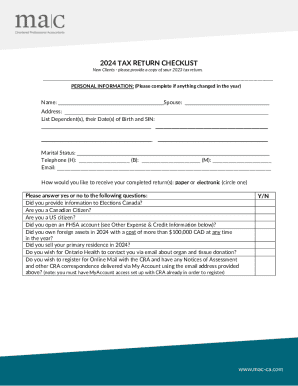

Get the free 2025-2026 Low Income Form for calendar year 2024

Get, Create, Make and Sign 2025-2026 low income form

How to edit 2025-2026 low income form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 low income form

How to fill out 2025-2026 low income form

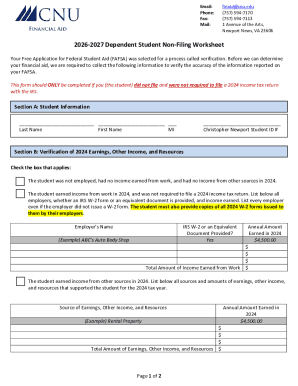

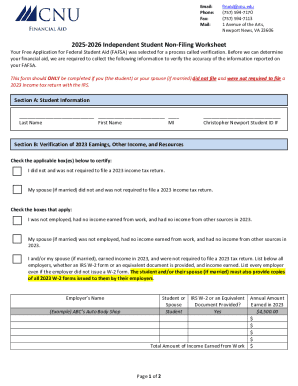

Who needs 2025-2026 low income form?

