Get the free Insurance Loss Claim Check ProcessEffec ve March 25th ...

Get, Create, Make and Sign insurance loss claim check

Editing insurance loss claim check online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance loss claim check

How to fill out insurance loss claim check

Who needs insurance loss claim check?

Understanding the Insurance Loss Claim Check Form: A Comprehensive Guide

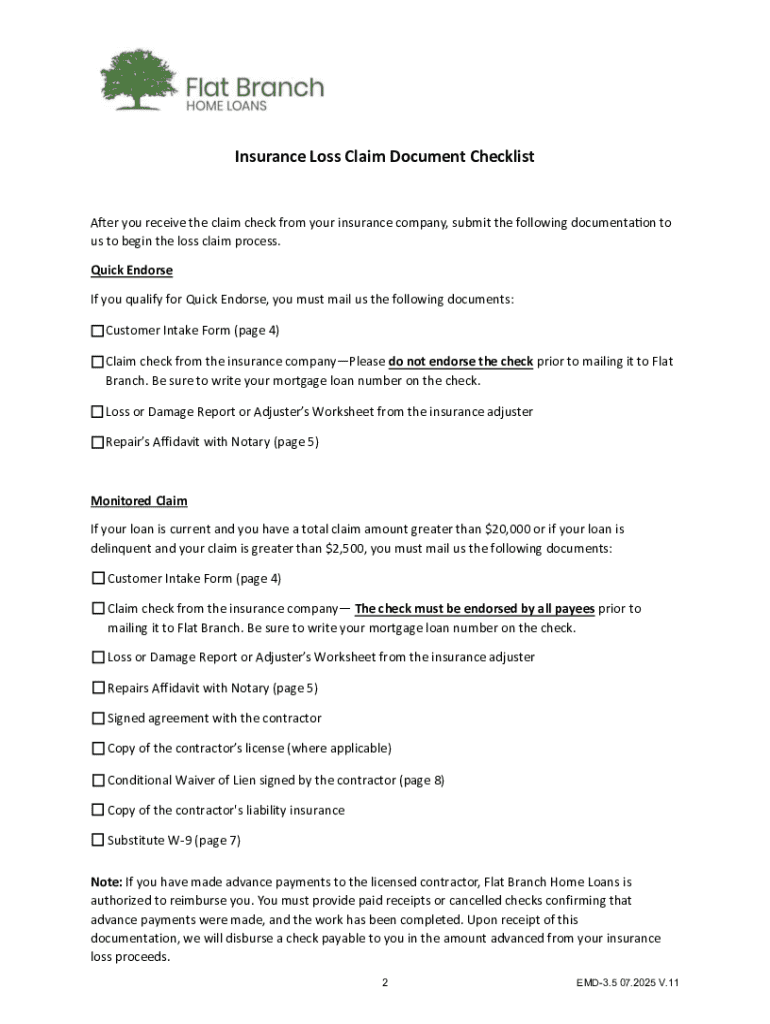

Overview of insurance loss claim checks

An insurance loss claim check is a vital document in the insurance process, representing funds that an insurance company disburses to a policyholder following a verified loss. This check typically covers claims made for property damage, personal property loss, or liability claims. Understanding your claim check is essential; it clarifies what the insurance covers and can significantly impact your financial recovery post-loss.

Claim checks serve many purposes, from facilitating repairs on a damaged home to compensating for lost personal property. It’s not merely a check; it’s an essential document that provides evidence of your claim approved by the insurer. Those navigating through a loss, whether minor or significant, must fully grasp the nuances of their claim checks to avoid complications or misunderstandings.

Who needs an insurance loss claim check form?

Various individuals and entities may require an insurance loss claim check form. Homeowners and property owners frequently file for damage in cases of disasters such as fires, floods, or severe weather. For them, understanding how to correctly fill out and submit this form can mean the difference between a timely payout and a prolonged claims process.

