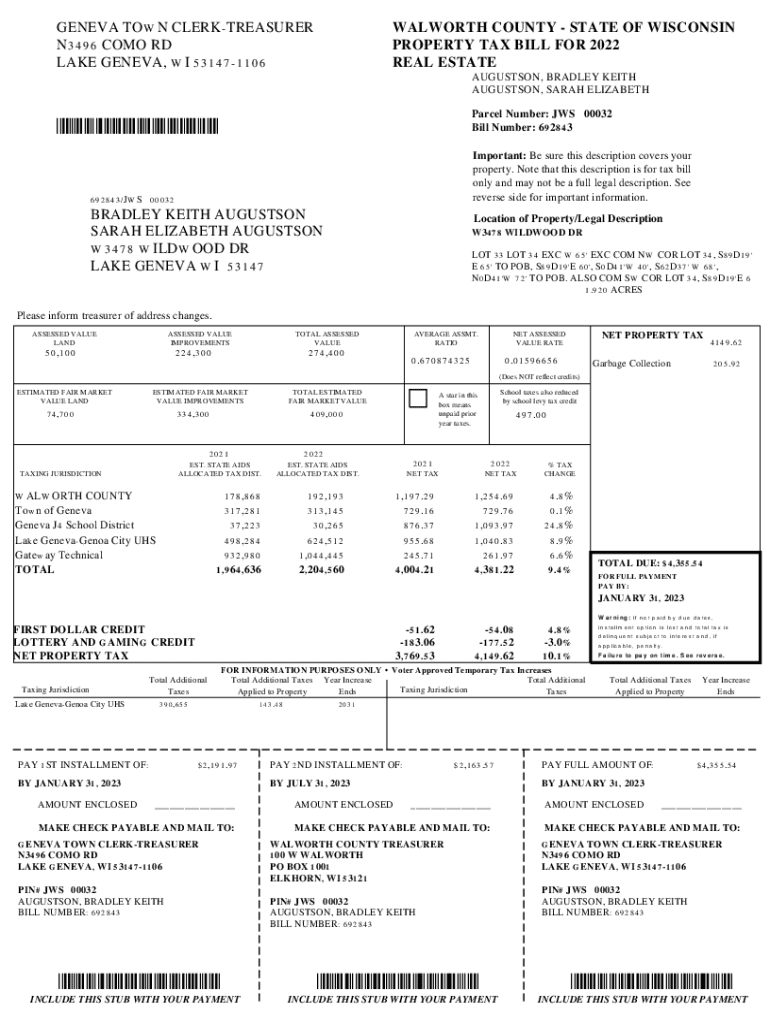

Get the free 2022 Tax Bill, Town of Geneva, Parcel JWS 00032

Get, Create, Make and Sign 2022 tax bill town

Editing 2022 tax bill town online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2022 tax bill town

How to fill out 2022 tax bill town

Who needs 2022 tax bill town?