2 Low Income Form: A Comprehensive Guide

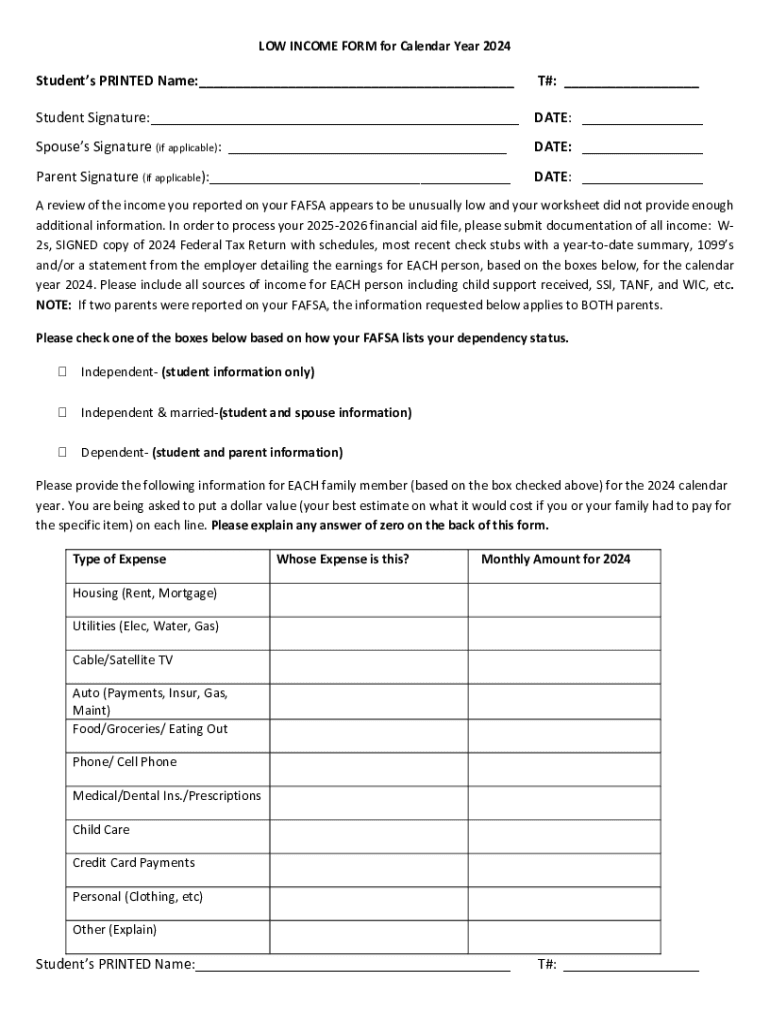

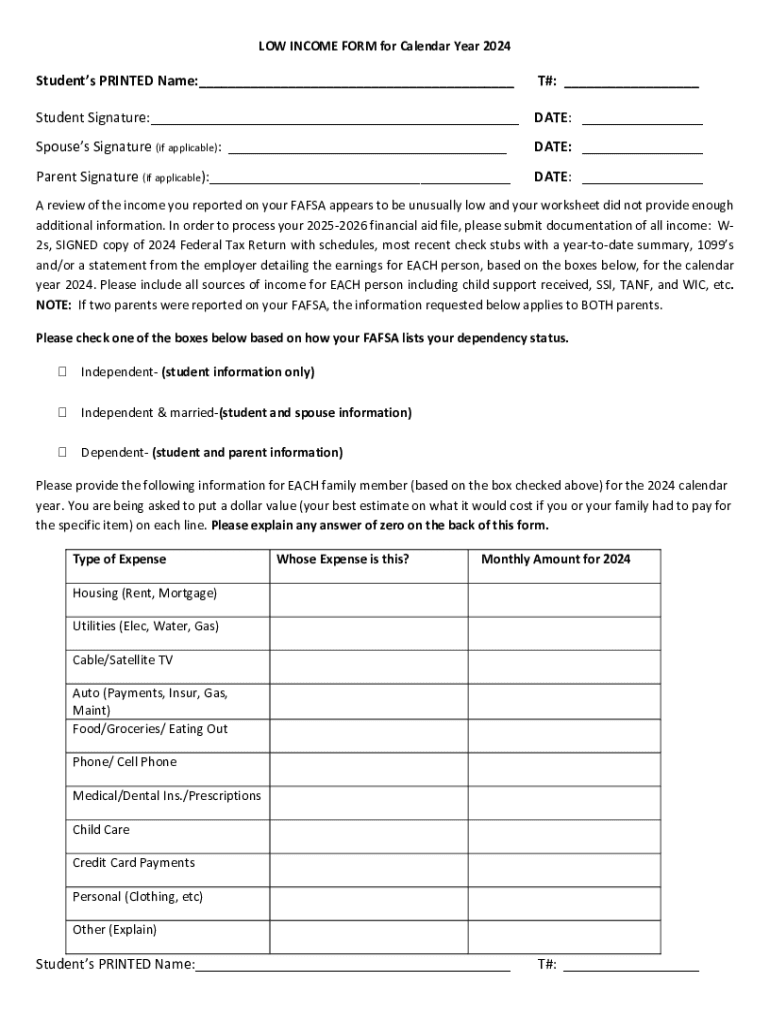

Understanding the 2 low income form

The 2 low income form serves as a critical document for individuals and families seeking financial assistance for various programs, including educational funding and subsidized services. This form provides a structured way to report income information and other relevant data that qualifying agencies need to determine eligibility for aid. Its accuracy is paramount, as it impacts not only the speed of processing but also the amount of financial support a household may receive.

Accurate submission of the low income form ensures that applicants receive the financial support they are eligible for, whether it’s through reduced tuition rates, healthcare benefits, or housing assistance. A well-prepared application signals to reviewing agencies that the applicant is informed and committed to securing the necessary aid.

Who should use the 2 low income form

The target demographic for the 2 low income form primarily includes families with a total income that falls below specific thresholds set by state and federal programs. Eligibility can vary depending on multiple factors, including family size and the source of income. Students often utilize this form to access financial aid opportunities, including grants, scholarships, and work-study positions.

Typically, the form is intended for individuals seeking assistance with education, healthcare, and housing needs. Understanding whether you meet these eligibility criteria is vital before initiating the application process. If you have a family of four that earns under $50,000 per year, you may qualify for various assistance programs available through state and federal resources.

Preparing to fill out the low income form

Before beginning the 2 low income form, gathering the required documentation is essential. This will not only streamline the process but also ensure accuracy of the information provided. Key documents you'll need include income verification documents, such as pay stubs and tax returns, along with Social Security information for qualified family members.

Moreover, other essential documents may include identification (such as a state ID or driver's license) and proof of residency. Together, these documents create a comprehensive snapshot of your financial situation, allowing for better assessment of your eligibility for assistance.

Utilizing tools like pdfFiller can greatly enhance your experience when preparing these documents. This platform not only allows you to fill out PDFs effortlessly but also includes editing and signing capabilities, ensuring everything is set before submission.

Step-by-step guide to completing the 2 low income form

Beginning the process of filling out the form entails creating an account on pdfFiller. This account will allow you to store and manage all your documents in one accessible location. Once your account is set up, navigate to the low income form template to get started on your application.

