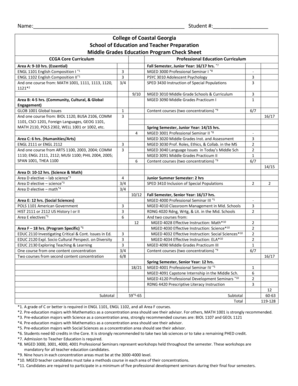

Generic Payroll Deduction Authorization Form

What is generic payroll deduction authorization form?

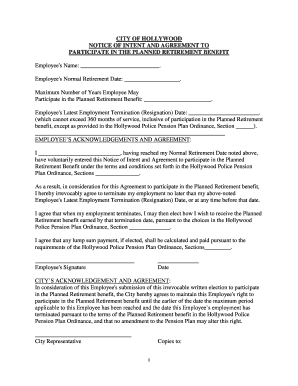

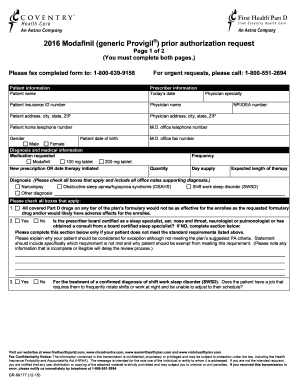

A generic payroll deduction authorization form is a document that allows an employee to grant permission to their employer to deduct certain amounts from their paycheck. This form is commonly used for various purposes, such as making voluntary contributions to retirement plans, paying off loans, or covering medical insurance premiums.

What are the types of generic payroll deduction authorization form?

There are several types of generic payroll deduction authorization forms available, depending on the specific deductions an employee wishes to authorize. Some common types include:

How to complete generic payroll deduction authorization form

Completing a generic payroll deduction authorization form is a simple process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.