Offer To Purchase Real Estate Form - Page 2

What is Offer To Purchase Real Estate Form?

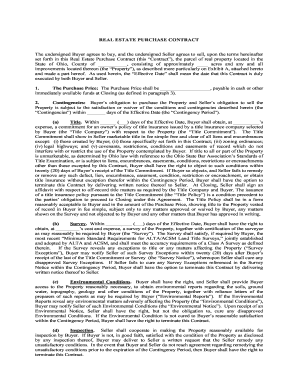

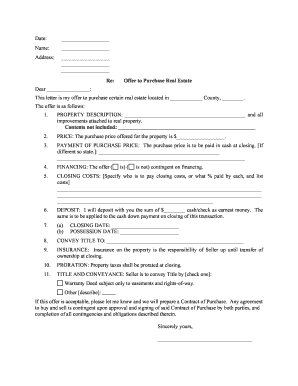

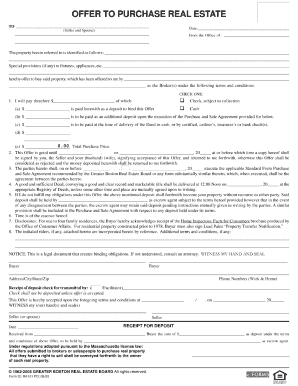

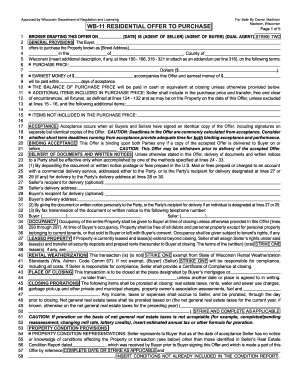

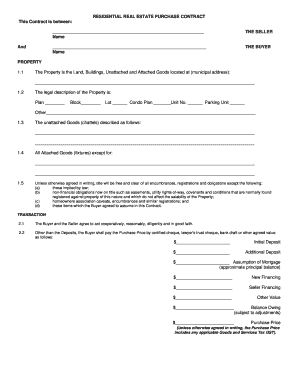

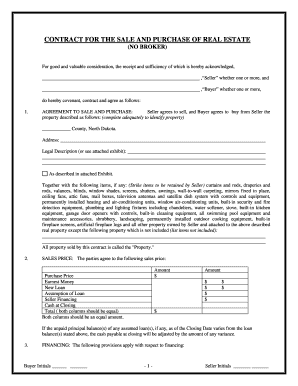

An Offer To Purchase Real Estate Form is a legal document that outlines the terms and conditions of a potential buyer's offer to purchase a piece of real estate. It is an important step in the real estate transaction process as it determines the buyer's intentions, including the purchase price, financing terms, and contingencies.

What are the types of Offer To Purchase Real Estate Form?

There are various types of Offer To Purchase Real Estate Forms available, depending on the specific needs of the buyer and the type of property being purchased. Some common types include: 1. Residential Offer To Purchase Form: Used for purchasing residential properties such as houses, apartments, or condominiums. 2. Commercial Offer To Purchase Form: Used for purchasing commercial properties such as office buildings, retail spaces, or industrial properties. 3. Land Offer To Purchase Form: Used for purchasing vacant land or undeveloped properties. 4. Investment Offer To Purchase Form: Used for purchasing properties with the intention of generating income or for investment purposes.

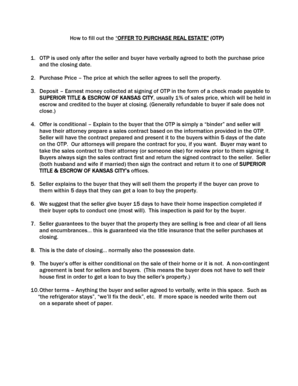

How to complete Offer To Purchase Real Estate Form

Completing an Offer To Purchase Real Estate Form may seem daunting, but with the right information, it can be a straightforward process. Here are the steps to complete the form: 1. Fill out the buyer's information: Provide your name, contact details, and any other required personal information. 2. Describe the property: Include the address, legal description, and any other relevant details about the property you are making an offer on. 3. Specify the purchase price and financing terms: Indicate the amount you are willing to pay for the property and how you plan to finance the purchase. 4. Include contingencies: Outline any conditions that must be met for the offer to be valid, such as obtaining financing or passing a home inspection. 5. Sign the form: Once you have completed all the necessary information, sign the form to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.