Business owners also heavily rely on these forms, particularly when dealing with property damage that affects their operations. A correctly submitted claim can lead to immediate funds needed for repairs, ensuring business continuity. Lastly, renters may be eligible for coverage under their renters' insurance. Although they don't own the property, they need to account for any personal property loss, making the claim check form relevant in their insurance dealings.

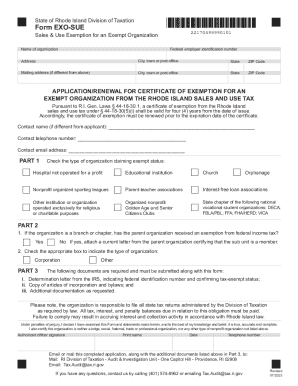

Components of the insurance loss claim check form

Every insurance loss claim check form is structured to collect essential information efficiently. The first section typically requests required personal information. This includes the policyholder’s name, contact details, claim number, and policy number—crucial identifiers that tie the claim to the correct account.

Another vital part of the form is the details of the loss, wherein individuals must provide a comprehensive description of the damaged property, including its condition prior to the incident, the date of the loss, and the cause of the loss. Finally, the form must be signed and dated; this is non-negotiable, as it signifies that the information provided is accurate and complete. Without a signature, the claim cannot proceed.

Step-by-step instructions for filling out the form

Filling out the insurance loss claim check form can feel daunting. However, breaking it down into manageable steps can simplify this process.

How to submit the claim form

Submitting your insurance loss claim check form can be done through various channels. For many, digital submission is the quickest option.

Tracking your claim after submission

Once the insurance loss claim check form has been submitted, tracking its progress is crucial. Understanding processing times can help manage expectations. Often, it can take several days to weeks depending on the insurer's workload and the complexity of the claim.

Follow up by contacting your insurance agent or company. They can provide updates and clarify any required actions on your part. Anticipate assessments and adjustments, as insurance companies may need further documentation or will arrange for an adjuster to evaluate the damage, which could lead to possible delays.

The role of eSigning in claim check management

With technology's advancement, eSigning has become an efficient method for handling insurance loss claim check forms. Utilizing electronic signatures can expedite the submission process, allowing for immediate acknowledgment by your insurance company.

For those unfamiliar with eSigning, platforms like pdfFiller simplify the process. Users can upload their forms, sign electronically, and submit with ease. This method not only saves time but also reduces paper use, making it environmentally friendly.

Handling potential issues with your claim check

While submitting an insurance loss claim check form might seem straightforward, complications can arise. Delays in processing or outright denials can occur, often due to incomplete information or discrepancies in the documentation.

In the event of disputes, escalate your claim by directly contacting your insurer. Gather all evidence and communication to support your case, and don’t hesitate to seek help from a legal advisor if necessary. Additionally, during the entire process, safeguarding your personal information is crucial to protect against identity theft.

Tips for managing your insurance documents

Proper document management is vital during the insurance claim process. Start by keeping all insurance docs organized—files should be easily accessible, whether physical or digital.

FAQs about insurance loss claim checks

Case studies/examples

Sharing stories helps illustrate the importance of efficiently managing an insurance loss claim check. For instance, a homeowner experienced minor flooding which damaged her basement. She swiftly documented the damage, filed her claim, and submitted the form correctly using pdfFiller. The quick submission, backed by thorough documentation, ensured she received the claim funds in a timely manner.

Conversely, another individual lost valuable collectibles in a theft but failed to document the items before filing the claim. Without clear evidence or details, the insurance company denied the claim, serving as a cautionary tale for future claimants about the importance of meticulous documentation.

Interactive tools and resources

To assist individuals navigating the insurance loss claim process, interactive tools can be invaluable. A claim check calculator can help estimate potential payouts based on the documented losses from various incidents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send insurance loss claim check to be eSigned by others?

Can I sign the insurance loss claim check electronically in Chrome?

Can I create an electronic signature for signing my insurance loss claim check in Gmail?

What is insurance loss claim check?

Who is required to file insurance loss claim check?

How to fill out insurance loss claim check?

What is the purpose of insurance loss claim check?

What information must be reported on insurance loss claim check?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.