Get the free UT 84101

Get, Create, Make and Sign ut 84101

Editing ut 84101 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ut 84101

How to fill out ut 84101

Who needs ut 84101?

UT 84101 Form: A Comprehensive Guide

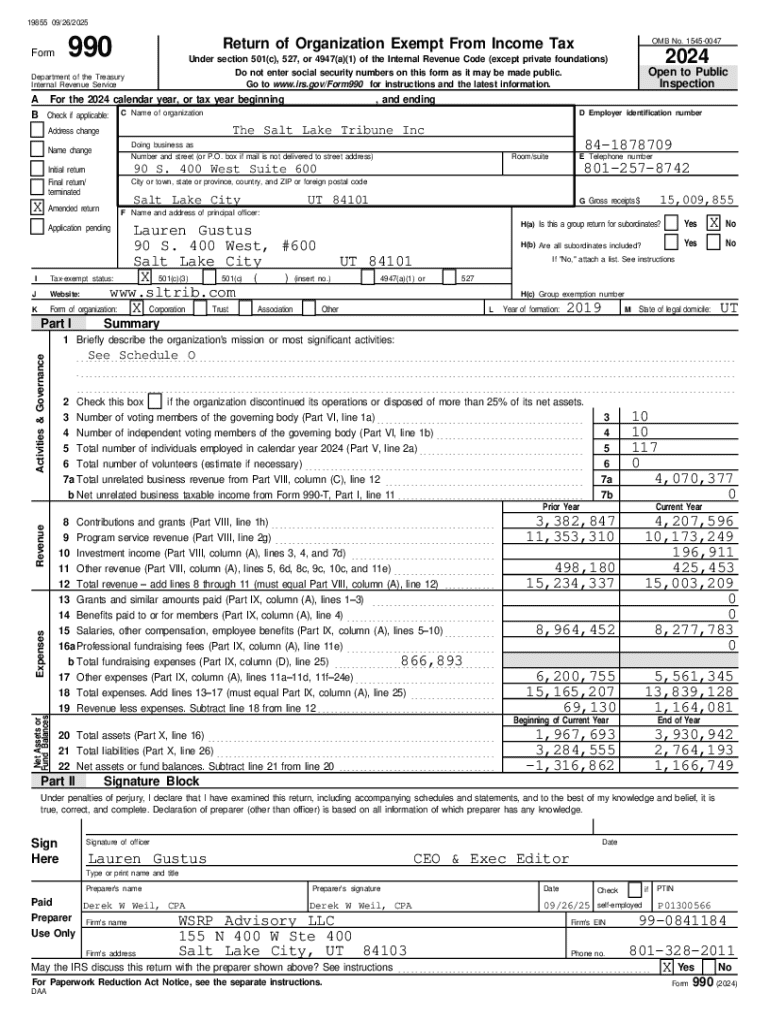

Overview of the UT 84101 Form

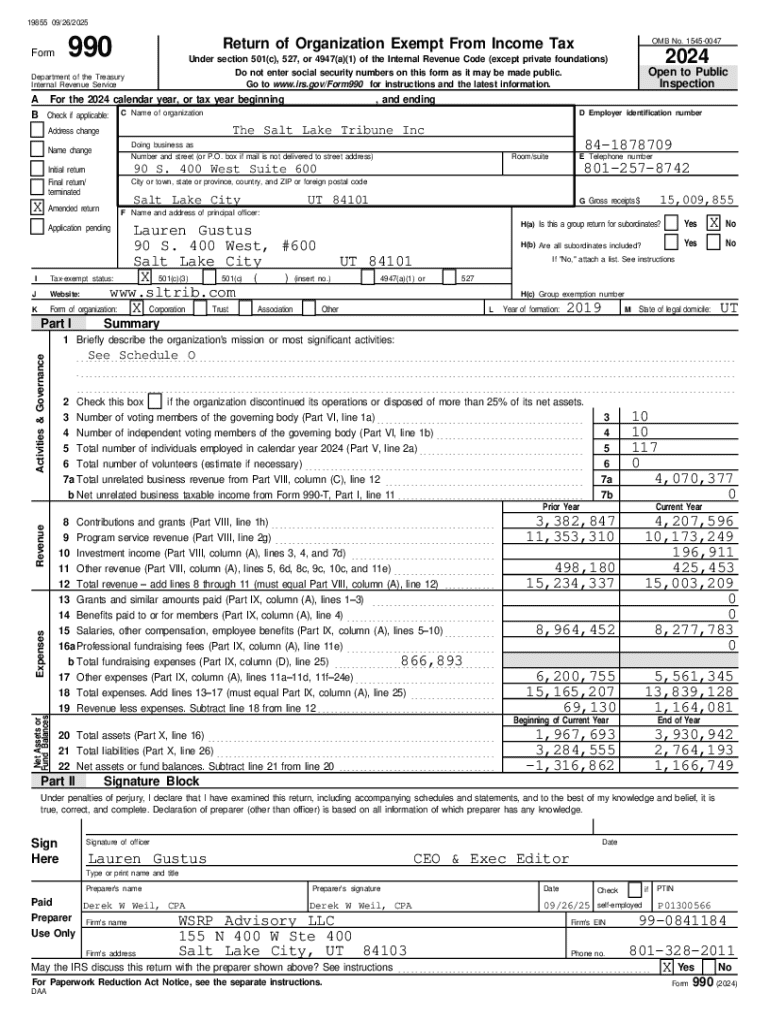

The UT 84101 form is an essential document utilized primarily in the state of Utah. It serves a specific purpose, often related to tax filings or other formal submissions required by state agencies. This form facilitates various processes, ensuring compliance with state regulations while providing a structured way for individuals and organizations to report necessary information.

Common use cases for the UT 84101 form include income reporting for self-employed individuals, applications for permits, or filing specific claims. It ensures that the submitted information is organized and standardized, which helps in the efficient processing of relevant data by governmental agencies.

