filing. Understanding these factors can help investors and stakeholders effectively interpret the 10-Q data and make informed decisions.

Additional considerations

Post-filing obligations extend beyond the submission of the 10-Q. Companies must ensure ongoing compliance with SEC regulations, including the timely updating of any material changes in their financial circumstances. Regular amendments may be required to keep investors aligned with the latest developments.

Looking ahead, the future of 10-Q filings will likely evolve with technology, increasing the efficiency of financial reporting procedures. Emerging trends suggest a growing adoption of automated systems and AI-driven tools that can streamline this process even further, enhancing transparency and reducing human error.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 10-q - hillman solutions?

How do I edit 10-q - hillman solutions online?

How do I make edits in 10-q - hillman solutions without leaving Chrome?

What is 10-q - hillman solutions?

Who is required to file 10-q - hillman solutions?

How to fill out 10-q - hillman solutions?

What is the purpose of 10-q - hillman solutions?

What information must be reported on 10-q - hillman solutions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.