2022 Tax Bill Town Form Guide

Understanding the 2022 tax bill process

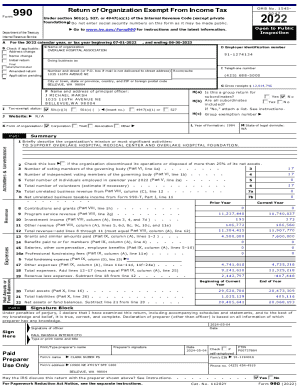

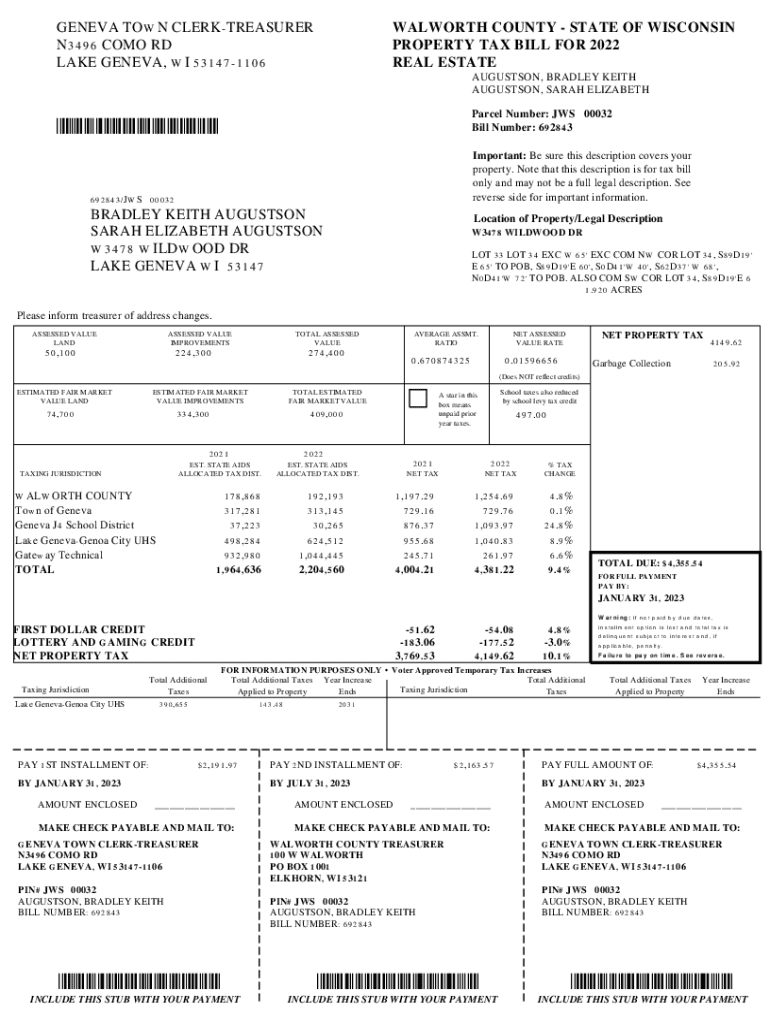

Each year, property owners receive a town tax bill that outlines their tax obligations for that fiscal year. The 2022 tax bill is no exception, and timely understanding of this document is essential for homeowners and business property owners alike. This bill reflects property taxes assessed based on your property’s value, and it plays a crucial role in how local governments finance public services and infrastructure.

Accurate tax bill management cannot be overstated. Misunderstandings or errors can lead to missed payments, thus accruing interest or penalties that affect your financial health. Staying informed about your rights and responsibilities as a taxpayer ensures a smooth transaction with your local taxing authority.

Accessing your 2022 town tax bill

Locating your 2022 tax bill is straightforward, with multiple options available. Most towns provide an online portal where residents can easily access their tax bills. This digital access allows for efficient management and tracking of your tax accounts. Additionally, you can often obtain a copy of your bill by visiting your local government office. This face-to-face option can be beneficial if you have specific questions or need assistance understanding your bill.

Once you retrieve your tax bill, review it for any discrepancies in property assessments or charges. Understanding how your property tax is calculated and ensuring the bill's accuracy is key to maintaining good standing with the tax office.

Detailed breakdown of the 2022 tax bill town form

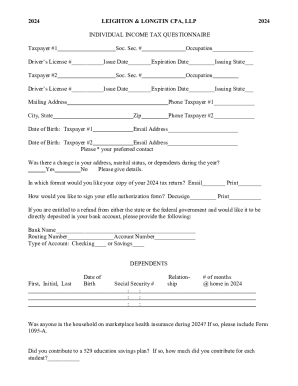

The tax bill form is structured to provide essential information that needs to be thoroughly understood by all taxpayers. Each bill includes general information fields specifying the taxpayer’s name, property address, and account number. This is followed by itemized charges that break down the total amount owed, offering a detailed picture of where your taxes are allocated. Common charges include general property taxes, assessments for local services, and special improvement district fees.

Deductions and credits apply to specific circumstances, such as homestead exclusions or senior citizen benefits. Knowing which deductions you are eligible for can significantly affect your total tax burden. Additionally, familiarity with assessments and mill rates helps the taxpayer understand how property values impact their final bill; higher property values usually lead to increased taxes, and understanding this can help you strategize for future years.

Step-by-step instructions for filling out the tax bill form

Filling out the 2022 tax bill form requires careful attention to detail. Begin by collecting necessary documents, such as previous years’ tax returns and property assessments. Gather all applicable receipts for expenses related to deductions. In the general information section, accurately enter your name, property details, and contact information to ensure the tax office can reach you if necessary.

When calculating itemized charges, reference people’s previous tax amounts with the current data to ensure consistency. Utilize example calculations to check your math—ensure to cross-verify with your local tax rates, as these can vary. Next, apply any deductions and credits; common ones for residents may include homestead exclusions and first-time buyer benefits. Finally, review the form thoroughly to guarantee accuracy before submission.