Step 1: Personal information section

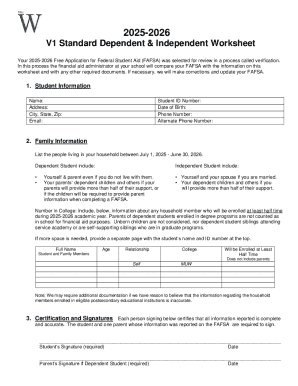

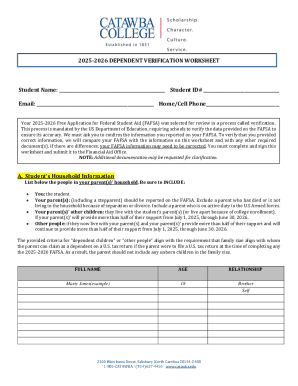

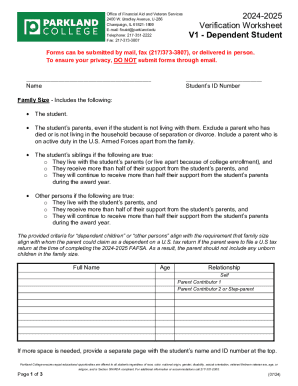

In the personal information section, you’ll need to accurately complete data fields such as your name, contact information, and family composition. It’s important to double-check all entries to avoid discrepancies in your application.

Step 2: Income information

You will report your total family income, which includes salaries, wages, and any additional income sources such as unemployment benefits or child support. Precise reporting here is crucial; the total annual income must directly reflect the figures from your documentation.

Step 3: Adjustments and exclusions

The form will require you to identify any qualifying exclusions, which may include specific expenses or financial setbacks. Accurately calculating your adjusted gross income is a vital step that could improve your chances of receiving aid.

Step 4: Dependency information

For students, understanding your dependency status is crucial. This section will clarify whether you are considered dependent or independent for financial aid purposes. Each status has different implications for how aid is calculated and awarded.

Step 5: Sign and submit

Finally, on pdfFiller, you can utilize the eSignature tool to sign your application electronically. Ensure to review your document with the final checklist before hitting the submit button. This can help avoid delays due to common errors.

Common mistakes to avoid when filling out the form

When submitting the 2 low income form, several common errors can impede your application. One major pitfall is inaccurate income reporting; underreporting or overreporting your income can significantly affect eligibility decisions. Therefore, precision is key.

Another frequent mistake is failing to include all necessary financial documentation. Each piece of information corroborates your reported income and provides context for your financial situation.

Don’t ignore previous year information unless advised, as neglecting to update this data can lead to confusion in the review process. Always provide current and relevant data to support your claims.

Understanding the review process

After submitting your application, it will enter a review process where staff will evaluate the provided information. This process may take several weeks, depending on the volume of applications and the accuracy of submitted documents. Keeping track of your application can ease anxiety during this period.

If your application is denied, understanding the reason behind the denial is crucial. Common reasons include inconsistent income reporting or missing documentation. To appeal, make any necessary adjustments as suggested by the reviewer and resubmit your application with a compelling argument that reflects your eligibility.

Interactive tools for managing your form

Leveraging the collaborative features of pdfFiller can facilitate working with financial aid advisors or other professionals. This collaborative environment allows for secure sharing of your completed form and gives you the opportunity to receive real-time feedback.

Additionally, pdfFiller offers tracking capabilities that allow users to monitor their submission status dynamically. Accessing updates and receiving alerts can help you stay informed, reducing stress throughout the application process.

Frequently asked questions (FAQs)

Many applicants may have general queries regarding the 2 low income form. Common questions revolve around eligibility criteria, deadlines, and essential requirements prior to submission. Ensuring clarity on these matters can mitigate confusion.

Specific inquiries often pertain to how income thresholds are set and any unique conditions that might apply to certain demographics. Understanding these nuances is vital for potential applicants wanting to secure financial assistance effectively.

Conclusion of the guide

The 2 low income form is a pivotal tool in accessing essential support services. A well-prepared application can significantly enhance your chances of receiving aid. Utilizing platforms like pdfFiller not only simplifies the process but also equips you with the tools necessary to manage your documentation efficiently.

As you move through this process, remember the importance of precision, thoroughness, and clarity in every step.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025-2026 low income form to be eSigned by others?

Can I create an electronic signature for signing my 2025-2026 low income form in Gmail?

How do I fill out 2025-2026 low income form using my mobile device?

What is 2025-2026 low income form?

Who is required to file 2025-2026 low income form?

How to fill out 2025-2026 low income form?

What is the purpose of 2025-2026 low income form?

What information must be reported on 2025-2026 low income form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.