Car Lease Calculator

What is car lease calculator?

A car lease calculator is a helpful tool that enables users to estimate the cost of leasing a car. It takes into account various factors such as the car's price, lease term, interest rate, and any additional fees or charges. By inputting these details, the calculator provides an approximation of the monthly lease payment, allowing users to better plan their budget and make informed decisions.

What are the types of car lease calculators?

There are several types of car lease calculators available, including: 1. Basic Lease Calculator: This type of calculator provides a simple estimation of the monthly lease payment based on the car's price, lease term, and interest rate. 2. Advanced Lease Calculator: This calculator offers more detailed calculations, taking into consideration additional factors such as the down payment, trade-in value, and any rebates or incentives. 3. Residual Value Lease Calculator: This type of calculator estimates the residual value of the car at the end of the lease term, which is important for determining the overall cost of the lease. 4. Lease vs. Buy Calculator: This calculator helps users compare the costs of leasing versus buying a car, considering factors such as depreciation, financing options, and anticipated usage.

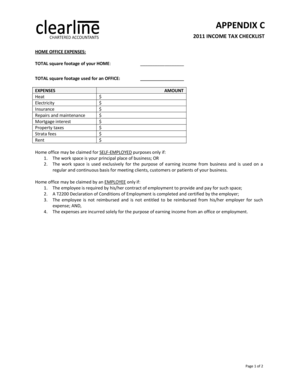

How to complete car lease calculator

Completing a car lease calculator is a straightforward process. Follow these steps: 1. Gather the necessary information: You will need details such as the car's price, lease term, interest rate, down payment, and any additional fees or charges. 2. Input the information: Enter the collected data into the appropriate fields of the car lease calculator. 3. Review the results: The calculator will generate an estimated monthly lease payment. Review this information and consider how it fits into your budget and financial goals. 4. Adjust the variables: If the estimated payment is higher than anticipated, you can adjust the variables such as the down payment or lease term to find a more suitable option. 5. Compare different scenarios: Utilize the calculator to compare different leasing scenarios, such as varying lease terms or interest rates, to find the most favorable option for your needs.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.