What is direct deposit authorization form chase?

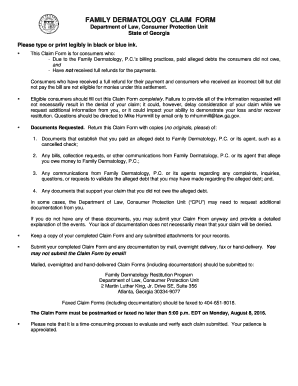

A direct deposit authorization form is a document that allows you to authorize an employer, institution, or government agency to directly deposit funds into your Chase bank account. By using this form, you can conveniently receive regular payments, such as your salary or benefits, directly into your account without the need for paper checks or manual deposits.

What are the types of direct deposit authorization form chase?

Chase offers different types of direct deposit authorization forms to cater to various needs. Here are some common types:

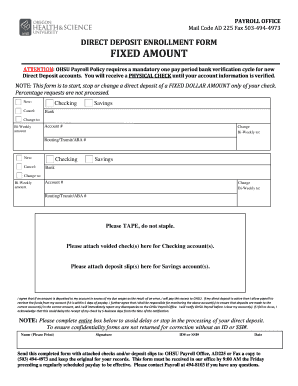

Payroll direct deposit authorization form: This form is used to authorize your employer to directly deposit your salary or wages into your Chase bank account.

Government benefit direct deposit authorization form: This form is used to authorize government agencies to directly deposit benefits, such as Social Security or unemployment benefits, into your Chase bank account.

Pension direct deposit authorization form: This form is used to authorize your pension provider to directly deposit your pension payments into your Chase bank account.

How to complete direct deposit authorization form chase

Completing a direct deposit authorization form with Chase is easy and straightforward. Here are the steps to follow:

01

Obtain the direct deposit authorization form from Chase. You can either download it from their website or obtain a physical copy from a Chase branch.

02

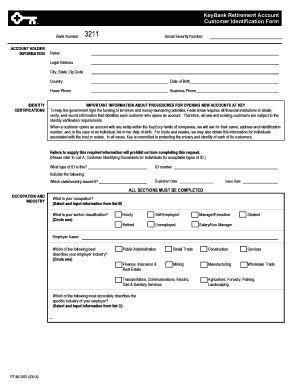

Fill out the required personal information, such as your name, address, and social security number.

03

Provide your Chase bank account details, including your account number and routing number. You can find these details on your checks or by logging into your Chase online banking account.

04

Select the type of direct deposit you wish to authorize, such as payroll, government benefits, or pension.

05

Sign and date the form to give your consent.

06

Submit the completed form to your employer, government agency, or pension provider as instructed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.