IRS W-2G 2010 free printable template

Instructions and Help about IRS W-2G

How to edit IRS W-2G

How to fill out IRS W-2G

About IRS W-2G 2010 previous version

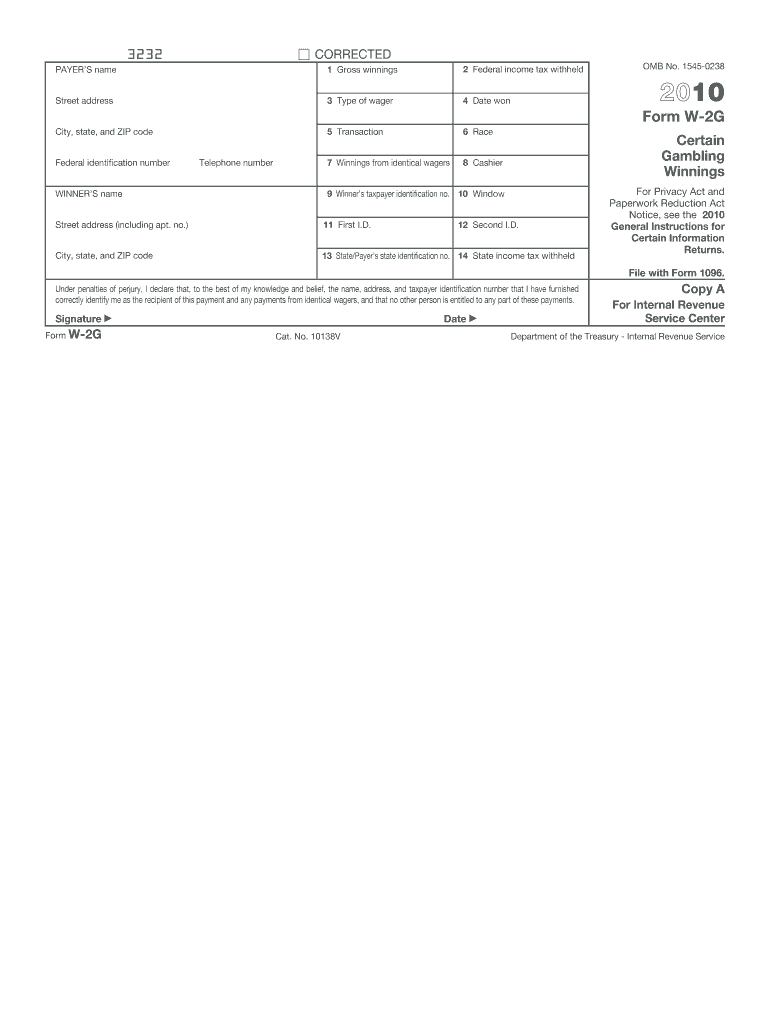

What is IRS W-2G?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

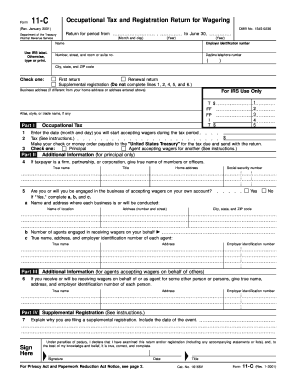

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-2G

What should I do if I realize I made a mistake after submitting the 2010 form w?

If you discover an error on your submitted 2010 form w, you can correct it by filing an amended form. Ensure that you indicate that it is an amendment and provide the correct information. It’s important to keep a record of both the original and amended submissions for future reference.

How can I verify the status of my submitted 2010 form w?

To verify the receipt and processing status of your 2010 form w, you can check the IRS e-file system if you filed electronically or contact the processing center for paper submissions. Be mindful of common e-file rejection codes such as mismatched names and social security numbers that can affect the status.

Are there specific data security measures I should follow when submitting the 2010 form w?

Yes, when submitting your 2010 form w online, ensure you use secure servers and trusted e-filing software that complies with IRS regulations. It’s also advisable to use strong passwords and not share your personal information unnecessarily to maintain data privacy.

What steps should I take if I receive a notice about my 2010 form w?

If you receive a notice related to your 2010 form w, review it carefully to understand the issue. Prepare any required documentation and promptly respond by following the instructions provided in the notice. Keeping a record of your correspondence is essential for clarity.

Can I e-file the 2010 form w using my mobile device?

Yes, many e-filing solutions compatible with the 2010 form w are available for mobile devices. Ensure that you use reliable software and check the technical requirements for optimal performance when submitting your form via a mobile device.

See what our users say