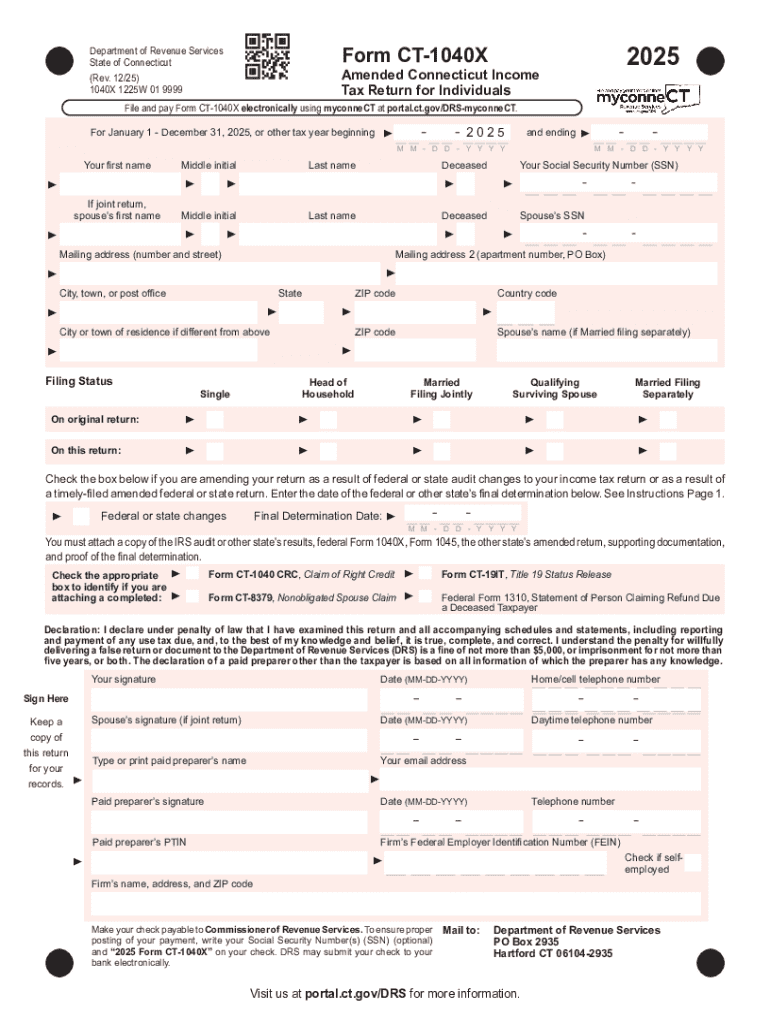

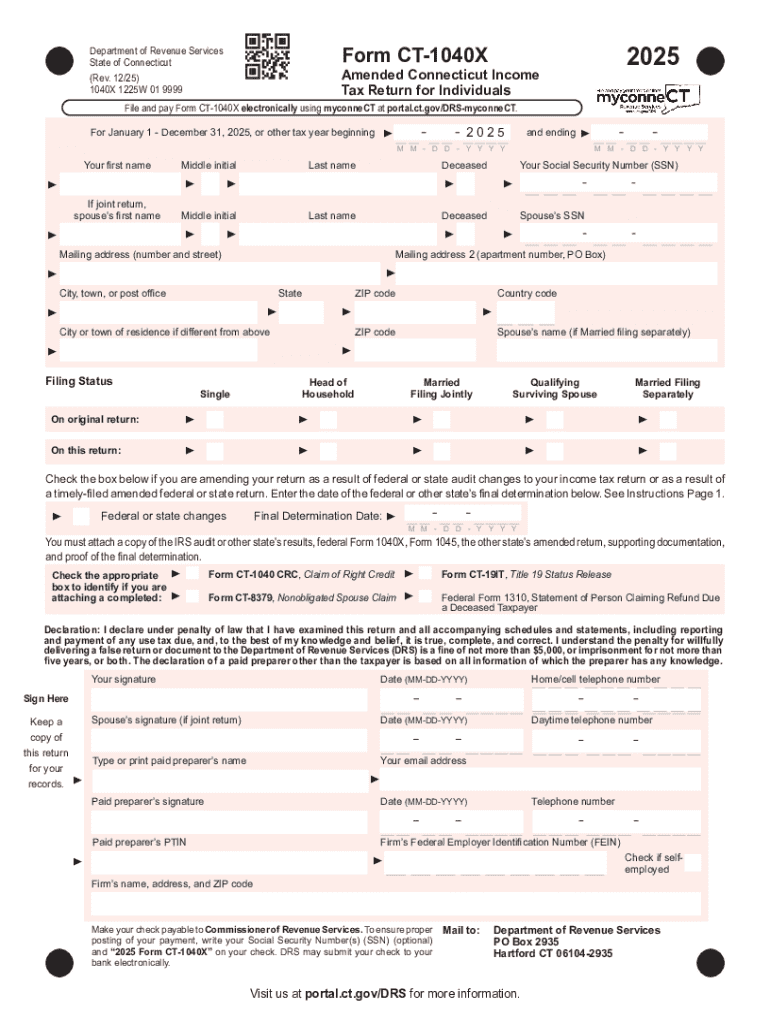

Get the free Form CT-1040X Amended Connecticut Income Tax Return for ...

Get, Create, Make and Sign form ct-1040x amended connecticut

Editing form ct-1040x amended connecticut online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ct-1040x amended connecticut

How to fill out form ct-1040x amended connecticut

Who needs form ct-1040x amended connecticut?

Understanding Form CT-1040X: Amended Connecticut Form for Your Tax Needs

Overview of Form CT-1040X

Form CT-1040X is Connecticut's designated form for amending an individual's income tax return. It serves a critical purpose by allowing taxpayers to correct errors or make adjustments to their originally filed CT-1040 form. Addressing inaccuracies or recent changes in tax status is essential to ensure that the taxpayer's records reflect the correct financial situation, which can significantly impact tax liability.

The importance of amending a tax return cannot be understated. Filing an amendment helps maintain compliance with state tax regulations and can lead to potential refunds if overpayments are identified. Additionally, taxpayers who neglect to correct their tax filings might face penalties or additional interests down the line.

Form CT-1040X is intended for individuals who need to make changes to their previously filed Connecticut tax returns. It's beneficial for those who have discovered mistakes in their income reporting, miscalculation of deductions, or changes in eligibility for tax credits.

Amended Connecticut income tax return

The CT-1040X form is specifically designed to facilitate amendments to prior tax returns. When you're correcting your tax returns using CT-1040X, you essentially provide the state with a revised account of your income, tax deductions, and credits, reflecting accurate calculations. It's essential to differentiate CT-1040X from the original CT-1040 form, as the former caters explicitly to amendments.

While both forms acknowledge income tax liabilities, the CT-1040X explicitly marks adjustments. Common reasons for filing this amendment form include clerical errors, new information concerning income that wasn't available when initially filed, or correcting the amounts of taxable income.

