Get the free 2025 Corporation Franchise Tax Return (M4) Instructions

Get, Create, Make and Sign 2025 corporation franchise tax

Editing 2025 corporation franchise tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 corporation franchise tax

How to fill out 2025 corporation franchise tax

Who needs 2025 corporation franchise tax?

2025 Corporation Franchise Tax Form - How-to Guide

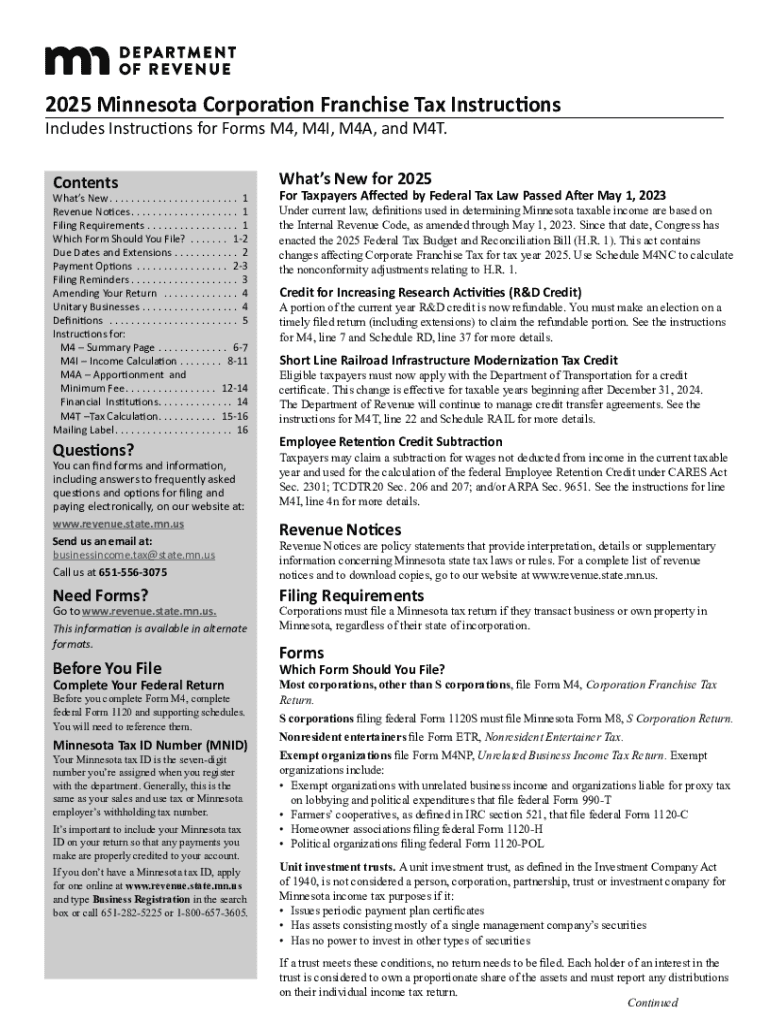

Understanding the 2025 corporation franchise tax form

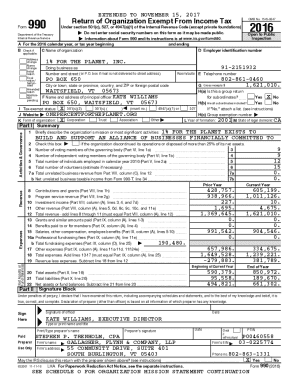

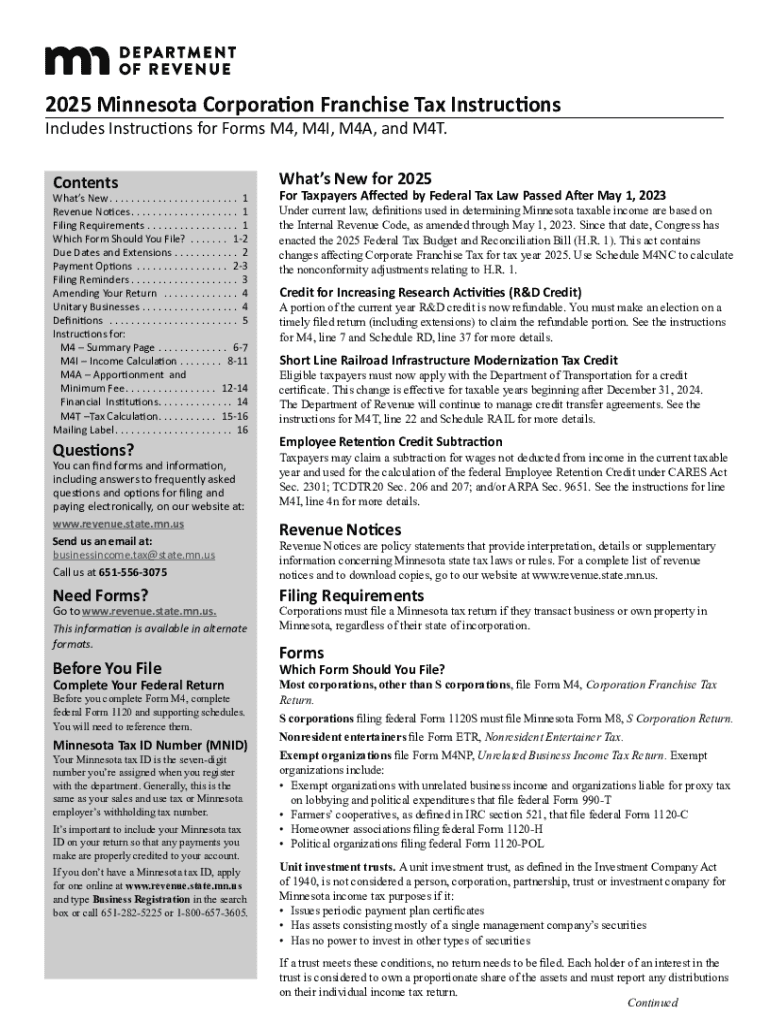

Franchise taxes are a mandated fee levied on businesses by state governments, serving as a revenue stream for state budgets. For corporations, understanding the 2025 corporation franchise tax form is crucial to ensure compliance and avoid penalties. This form not only documents tax liability but also reflects the corporation's overall financial health and serves as a vital record during auditing processes.

The significance of the 2025 corporation franchise tax form extends beyond mere compliance. It offers insights into a corporation's revenue generation and operational efficacy, essential for informed decision-making. Adhering to key deadlines and recognizing fiscal year considerations can simplify the filing process, ensuring corporations meet their tax responsibilities timely and efficiently.

Who needs to file the 2025 corporation franchise tax form?