Accurate completion of the UT 84101 form is crucial as mistakes can lead to delays, penalties, or, in some cases, denial of application. Utilizing tools like pdfFiller can mitigate these risks by providing features to easily edit the form, ensuring that all information submitted is precise and up-to-date.

Understanding the Requirements

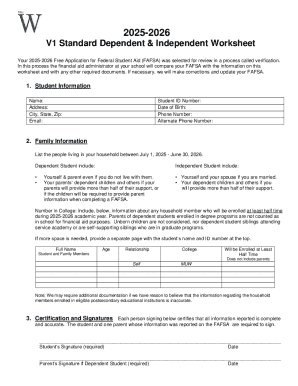

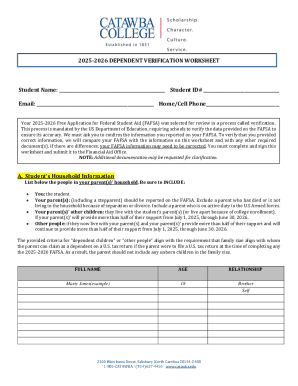

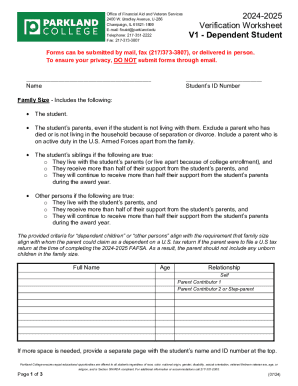

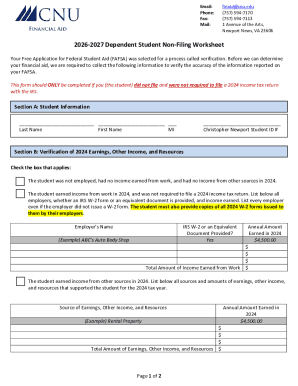

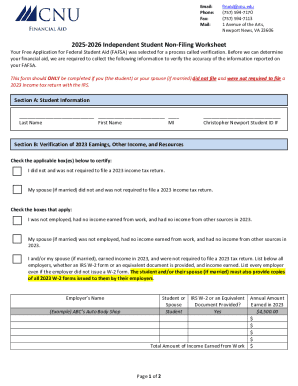

To fill out the UT 84101 form successfully, understanding the eligibility criteria is paramount. Primarily, any individual or organization that meets the specified requirements of the state of Utah must complete this form. This can include age restrictions for certain types of filings, as well as residency requirements based on the individual's circumstances.