When to file Form CT-1040X?

You should file Form CT-1040X when specific circumstances arise that necessitate amending your tax return. Common situations include discovering mistakes in income calculations, missing W-2s, or realizing eligibility for deductions or credits that were initially overlooked. It's crucial to act promptly to mitigate penalties and interests that might accrue from filing late or failing to amend.

Timelines are pivotal when it comes to amending, and taxpayers in Connecticut generally have three years from the original due date of the return to file amendments to receive refunds. Failure to act within this timeframe can lead to forfeiting the opportunity for refunds or adjustments.

Filing delays can have repercussions for your tax situation; missed deadlines might lead to complications with your tax records, potentially triggering audits or penalties from the Connecticut Department of Revenue Services.

What changes can you make with Form CT-1040X?

When it comes to modifications using Form CT-1040X, you can make various types of changes, including adjustments to your reported income, claiming additional allowable deductions, or rectifying credits. For example, if you missed claiming a valuable deduction, this form allows you to include it in your amended return.

However, there are some limitations to keep in mind. Certain carryovers may not be available for amendments, and you cannot amend your return to include losses or deductions from tax years other than the year you are amending. It's also important to differentiate between correcting mistakes and claiming missed deductions because the manner of reporting can differ based on your situation.

Key points to remember about Form CT-1040X

Before filing Form CT-1040X, there are essential details to double-check to ensure accuracy. Verify that all information aligns with your corrected figures and that all supporting documents are included. Accuracy is vital, as it reduces the chance of further amendments and helps avoid unnecessary complications.