Not every entity is required to file the 2025 corporation franchise tax form. Corporations that generate income or have a physical presence in a state are typically required to file. This includes C corporations and certain transformations of partnerships or LLCs into corporations. Conversely, some nonprofits and entities earning below certain thresholds may qualify for exemptions.

Understanding terms like 'nexus'—which refers to the adequate physical or economic connection to a state that obligates franchising tax—can clarify eligibility. The criteria for filing may vary significantly between states, hence checking local regulations is essential.

Preparing for the 2025 corporation franchise tax form submission

Preparing for the 2025 corporation franchise tax form submission starts with gathering necessary documentation. Essential documents include your organization's Articles of Incorporation, Bylaws, and financial statements such as balance sheets and income statements. This data will help in accurately reporting revenue and calculating taxes owed.

Next, understanding the financial metrics used in tax calculations is crucial. Elements like your taxable revenue and expenses will guide you in determining your taxable margin. Accurate financial reporting also mitigates the risk of future inquiries by tax authorities.

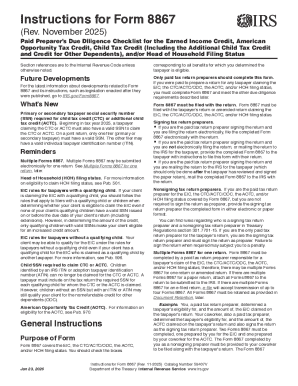

Step-by-step instructions for completing the 2025 corporation franchise tax form

The form involves multiple sections. Each section serves a unique purpose and collectively contributes to determining your franchise tax. To begin, Section 1 gathers basic entity information such as your business name, address, and taxpayer identification number.