Editing your tax bill form with pdfFiller

After filling out your tax form, using pdfFiller offers an efficient route for editing and finalizing your documents. Start by uploading your completed document onto the platform; this allows you to leverage its comprehensive editing tools. The ability to edit text ensures you can make changes directly where needed without hassle.

In addition to text editing, pdfFiller also provides annotation options for clarifying changes or notes for your tax advisor. If your form requires signatures or dates, the e-signature functionality saves time and streamlines the finalization process. Should you need to make any changes after you’ve submitted the form, pdfFiller provides a straightforward process for retrieving and revising your document.

E-signing your tax bill form

E-signatures have become a standard part of document submission in recent years, and understanding this process for your 2022 tax bill is essential. Preparing for e-signing involves ensuring the document is finalized and reviewing all entries for accuracy. Using pdfFiller, you can quickly apply e-signatures directly on your tax bill form, significantly speeding up the submission process.

E-signatures are not just convenient; they hold legal validity in tax processes nearly everywhere in the United States. However, it’s imperative to familiarize yourself with the specifics of e-signatures in your state to ensure compliance, particularly regarding timelines and additional required documents.

Tips for submitting your 2022 tax bill

When ready to submit your 2022 tax bill, consider the advantages and drawbacks of electronic versus paper submission. While electronic submissions may offer quicker processing times, ensure that you have the correct email confirmation after sending to prevent any mishaps. On the other hand, if you choose to send a paper submission, opt for tracked mail services to confirm delivery.

Regardless of your submission method, it’s crucial to track your submission to confirm its status. This way, you can rectify any issues before the deadline. Also, be vigilant against common mistakes, such as incorrect amounts on deductions or submitting without a signature, as these can lead to delays or complications in processing your tax bill.

Collaborating on your tax bill form

Collaboration can streamline the process when working on your 2022 tax bill form, particularly if you involve family members or financial advisors. Using pdfFiller, you can easily share your document for input or clarification from trusted parties. This feature enriches the collaborative experience and ensures all concerns or questions are addressed consistently.

Additionally, utilizing the comments and feedback options within pdfFiller creates a robust review process. You’ll be able to address multiple points of view, meaning your tax document will be more accurate and reflective of all relevant deductions and expenses. Be sure to outline specific areas where collaboration might enhance accuracy and minimize oversight.

Managing and storing your tax documents

Proper management and storage of your tax documents are essential to ensure that you can access them when needed, especially as tax time rolls around each year. Best practices involve storing your documents in an organized manner; whether digitally or physically, everything should be easy to locate. Using cloud storage services can also safeguard your documents against loss while providing convenient access from anywhere.

Conducting a year-end review of your tax documents prepares you for the upcoming tax season and alleviates the stress of piecing together records at the last minute. This includes reviewing deductions applied in the current year and understanding any adjustments you might need for the future. Being proactive in your approach allows for better financial planning concerning property taxes and potential selling of property.

Frequently asked questions (FAQs)

Navigating your 2022 town tax bill form can bring about numerous queries. Some common concerns may include how variances in property assessments may affect future tax bills, what steps to take if you believe there’s been an error, and how long it generally takes for a submission to be processed. Addressing these questions ensures that you maintain a clear understanding of the process and can move forward confidently.

Furthermore, some may inquire about the types of deductions relevant for 2022 or the process for appealing an assessment they believe is unjust. It’s beneficial to research these additional aspects, as becoming well-informed can diminish the immediate stress tied to tax obligations and better prepare you for the upcoming financial year.

Contact information for further assistance

For those still facing difficulties or needing additional specifics regarding their local tax situation, your best bet is to contact your local tax office directly. Depending on your state or municipality, there may also be hotlines or online resources specifically designed to assist taxpayers with questions about their 2022 tax bills. Ensuring you have the correct contact information will help clarify your tax queries effectively and efficiently.

Remember to utilize online resources to guide you through various forms or FAQs tailored to your locality. These can help pinpoint answers quickly, making the tax season less daunting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2022 tax bill town?

Can I create an eSignature for the 2022 tax bill town in Gmail?

How do I complete 2022 tax bill town on an Android device?

What is 2022 tax bill town?

Who is required to file 2022 tax bill town?

How to fill out 2022 tax bill town?

What is the purpose of 2022 tax bill town?

What information must be reported on 2022 tax bill town?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.