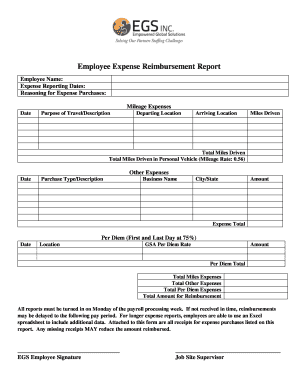

Mileage Reimbursement Form Excel

What is mileage reimbursement form excel?

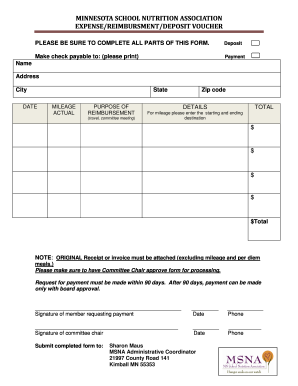

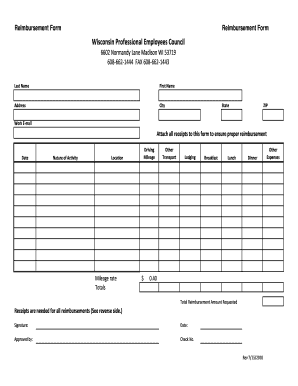

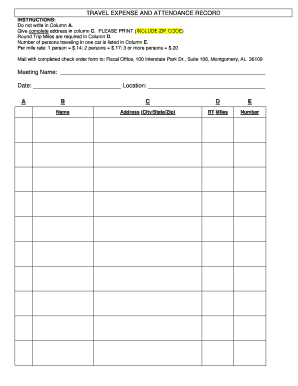

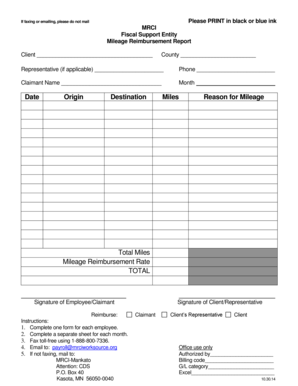

A mileage reimbursement form excel is a document used by organizations to track and reimburse employees for their business-related travel expenses. This form, in Excel format, allows employees to input their mileage details, such as the starting and ending locations, distance traveled, and purpose of the trip. It helps organizations calculate the reimbursement amount accurately and ensures that employees are reimbursed for their incurred expenses.

What are the types of mileage reimbursement form excel?

There are several types of mileage reimbursement forms in Excel format that organizations can choose from depending on their specific needs. Some common types include: 1. Basic Mileage Reimbursement Form: This form includes fields for entering basic information such as employee name, date, starting and ending locations, and distance traveled. 2. Detailed Mileage Reimbursement Form: This form provides more detailed fields for recording additional information such as the purpose of the trip, vehicle details, tolls, parking fees, etc. 3. Monthly Mileage Log Form: This form is designed to track and calculate mileage over a monthly period. It may include additional fields for recording the dates and purposes of each trip. 4. IRS Standard Mileage Rate Form: This form follows the mileage reimbursement guidelines set by the Internal Revenue Service (IRS) and calculates the reimbursement amount based on the standard mileage rates set by the IRS.

How to complete mileage reimbursement form excel

Completing a mileage reimbursement form in Excel is a straightforward process. Here are the steps to follow: 1. Open the Excel file containing the mileage reimbursement form. 2. Fill in your basic information, such as your name, employee ID, and date. 3. Enter the starting and ending locations of your trip. 4. Input the total distance traveled. 5. Specify the purpose of your trip, whether it is for a meeting, site visit, or any other business-related activity. 6. If applicable, provide additional details such as tolls, parking fees, or any other expenses incurred during the trip. 7. Double-check all the entered information for accuracy. 8. Save the completed form for submission to your employer or finance department.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.