Common pitfalls include overlooking deadlines, neglecting supporting documents, or failing to sign the form electronically. Furthermore, knowing the potential penalties for not amending or for submitting false information is crucial, as this may lead to heightened scrutiny from tax authorities.

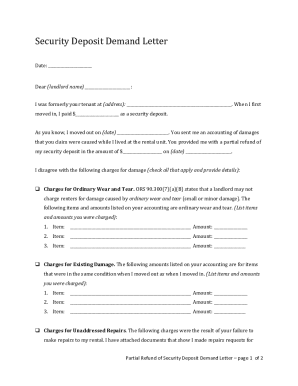

Filing instructions for Form CT-1040X

Completing Form CT-1040X requires a thoughtful approach. Start with gathering all necessary documentation, including your original CT-1040, supporting documents related to changes, and references for any deductions or credits you plan to claim. Organize this information to make the filling process smoother.

Next, carefully fill out the form sections. Each section corresponds to specific data points, such as income adjustments or additional credits. Ensure calculations are accurate to avoid errors in your amended return. After making the necessary adjustments, you'll need to include any additional forms or schedules that may be required for your specific situation.

Lastly, consider your filing options. Connecticut allows for electronic submission, which is generally the faster and more efficient method. However, if you prefer or require paper filing, print the completed form and mail it to the appropriate address, ensuring it is sent with sufficient time to meet deadlines.

How to track your amended return

Once you've submitted Form CT-1040X, tracking your amended return is essential for peace of mind. Connecticut's Department of Revenue Services typically provides a way to check the status of your amended return through their website. Having your personal information and details from your amended return on hand will assist in this process.

After submission, you can expect updates regarding the processing of your amended return, which can often take several weeks. Generally, taxpayers will be notified of any additional amount due or any potential refunds as the processing moves forward.

Utilizing pdfFiller for Form CT-1040X

pdfFiller offers a range of features tailored for Form CT-1040X that can simplify creating and filing your amended tax return. Users can easily edit the PDF to ensure all details are accurate, which is critical to prevent errors when submitting amended returns. The eSigning feature allows for a seamless filing process, helping individuals finalize their forms without needing to print and scan.

Moreover, collaboration tools offered by pdfFiller enable teams to work together efficiently on amendments, making it a smart choice for those who handle multiple tax filings. Utilizing a cloud-based solution means you can access your documents from anywhere, improving flexibility and accessibility throughout the tax filing process.

User testimonials provide insight into the benefits of using pdfFiller for tax amendments, showcasing successful experiences regarding accuracy and efficiency while managing tax documents.

FAQs related to Form CT-1040X

Frequently asked questions often revolve around the practical aspects of amending returns, such as whether it's possible to amend a return online. In Connecticut, electronic filing of amendments is supported, making it easier to manage your tax situation swiftly.

Taxpayers usually wonder how long it takes to process an amended return. Generally, the review period can take several weeks to a few months, depending on the complexity of the filing and current processing times. Should an amendment result in a refund or a balance due, the taxpayer should be prepared for adjustments to their tax account.

For further questions or specific support, contacting the Connecticut Department of Revenue Services may provide you with additional insights and advice tailored to your situation.

Final tips for a successful amendment

When it comes to effectively amending your tax return with Form CT-1040X, several best practices stand out. Prioritize thorough documentation and maintain meticulous records of all tax-related communications and submissions. Having clear and organized documentation can greatly streamline any future amendments or audits.

Equally important is double-checking information for accuracy on your amended return. Any discrepancies can lead to delays or complications. Finally, utilizing tools such as pdfFiller can significantly enhance your experiences, allowing for easy edits, streamlined sharing, and efficient collaboration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form ct-1040x amended connecticut from Google Drive?

How do I execute form ct-1040x amended connecticut online?

How do I edit form ct-1040x amended connecticut online?

What is form ct-1040x amended connecticut?

Who is required to file form ct-1040x amended connecticut?

How to fill out form ct-1040x amended connecticut?

What is the purpose of form ct-1040x amended connecticut?

What information must be reported on form ct-1040x amended connecticut?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.