Moving to Section 2, you will indicate your taxable revenue, which dictates tax liability. Here, careful reporting of revenue from all relevant sources is essential. In Section 3, you will calculate the franchise tax due, choosing between two calculation methods: total revenue or the 70% method based on the federal taxable income.

Section 4 focuses on filing reminders while Section 5 allows you to attach additional information and supporting schedules if necessary. Completing the form accurately is vital for avoiding unnecessary complications.

Interactive tools and resources to assist with filing

pdfFiller provides a robust suite of interactive tools dedicated to simplifying the filing process for the 2025 corporation franchise tax form. From intuitive online tools allowing for easy form adaptations to e-filing options that help streamline submissions, users can maximize efficiency.

User-friendly interactive calculators are also available for estimating taxes based on entered figures, thus providing real-time feedback for financial planning. These tools not only enhance accuracy but also allow businesses to stay organized by managing their forms and associated documents in one location.

Common mistakes and how to avoid them

Accurately completing the 2025 corporation franchise tax form is crucial, as mistakes can lead to compliance issues and financial repercussions. Common errors include incorrect financial reporting—such as misclassifying revenue categories or omitting essential expenses—which can skew taxable income calculations.

Additionally, failing to file by the deadline can incur significant penalties and interest on overdue taxes. By thoroughly reviewing the form before submission and utilizing pdfFiller's validation options, corporations can minimize these common pitfalls and ensure smooth processing.

Post-filing procedures for the 2025 corporation franchise tax form

Once you have submitted the 2025 corporation franchise tax form, it is essential to maintain a solid recordkeeping system. Tax authorities may request your documentation, so organizing files and maintaining detailed records is prudent for audit readiness and future reference.

After filing, corporations should be prepared to respond to potential inquiries. Keeping communication channels open with tax authorities and seeking professional help if questions arise can reduce stress and lead to more favorable outcomes.

Collaborative features available on pdfFiller for teams

Many teams find that collaboration enhances the efficiency and accuracy of the tax filing process. pdfFiller's platform facilitates real-time editing and feedback feature to ensure that all team members can contribute to the 2025 corporation franchise tax form, allowing for comprehensive input and quality control.

Moreover, the secure document-sharing functionality is invaluable for compliance teams. It enables seamless communication and ensures everyone has access to the most current version of the document, which is critical during the tax filing period. Keeping track of changes and maintaining an effective version control system guarantees clarity and accountability within the team.

eSigning your 2025 corporation franchise tax form on pdfFiller

eSigning your 2025 corporation franchise tax form through pdfFiller is an efficient method to finalize your submission. The eSignature feature ensures that the document remains legally binding and secure, alleviating concerns about authenticity that might arise with traditional signatures.

To eSign, follow a straightforward process directly within the platform. Once you have completed the form, simply click on the eSignature option, verify your identity, and sign electronically. eSigning is necessary when validating tax forms, especially for compliance purposes.

Frequently asked questions about the 2025 corporation franchise tax form

Individuals filing the 2025 corporation franchise tax form often have a range of concerns. Understanding the nature of the tax, eligibility for exemptions, and whether to opt for total revenue calculation or the 70% method can be complex. Often, our community sees first-time filers worry about missing essential documentation or not calculating revenue accurately.

These FAQs can demystify these processes and provide valuable tips. For example, new filers should focus on gathering the proper documents early and ensure to double-check figures before submission to prevent common pitfalls.

Additional support options available

Navigating the complexities of the 2025 corporation franchise tax form can be daunting, but support is readily available. pdfFiller's customer support team is knowledgeable on tax-related inquiries and is equipped to assist users through the submission process smoothly.

Additionally, community forums and a vast knowledge base can address common concerns and provide insights from fellow users. For those requiring in-depth assistance, accessing professional tax services can relieve the burden of compliance and ensure accuracy in tax filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2025 corporation franchise tax from Google Drive?

How do I make edits in 2025 corporation franchise tax without leaving Chrome?

How do I edit 2025 corporation franchise tax straight from my smartphone?

What is 2025 corporation franchise tax?

Who is required to file 2025 corporation franchise tax?

How to fill out 2025 corporation franchise tax?

What is the purpose of 2025 corporation franchise tax?

What information must be reported on 2025 corporation franchise tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.