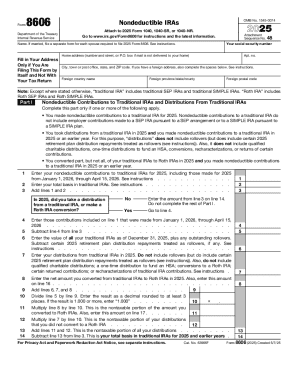

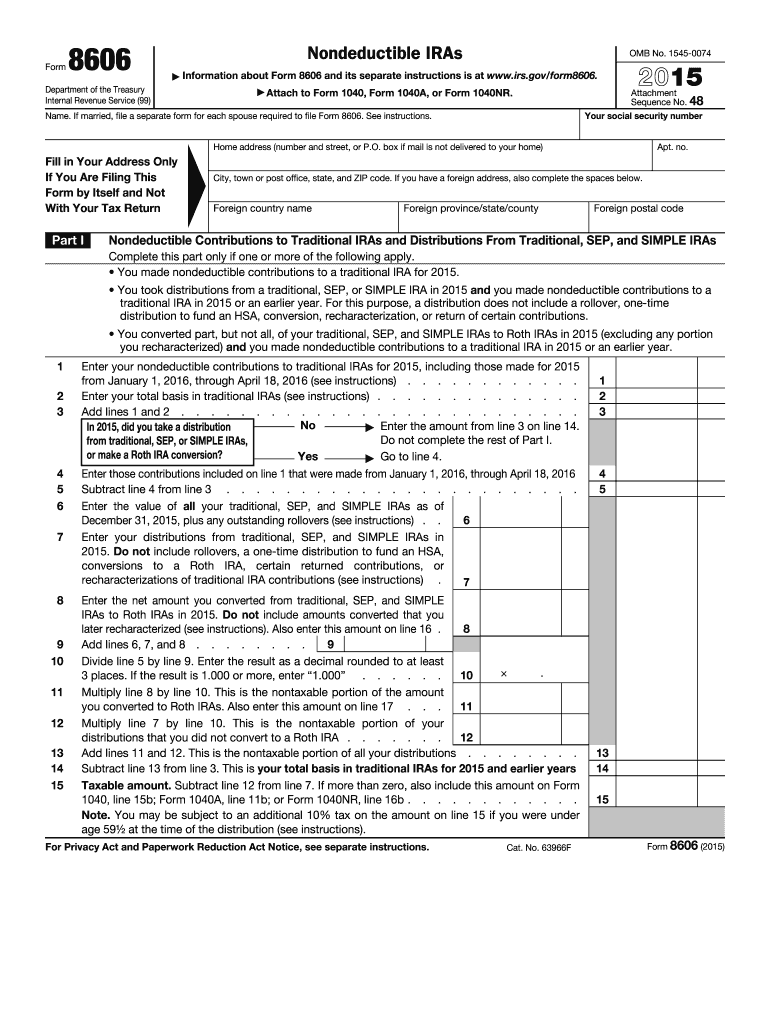

IRS 8606 2015 free printable template

Instructions and Help about IRS 8606

How to edit IRS 8606

How to fill out IRS 8606

About IRS 8 previous version

What is IRS 8606?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8606

What should I do if I realize there is an error on my IRS 8606 after submission?

If you discover an error on your IRS 8606 after it has been submitted, you will need to file an amended tax return using Form 1040-X to correct the mistake. It's important to provide accurate information and documentation supporting your corrected entries. Keep in mind that any additional taxes owed should be paid as soon as possible to avoid penalties.

How can I check the status of my IRS 8606 submission?

You can check the status of your IRS 8606 submission by using the IRS 'Where's My Refund?' tool if you're expecting a refund, or by calling the IRS directly. Keep in mind that e-filed returns may be processed faster than paper submissions, and tracking may vary depending on the method of filing.

What should I do if my IRS 8606 submission is rejected?

If your IRS 8606 submission is rejected, the IRS will provide a reason, often in the form of a specific error code. You can correct the issue based on this feedback, and then resubmit the form electronically or by mail. Make sure to review the common rejection codes to prevent similar issues in the future.

Are electronic signatures accepted for IRS 8606 submissions?

Yes, IRS accepts electronic signatures for the IRS 8606 when filed electronically, making it easier and more efficient. Be sure to follow the e-filing requirements and ensure your software is compatible with IRS standards for electronic submissions.

What precautions should I take to ensure the privacy of my IRS 8606 information?

To protect your privacy while handling the IRS 8606, ensure that you are using secure channels for submission, such as reputable e-filing software or the IRS website. It's important to keep physical copies in a secured location and to be cautious about sharing personal information online to prevent identity theft.

See what our users say