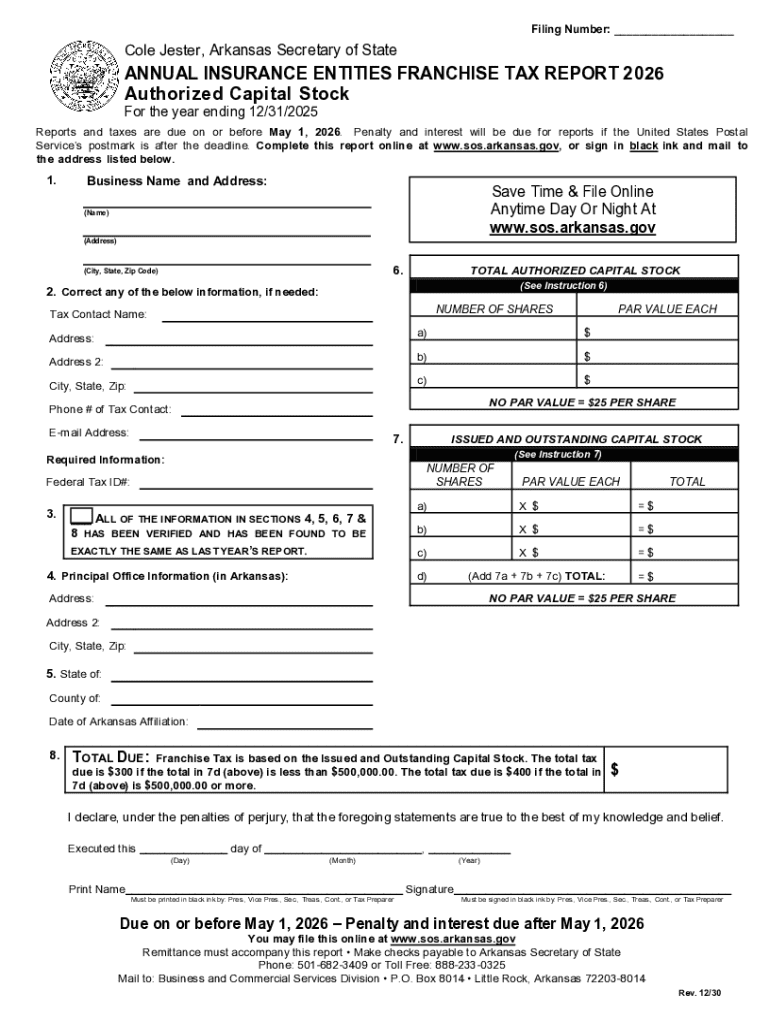

Get the free AMENDED LLC FRANCHISE TAX REPORT 2026

Get, Create, Make and Sign amended llc franchise tax

How to edit amended llc franchise tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out amended llc franchise tax

How to fill out amended llc franchise tax

Who needs amended llc franchise tax?

Understanding the Amended Franchise Tax Form

Understanding the amended franchise tax form

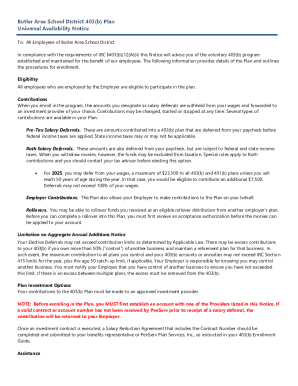

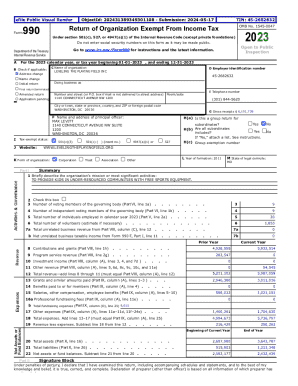

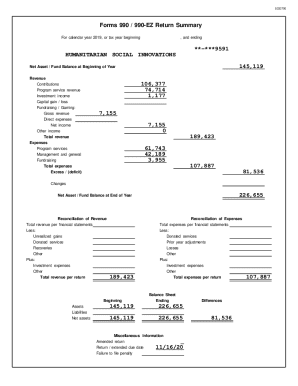

The amended LLC franchise tax form is crucial for limited liability companies (LLCs) that need to correct or update their previously filed tax returns. This form serves to notify the tax authorities about any changes or errors in the initial filing that might affect the LLC's tax obligations. Accurate reporting is necessary to maintain compliance and ensure that the business is meeting its financial responsibilities.

Amending your franchise tax form is not just about altering figures; it’s about reflecting the actual state of your business’s finances. If the initial submission contained inaccuracies or if there are changes in ownership or operations, submitting an amended form becomes essential. This process helps ensure that your tax liability is fair and accurate, which is critical for every business.

Additionally, LLC franchise tax regulations can vary significantly from state to state. Familiarizing yourself with local laws and amendments is necessary if your business operates in multiple jurisdictions, making compliance even more complex. Ensuring that your franchise tax form reflects true and complete information is vital to maintaining the integrity and longevity of your LLC.

Reasons you may need to amend your franchise tax form

There are several scenarios that can prompt the need for an amended LLC franchise tax form. Understanding these can save your business from potential penalties and ensure compliance with state tax obligations. One of the most common reasons for amending is the correction of errors on previous filings.

Another significant reason for submission of an amended return is when there are changes in business structure or ownership. LLCs undergo transformations such as adding members, changing the business model from a single-member to a multi-member LLC, or encountering changes in percentage ownership. These structural changes can directly influence the tax obligations the LLC faces.