The information required tends to comprise personal details such as name, address, and Social Security number, as well as specific details related to the purpose of the filing. Additionally, applicants may need to supply supporting documentation, which could include financial records or identification proofs that validate the information provided in the form.

Step-by-Step Guide to Filling Out the UT 84101 Form

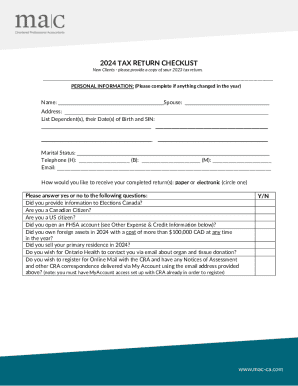

Filling out the UT 84101 form can be done efficiently if the process is handled systematically. The first section requires basic personal information, including your full name, current address, contact number, and email address. It's crucial to ensure that all contact information is entered correctly to avoid any future complications.

The second section expects detailed responses. It’s important to provide accurate and thorough answers to questions posed. Using clear language and avoiding jargon increases the chances of your form being processed efficiently. Specificity in your responses can prevent delays due to requests for clarification.

If there’s payment information involved, accurately filling out the payment section is vital. This includes providing correct bank details or credit card information, along with understanding fees that may be applicable. Always double-check these details to ensure a smooth transaction.

Finally, don’t overlook the review section. Carefully check your form for errors or omissions. Common pitfalls include incorrect personal details, missed signatures, or failing to attach necessary documents.

Interactive tools and features from pdfFiller

pdfFiller provides users with a multitude of interactive tools designed to streamline the form-filling process. One of the most significant features is the ability to fill out forms online easily. With auto-fill capabilities, users can save time by having their previously entered information populated in new forms.

In addition to filling tools, pdfFiller offers a variety of editing options. Users can add text boxes, annotate, or highlight specific sections to draw attention to important details. This flexibility ensures that correcting any omissions or errors can be done effortlessly.

Adding an electronic signature is also straightforward with pdfFiller. The platform walks users through creating and embedding a legally valid eSignature, providing peace of mind that the submission is both professional and secure.

Tips for efficient form management with pdfFiller

Effective form management is integral for both individuals and teams. Organizing completed forms within pdfFiller can be achieved by categorizing documents based on project, type, or priority, making retrieval seamlessly efficient in the future.

Collaboration is also made significantly easier with pdfFiller. Users can share the UT 84101 form with team members directly through the platform. This allows for real-time feedback and enables collaborators to leave comments and suggestions directly on the document, facilitating productive discussions.

Security is a paramount concern when handling sensitive information. pdfFiller complies with the highest security standards, ensuring that all data is protected. Users can trust that their documents are safe from unauthorized access.

Common issues and troubleshooting

Filling out the UT 84101 form may come with its share of challenges. Frequently encountered problems include supplying incorrect or incomplete information, failing to meet deadlines, or overlooking necessary attachments and signatures. Such mistakes can delay processing or negatively affect outcomes.

To combat these issues, pdfFiller offers customer support that can guide users through specific problems they encounter. Utilizing available resources, such as help articles or live chat, can offer additional assistance when needed.

Special considerations and additional information

Staying updated with any changes to the UT 84101 form is essential. Regulatory changes may affect eligibility criteria, deadlines, or required documentation. Regularly checking the official state website or using resources provided by pdfFiller can ensure users remain informed.

Frequently asked questions regarding the UT 84101 form often revolve around submission processes and deadlines. Addressing these concerns can alleviate apprehensions and clarify expectations. Additional forms may also be necessary, and users can rely on pdfFiller’s platform to access related documents without hassle.

Conclusion

Utilizing pdfFiller for completing the UT 84101 form can streamline the entire process. With comprehensive tools for editing, collaborating, and securely managing documents, anyone can navigate their form requirements efficiently, ensuring accuracy and compliance.

By embracing the effective solutions that pdfFiller provides, users can focus on their objectives rather than worrying about the complexities of document submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ut 84101 in Gmail?

Can I create an eSignature for the ut 84101 in Gmail?

How do I edit ut 84101 on an iOS device?

What is ut 84101?

Who is required to file ut 84101?

How to fill out ut 84101?

What is the purpose of ut 84101?

What information must be reported on ut 84101?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.