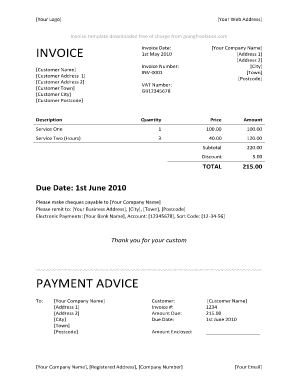

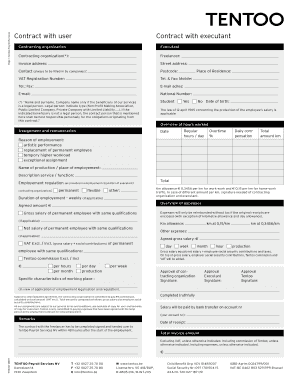

What is Contractor-freelancer Invoice?

A contractor-freelancer invoice is a document that outlines the services provided by a contractor or freelancer and the corresponding payment details. It serves as a formal request for payment and acts as a record of the work performed and the amount owed by the client. A well-prepared contractor-freelancer invoice is essential for maintaining a professional relationship with clients and ensuring timely payments.

What are the types of Contractor-freelancer Invoice?

There are several types of contractor-freelancer invoices that can be used depending on the specific needs and requirements of the contractor or freelancer. Some common types include:

Hourly Rate Invoice: This type of invoice is used when charging clients based on the number of hours worked.

Fixed Price Invoice: This type of invoice is used when charging clients a predetermined amount for a specific project or service.

Retainer Invoice: This type of invoice is used when clients pay a fixed amount in advance to secure the services of a contractor or freelancer.

Recurring Invoice: This type of invoice is used for ongoing services and is sent at regular intervals, such as monthly or weekly.

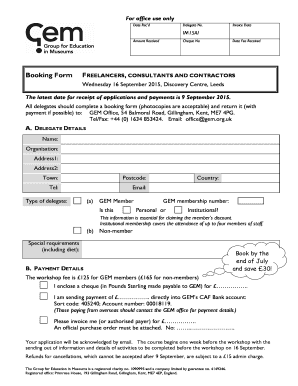

How to complete Contractor-freelancer Invoice

Completing a contractor-freelancer invoice requires attention to detail and accuracy to ensure a smooth payment process. Here are the steps to follow:

01

Include your contact information at the top of the invoice, including your name, address, phone number, and email.

02

Add the client's contact information, including their name, company name, address, and email.

03

Specify the invoice number and date of issuance for reference and record-keeping purposes.

04

Provide a detailed description of the services rendered, including the quantity, hourly rate or fixed price, and any additional charges.

05

Calculate the total amount owed by summing up the individual service charges and any applicable taxes.

06

Include payment terms and methods, such as the due date, accepted payment methods, and any late payment penalties.

07

Attach any supporting documents, such as receipts or contracts, if necessary.

08

Review the invoice for accuracy, ensuring all information is correct and complete.

09

Send the completed invoice to the client via email or other preferred method.

10

Follow up with the client to ensure receipt of the invoice and prompt payment.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.