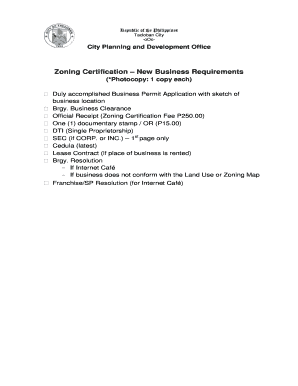

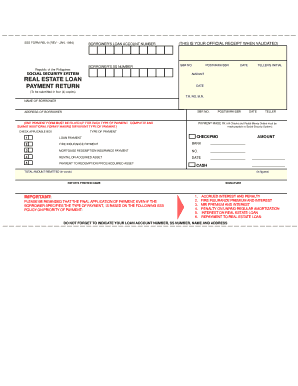

Official Receipt Philippines

What is official receipt philippines?

An official receipt in the Philippines is a document that serves as proof of sales or services rendered by a business. It is an important legal document that is required by the Bureau of Internal Revenue (BIR) for tax purposes. The official receipt contains essential information, such as the name of the business, the transaction details, and the payment received from the customer. It is crucial for businesses to issue official receipts accurately and promptly to comply with the law and maintain transparency in their financial transactions.

What are the types of official receipt philippines?

In the Philippines, there are two main types of official receipts: the VAT official receipt (OR) and the non-VAT official receipt (NOR). Both types of receipts serve the same purpose of providing proof of transaction, but they differ in terms of the taxes imposed on the business. The VAT official receipt is used by businesses registered under the Value Added Tax system, which means they are required to pay VAT on their sales. On the other hand, the non-VAT official receipt is used by businesses exempted from VAT or those with sales falling below the VAT threshold. It is important for businesses to determine the appropriate type of official receipt to issue based on their VAT registration status.

How to complete official receipt philippines

Completing an official receipt in the Philippines requires attention to detail and adherence to the BIR guidelines. Here is a step-by-step guide to completing an official receipt:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.