Additionally, local tax reporting requirements may evolve over time. New regulations can emerge that affect how income is reported or what deductions can be claimed. Businesses must stay informed about these adjustments to ensure they are accurately reflecting their tax positions with the amended LLC franchise tax form.

Step-by-step guide to amending the franchise tax form

For business owners needing to navigate the process of amending their franchise tax forms, following a structured approach is essential. Below are detailed steps to simplify the amendment process.

Frequently asked questions (FAQs) about the amended franchise tax form

It’s common for business owners to have questions regarding the amended LLC franchise tax form and the implications it may have on their LLC. Here are some frequently asked questions along with their answers.

Common mistakes to avoid when amending your franchise tax form

When navigating the amendment process, many business owners stumble upon common pitfalls that can lead to further complications with their tax filings. Here are key mistakes to avoid.

Utilizing pdfFiller for your amended franchise tax form

pdfFiller offers a powerful solution for managing the complexities involved in filing your amended LLC franchise tax form. Its suite of features enhances the process from editing to eSigning, making tax preparation straightforward.

Users can easily edit PDFs, ensuring that any corrections or updates are accurately reflected in the amended form. The platform’s collaboration tools allow multiple stakeholders in the business to review and provide input, dramatically simplifying the amendment process.

Storing your tax forms in a cloud-based environment helps maintain an organized and secure repository. This organizational aspect is critical when it comes to preserving privacy practices and easily retrieving documents for future needs.

Real-life scenarios: when to amend your franchise tax form

Understanding the practical implications of amending an LLC franchise tax form can be elucidated through real-life scenarios experienced by various businesses. For example, a small LLC that underestimated its gross income in its original filing might face significant penalties if adjustments are not made promptly.

Another scenario is an LLC that underwent a structural change by admitting new partners. The new ownership structure could lead to different tax obligations. In these cases, both entities should file an amended form to accurately reflect the tax status and avoid future complications.

In learning from these real-life experiences, businesses are encouraged to approach the amendment process with diligence, always ensuring that documentation is accurate and up-to-date. The lessons learned often highlight the importance of preventative measures, such as diligent record-keeping and staying informed about tax obligations.

Conclusion

Maintaining accurate tax filings is not just a legal obligation but a fundamental aspect of sound business management. Amending your LLC franchise tax form, when necessary, helps ensure that your business remains in compliance and avoids potential penalties.

Utilizing digital tools, such as those offered by pdfFiller, can streamline the amendment process, making it more manageable and efficient. By empowering users with easy access to editing, signing, and document management, businesses can navigate their financial obligations with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my amended llc franchise tax in Gmail?

How can I modify amended llc franchise tax without leaving Google Drive?

Can I create an eSignature for the amended llc franchise tax in Gmail?

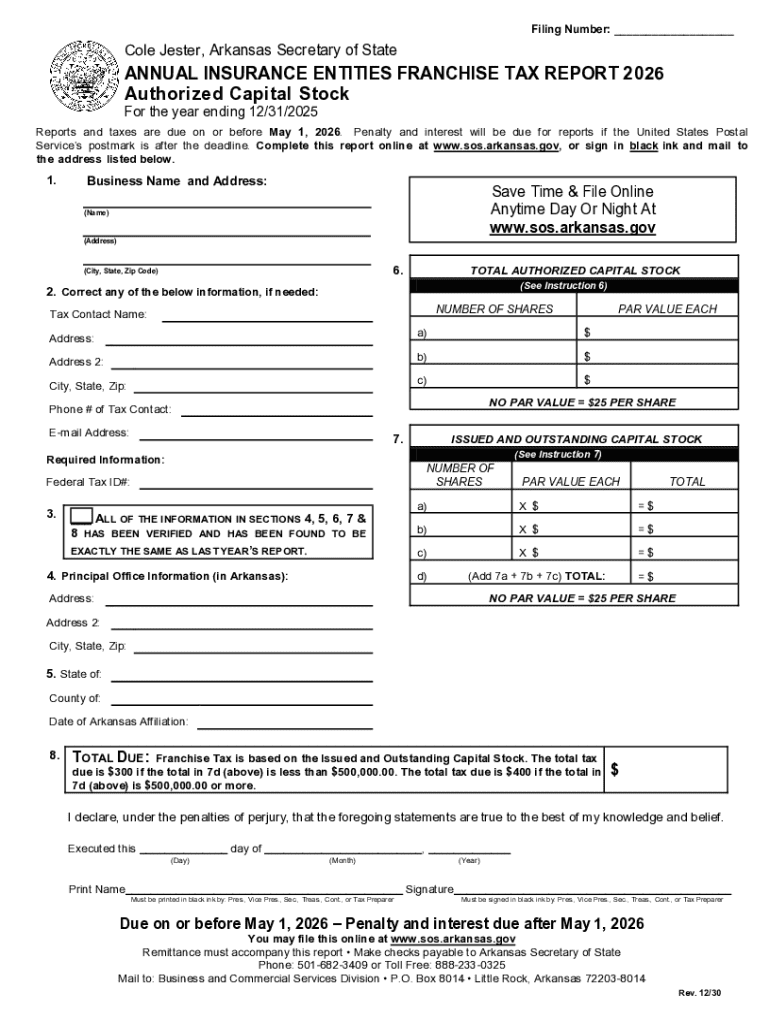

What is amended llc franchise tax?

Who is required to file amended llc franchise tax?

How to fill out amended llc franchise tax?

What is the purpose of amended llc franchise tax?

What information must be reported on amended llc franchise tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.